Bangladesh to loosen interest rate on IMF prescription

Bangladesh Bank is going to introduce a flexible interest rate and exchange rate instead of fixed or band rates in line with the prescription of International Monetary Fund (IMF).

"We are moving towards a fully market-based interest rate soon, which will allow banks to fix the interest rate based on demand and supply," Bangladesh Bank Governor Abdur Rouf Talukder said in a discussion yesterday.

However, the BB governor did not announce when Bangladesh Bank would introduce the flexible interest rate and exchange rate.

Additionally, the central bank also plans to introduce a market-based exchange rate and is now working to adopt the "crawling peg" method, the BB governor told the discussion at the Pan Pacific Sonargaon Dhaka as chief guest.

The discussion titled "Fiscal and Monetary Policies in the Evolving Economic Order (Risks, Vulnerabilities and Solutions)" was organised by The Department of Development Studies at the University of Dhaka and Bangla daily Bonik Barta.

It was a part of a two-day 1st Development Studies International Conference Dhaka (DSIC 2024).

A formal declaration for the flexible interest rate and exchange rate is likely to be made during the announcement of the upcoming monetary policy, but could be announced before that, said central bank officials.

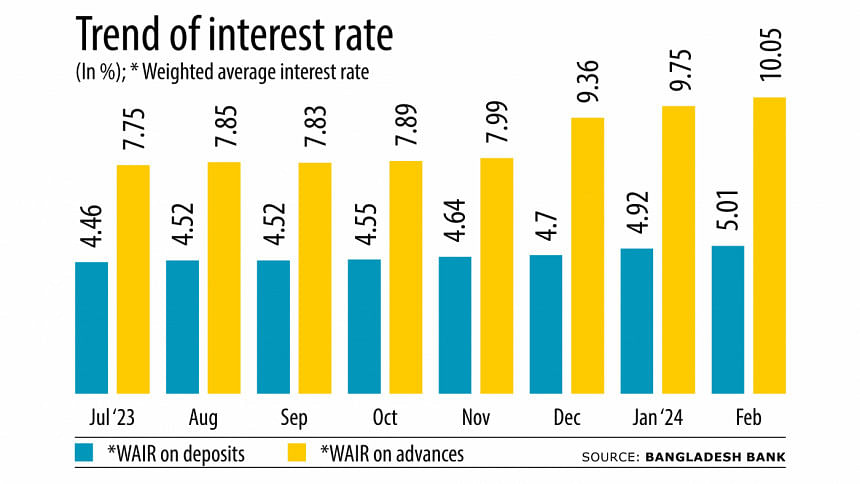

"In the case of interest rates, we now follow the reference rate -- the Six-Month Moving Average Rate of Treasury Bills, abbreviated as SMART," said Talukder.

"Previously, it was capped at 9 percent for lending and 6 percent for deposits but now we are very close to a market-based interest rate," he said.

"Very shortly, we will move to a fully market-based interest rate, where there will be no restrictions," he added.

In July last year, the central bank withdrew the 9 percent lending rate cap and introduced the SMART method.

The BB governor also said they were currently working to introduce a crawling peg as a part of its plans to introduce a market-based exchange rate.

The crawling peg is an exchange rate regime that allows currency depreciation or appreciation to happen gradually. It is usually seen as a part of a fixed exchange rate regime.

Mentioning the debate around printing money to inject into the economy, the BB governor said they are currently going for zero devolvement of government securities, which means the central bank is not buying treasury bills or bonds.

While speaking about the external aspects, he said exports are increasing and non-essential imports are being controlled to preserve foreign exchange reserves.

Remittances have also increased while the current account is in the positive, he said, adding that the financial account is still in the negative.

"Currently, we have two issues. One is high inflation and the other is the falling trend of forex reserves," he said, adding that the central bank had already taken a number of measures to address the issues.

Regarding the issuance of bonds, the BB governor explained that the government had issued bonds to pay outstanding dues to the power and fertiliser sector.

"If the government did not issue the bonds, then importers' loans would be classified, especially because banks could not provide funds due to the liquidity crisis," he explained further.

He further claimed that no new money was being created through the issuance of bonds.

WHAT DID OTHER EXPERTS SAY?

Meanwhile, former Bangladesh Bank governor Salehuddin Ahmed made three suggestions.

They were to not undermine growth in order to curb inflation, to not formulate an ineffective monetary policy, and to use the central bank's autonomy to ensure discipline in the financial sector.

"The time has come for the central bank to take a strong stand, defying political influence and influences of a certain quarter," Ahmed said.

While moderating the discussion, another former BB governor, Atiur Rahman, said consumers are feeling the heat of high inflation rate, which stood at 9.81 percent in March, and that it needs to be tamed.

He added that the contractionary monetary policy needs to be continued to bring the inflation rate to 7 percent. However, Rahman warned, "The monetary policy cannot do so alone; the fiscal policy also is needed here."

Former finance secretary Mohammad Tareque suggested improving the government's spending to GDP ratio, which has been hovering at around 16 percent for the past few years.

In fact, it declined to 15 percent last year.

But in countries such as Vietnam, government spending amounts to around 30 percent of the GDP, he said, adding that Bangladesh may face difficulties in future if the government's spending capacity is not bolstered.

Comptroller and Auditor General of Bangladesh Mohammad Muslim Chowdhury said the monetary policy should be truly contractionary because the fiscal policy has an immediate effect while the monetary policy takes more time to have an impact on the economy.

During the Covid-19 pandemic, the monetary and fiscal policies worked together in Bangladesh, said Fazle Kabir, a former finance secretary and a former BB governor, adding that it was no longer the case.

"The monetary policy and fiscal policy should go hand in hand, but unfortunately that is not happening in Bangladesh," Kabir said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments