Crawling peg system: A welcome step but will it be enough to boost reserves?

The crawling peg system for the taka is a delayed and, perhaps, inadequate response to the bleeding of forex reserves. Some economists suggest the central bank should go beyond this formula and open the exchange rate to market forces to stop the continuous erosion of reserves. Either way, exporters and remitters will celebrate more flexibility in the exchange rate.

In January, Bangladesh's central bank disclosed a plan to introduce the crawling peg for its currency, backtracking on its earlier pledge to allow the exchange rate to float freely. The new system may now get off the ground by June, making a clear departure from the tight control over the exchange rate. Since becoming an independent country in 1971, Bangladesh managed currency volatility through a series of fixed exchange rates.

Now it has to make a painful choice.

The crawling peg, a system of exchange rate adjustments, falls between two extremes: the fixed rate and the floating or market-based rate. The key difference is that a crawling peg allows for limited fluctuations within a predefined range, while a fixed exchange rate has almost no flexibility.

The new system is primed to bring more flexibility to the exchange rate regime by loosening the central bank's grip on the taka, a key prescription from the International Monetary Fund. Still, a question remains: will the central bank bring the new exchange corridor closer to the informal market rate to curb opaque currency flows?

"The crawling peg is just a formula. If the dollar-taka exchange rate based on the crawling peg comes close to the informal market rate, it may yield some benefits because that will discourage dollar flows into the informal market," said Zahid Hussain, former lead economist of the World Bank's Dhaka office.

"But if the gap between the formal and informal markets is as wide as ever even after the introduction of the new system, it won't make much of a difference," he said.

Hussain's observation reflects wider concerns over the deterioration in external buffers with official reserves slipping below $20 billion, less than half their historic peak in 2021.

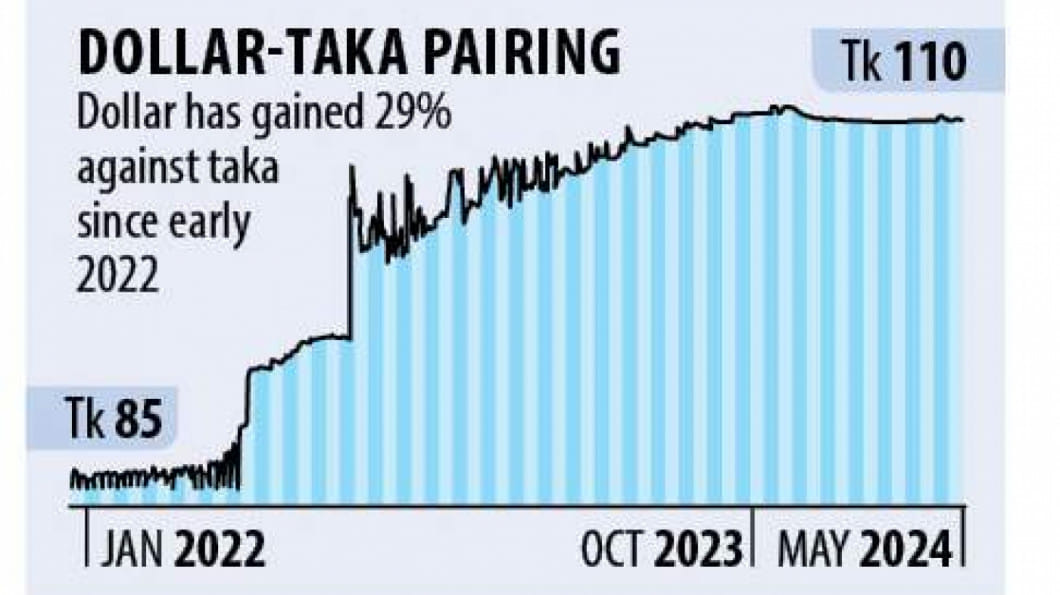

Since mid-2022, the taka has been depreciating against the dollar, a trend primarily attributed to a balance of payments deficit leading to a significant reduction in reserves. The weakening of the taka has fuelled domestic inflation as the cost of imports has risen. In response to these challenges, Bangladesh Bank charted a gradual shift towards a market-based exchange rate system. And the crawling peg is a transition to a more flexible exchange rate and a way to prevent further depletion of foreign exchange reserves.

The crawling peg is not without a virtue. It will go some way toward rebuilding resilience and adaptability to external shocks, especially as Bangladesh graduates from the LDC category in 2026 and becomes more closely integrated into the global financial system. That means Bangladesh is on course to adopt a "more modernised and forward-looking monetary policy framework." It will also augment the central bank's freedom in monetary policy.

"While the authorities have appropriately accelerated reforms to allow greater exchange rate flexibility, managing transition risks remains crucial. Policy actions to restore external resilience need to be well-calibrated and carefully sequenced to facilitate a non-disruptive transition toward greater exchange rate flexibility," the IMF said in a report in December 2023.

The crawling peg system would be linked to a carefully selected set of currencies and operate within a predefined exchange rate band. This strategy is aimed at tempering unusual fluctuations in the currency's value.

"The central bank would establish a stable benchmark while retaining the flexibility to intervene in the market as necessary to maintain the currency within the designated boundaries," Bangladesh Bank said in January.

Before the buzz over the crawling peg was in the air, the central bank in July 2023 introduced the market-based exchange rate. That was only on paper. In practice, however, the exchange rate is fixed by the Bangladesh Foreign Exchange Dealers' Association and the Association of Bankers on unofficial instructions from the central bank.

According to an IMF assessment, the exchange rate not being market-based was the reason behind the deficit in the financial account, which widened to $8.36 billion in the July-February period from $2.32 billion a year earlier. As a result, much of the export proceeds did not return home to Bangladesh, while remittances were still flowing through unofficial channels.

Bangladesh is navigating a combination of risks -- elevated inflation and slowing economic growth. So, greater exchange rate flexibility may help the nation stem losses of forex reserves and eventually ease depreciation pressure on the taka, triggered initially by the worsening terms of trade and later by the reversal in the financial account.

The crawling peg system, if introduced, will hopefully bring cheers to exporters and remitters.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments