Exporters to win, consumers to bear the brunt

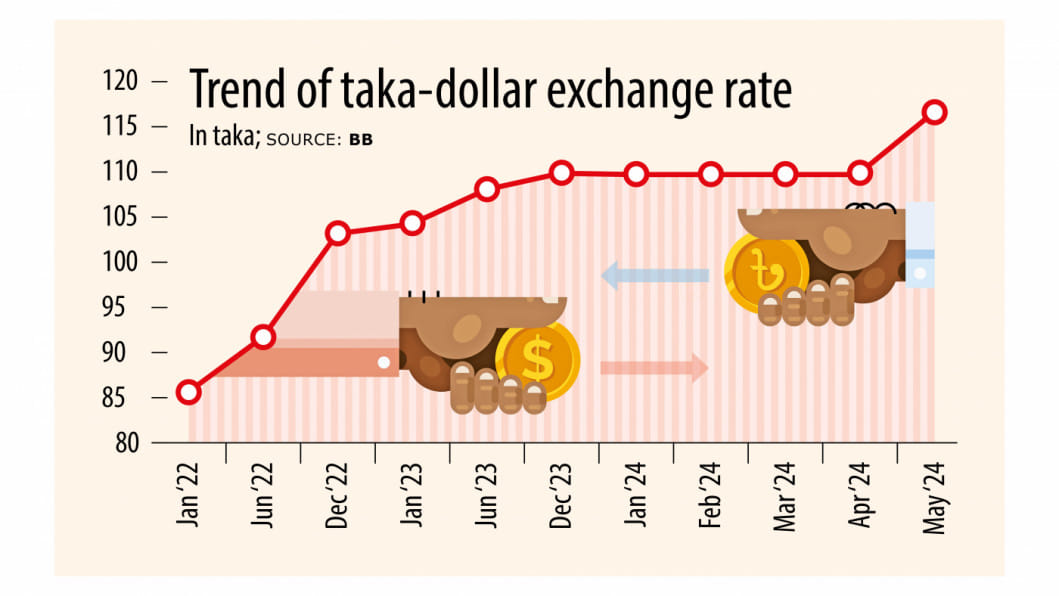

The crawling peg has further devalued the taka. And it is a huge devaluation at one go -- from Tk 110 to Tk 117. This devaluation will leave a significant impact on the economy. The exporters will get Tk 7 more against each dollar as export proceeds thanks to the official recognition of taka's devaluation with the announcement of the crawling peg – a huge benefit for the exporters.

One of the main objectives of the government for the introduction of the crawling peg is to make the country's international trade more competitive.

Let's take into account Bangladesh's export earnings of the last fiscal year. Last year, merchandise shipment from Bangladesh was $55.55 billion. We can easily calculate the exchange rate like $55.55 billion multiplied by Tk 110 at the previous rate. But now the amount will be $55.55 billion multiplied by Tk 117 because of the latest devaluation.

The exporters have already welcomed the central bank's move to devaluate the local currency, which they have long been waiting for.

Now, let's focus on the other side of the story. As Bangladesh is an import-dependent country, the import cost will definitely rise as the businesses will have to spend high for buying dollars from the banking system for opening letters of credit (LCs) to bring in commodities, especially essentials like edible oil, lentils and sugar.

In 2022-23 fiscal year, the total value of goods and services imported by Bangladesh was $68.6 billion. So, think about the amount that the importers will have to pay when they will have to spend Tk 7 more against every dollar for opening LCs.

Now, there is a possibility of experiencing a price hike of goods in the domestic market as the businessmen will show the dollar price hike as an excuse. The businesses may utilise this opportunity also, as they always take the opportunity of time and situations.

It should be mentioned here that the dollar has been trading at higher rates both at formal and informal market in the last two or three years. Very often the exporters have been saying that they have to buy each dollar at Tk 120-122 from the banks to open LCs for importing raw materials and goods.

Whatever, at the end of the day, there is a possibility of seeing a price hike of imported consumers goods in the domestic markets also.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments