Private sector's short-term foreign debt drops

The private sector's short-term foreign debt has gradually declined over the past three months up until March this year as a high rate of interest is discouraging borrowers from taking such loans from abroad.

The debt stood at $11.04 billion in March, $11.07 billion in February and $11.25 billion in January, according to Bangladesh Bank.

Central bank data shows that the monthly average of debt in this sector has been declining gradually since December 2022 as the interest rate of loans from foreign sources had been higher than that of domestic sources.

This sector's highest amount of debt was $16.41 billion in 2022. Then, the amount of debt started to reduce gradually and stood at $11.79 billion in 2023, according to the central bank data.

The reason behind the reduction of short-term foreign debt in the private sector is high interest rate, said an official of Bangladesh Bank.

The official said the interest rate of short-term foreign debt was only 1 percent prior to 2022.

But it has jumped to 8 percent to 9 percent now. This is why private sector borrowers are feeling discouraged in terms of taking loans from abroad, he said.

Meanwhile, the interest rate in Bangladesh was 7 percent to 8 percent until June last year since the central bank maintained a 9 percent lending rate ceiling before it was scrapped in July, according to the official.

The lending rate has since increased to 10 percent to 11 percent amid a lingering liquidity crunch.

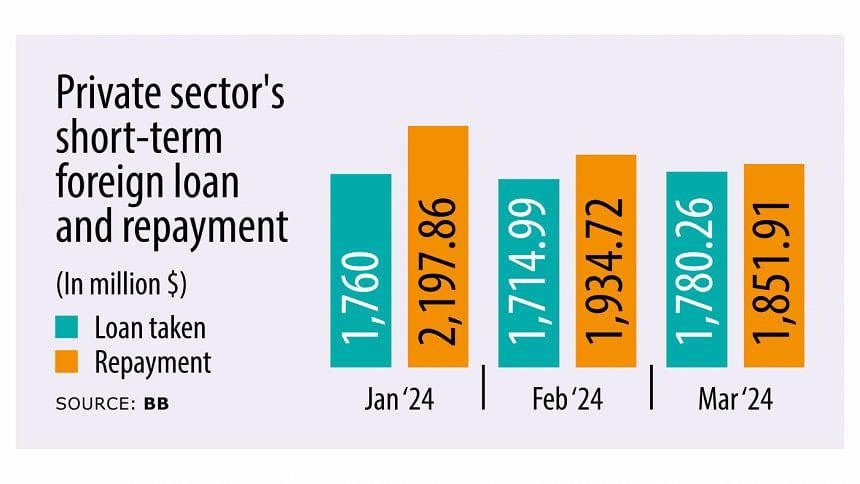

According to BB data, the private sector's monthly average of loans taken from abroad was $3,104 million in 2022, which declined to $2,149 million in 2023.

The monthly average was $1,800 million in 2024.

On the other hand, the monthly average repayment stood at $3,061 million in 2022, which reduced to $2,594 million in 2023, the central bank data showed.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments