BATB's profit drops as for high inflation deters smokers

British American Tobacco Bangladesh (BATB) saw a drop in its profits and sales in the January-March period of 2024, reasoning that people had cut back on smoking cigarettes amidst high inflationary pressure.

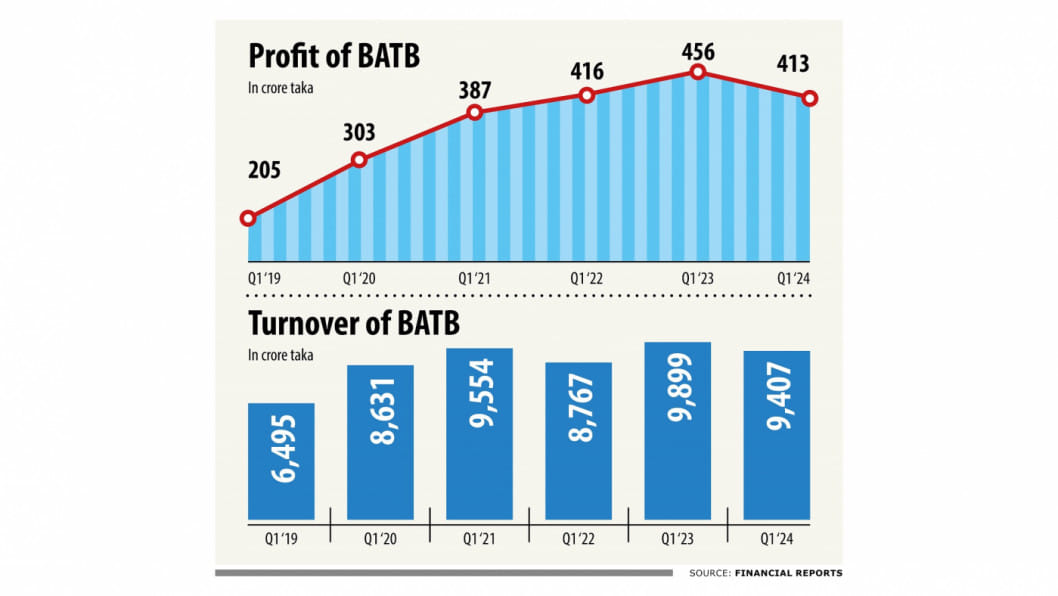

The listed multinational tobacco company registered 4 percent lower sales year-on-year to Tk 9,389 crore in the first quarter of the current year.

At the same time, its profits fell 9 percent to Tk 413 crore.

Thus, BATB's earnings per share stood at Tk 7.65 in the first quarter of 2024 compared to Tk 8.44 in the same quarter of 2023.

The 113-year-old company stated in its financial statements that its earnings decreased from the same period last year due to lower sales and tobacco leaves exports.

It sold 1,612 crore cigarettes in the three-month period, which represented a year-on-year drop of 10 percent.

At the same time, BATB's revenue from export of tobacco leaves plunged 81 percent to Tk 18 crore.

The company has cigarette factories in Dhaka and Savar, a green leaf threshing plant in Kushtia and a green leaf redrying plant in Manikganj.

A mid-level official of the company, preferring anonymity, said people had cut back on smoking cigarettes mainly due to high prices as inflationary pressures had reduced their disposable income.

The inflation rate in Bangladesh has remained above 9 percent since March last year.

As a result, most people were forced to cut back on their expenses, including on purchasing cigarettes, so it had an impact on the revenue of the company, he added.

The company provided 100 percent cash dividend to shareholders for 2023, the lowest among at least the past decade.

The Dhaka Stock Exchange (DSE) data showed that it had Tk 4,826 crore in cash reserves, meaning funds set aside to cover costs or expenses that are unplanned or unexpected.

BATB was listed with the stock exchange in 1977 and since then it has provided high dividends every year.

Its sponsors and directors hold around 73 percent of shares while institutional investors account for around 13 percent, foreign investors 6 percent and general investors the rest.

The company has Tk 540 crore in paid-up capital, meaning the amount of money received from shareholders in exchange for the shares of stock.

The A category company's stocks dropped 2.57 percent to Tk 363 at the DSE yesterday.

With that, the company's share price remains at its lowest in at least the past year.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments