Too much of cement: production capacity outstrips demand

Competition in the cement industry of Bangladesh could become even narrower as smaller producers are at risk of going out of business due to overcapacity in production and increasingly higher input costs.

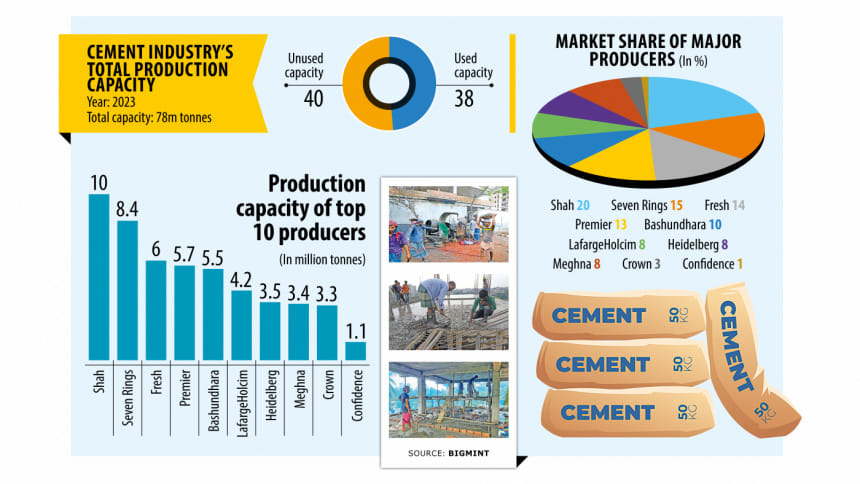

Local cement makers collectively churn out about 78 million tonnes of the construction material each year, exceeding the country's annual requirement by some 105 percent.

This data was released by Bigmint, an Indian platform for commodity price reporting, market intelligence and consulting, during the 4th Bangladesh International Trade Summit 2024.

The two-day event jointly organised by Ahmed Enterprise and Bigmint came to a close at the Pan Pacific Sonargaon Dhaka in the capital on Wednesday.

The data showed that four major producers, namely Shah Cement, Seven Rings Cement, Fresh Cement and Premier Cement, control 62 percent of the total market.

But with around 30 cement factories active across the country, the overall industry is in trouble because of higher production costs resulting from the ongoing US dollar crunch, said Shankar Kumar Roy, executive director of the Bangladesh Cement Manufacturers Association.

Besides, cement makers are facing difficulties in opening letters of credit (LCs) to import raw materials as banks are being uncooperative amid the forex crisis.

Regarding the overcapacity issue, Roy said many people invest in such industries without doing proper market research when they see there is scope to profit.

For this reason, smaller producers may face unhealthy competition and be forced out of the market.

Roy informed that the domestic cement industry is fully import based as none of the required raw materials, such as clinker and limestone, are readily available in the country.

As such, the cost of producing cement depends on raw material prices in the international market.

For example, the price of clinker is now $45 per tonne while it was $41 in 2022.

Also, the situation has only worsened due to the devaluation of the local currency against the US dollar, with importers now paying Tk 122 per greenback for opening LCs while it was Tk 118 previously.

As a result, the price of a 50-kilogramme bag of cement has increased by Tk 60 to Tk 50 over the past year. Still though, the higher prices are not making up for the increased production cost as there is no scope to pass the burden onto consumers, Roy said.

Bangladesh mainly imports cement raw materials from Vietnam, Indonesia, Thailand, Pakistan, India, the UAE, Oman, Saudi Arabia and Japan.

On the other hand, Mohammed Amirul Haque, managing director of Premier Cement Mills, does not see overcapacity as a burden for the industry as he anticipates further growth in demand for the country's continued urbanisation.

Against this backdrop, he said the manufacturers established their units with this target in mind.

Haque also said that rather than the overcapacity issue, the lack of proper market projections, gas and power supply are bigger concerns for the industry.

"So, there is nothing to be worried about regarding the overcapacity," he added while pointing out that the industry's excess production capacity can be better utilised in the future.

So, there is nothing to be worried about the over capacity of the cement industry, Haque said.

Md Jahangir Alam, vice-chancellor of the Rajshahi University of Engineering and Technology, said the cement industry is health hazardous and also pollutes the environment.

So, he emphasised on improving waste management at cement factories in industrial areas.

Alam also suggested using river routes to carry cement to save the environment and stressed the need for installing water purification systems to avoid river pollution in the process.

He also said the manufacturers should collect their required raw materials from neighbouring countries to keep costs lower and thereby ensure business sustainability.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments