No let-up in reserves slide

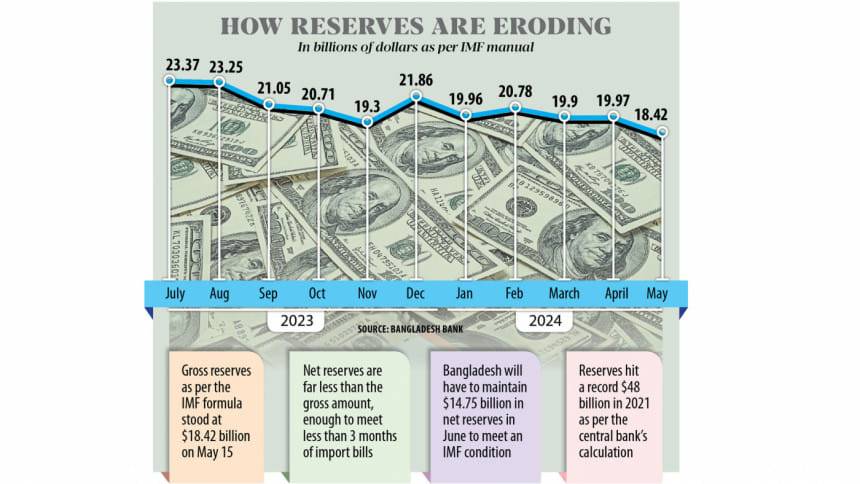

Bangladesh's foreign exchange reserves have been falling since September 2021 despite a series of government initiatives to reverse the trend.

As of Wednesday, the gross international reserves (GIR) was $18.42 billion, just enough to pay for imports over three and a half months.

The period barely meets the International Monetary Fund's minimum benchmark for countries to clear import payments.

According to Bangladesh Bank data, Bangladesh's monthly import bill is around $5 billion.

The country's net international reserves (NIR) -- the amount after deduction of foreign currency liabilities from gross reserves -- would be $13 billion, which covers two and half months of import.

The government can use the NIR at an instant, central bank officials say.

For imports, the central bank last week paid $1.63 billion through the Asian Clearing Union, an arrangement of 10 countries, including India, one of the largest trading partners of Bangladesh, for settling transactions. This caused the reserves to sink a little further.

Against this backdrop, the IMF in its latest review of Bangladesh's performance regarding the conditions for the $4.7 billion loan lowered the NIR target to $14.76 billion for June.

WHY ARE THE RESERVES FALLING?

Amid the coronavirus restrictions, import payments, international travels, and outflow of foreign currency for other purposes fell drastically, and at the same time, inflow of remittance increased, taking the reserves to a record $48 billion in August 2021.

As import payments started to rise and the economy reopened, the reserves began to fall.

In 2022, the country's forex market became more volatile as supply chain disruptions elevated commodity prices globally amid the Russia-Ukraine war.

Bankers say, mismanagement in the forex market in Bangladesh, frequent policy changes by the central bank, and the gap between the official exchange rate and the unofficial one are also to blame.

Since August 2021, forex reserves have fallen by $24 billion.

A chief executive of a private bank, seeking anonymity, says when the exchange rate of US dollar was Tk120 per dollar in the market, the central bank fixed the rate at Tk110. This prompted Bangladeshi expatriates to remit through illegal channels.

At a time when countries devalued their currencies against the dollar, the central bank of Bangladesh upheld the value of its currency, says the executive, adding that this was not a good decision.

Before 2022, the central bank used to fix the dollar vs taka exchange rate. Then the Association of Bankers Bangladesh and Bangladesh Foreign Exchange Dealers Association fixed the rate in line with the direction of the central bank.

As the initiatives failed to calm the forex market, the banking regulator last week introduced a crawling peg system. As per the system, the mid-rate of USD is set at Tk117 per dollar.

Since 2021, the BB pumped around $27 billion to the market from its reserves. The banking regulator is now more cautious when it comes to injecting USD to banks.

IMPACT ON THE ECONOMY

Some international credit rating agencies, including Fitch, put Bangladesh on a negative outlook last year because of the depleting reserves and volatile forex market.

Forex reserves is one of the major indicators of economic strength of a country, says Mustafa K Mujeri, former chief economist of the Bangladesh Bank.

When foreign investors and banks want to invest or give loans to a country, they first check its forex reserves, says the executive director of Institute for Inclusive Finance and Development, adding that the higher a country's reserves, the better its credit rating.

Every country has a policy of maintaining forex reserves to settle the import bills for at least three months. It is risky if a country does not have one, according to him. If the reserves are not respectable, foreign investors lose confidence in the country.

CENTRAL BANK'S EXPECTATIONS

The central bank expects the reserves to rise after the introduction of the crawling peg system.

BB Deputy Governor Habibur Rahman said curbing forex reserve depletion was a major focus of the central bank.

"We have introduced the new system to this end," he said, adding that the hike in the exchange rate would help raise export and remittance flow in the coming months.

"Subsequently, the deficit in the financial account will narrow. It will give a boost to the reserves."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments