Fixed expenses to eat up 40pc of next budget

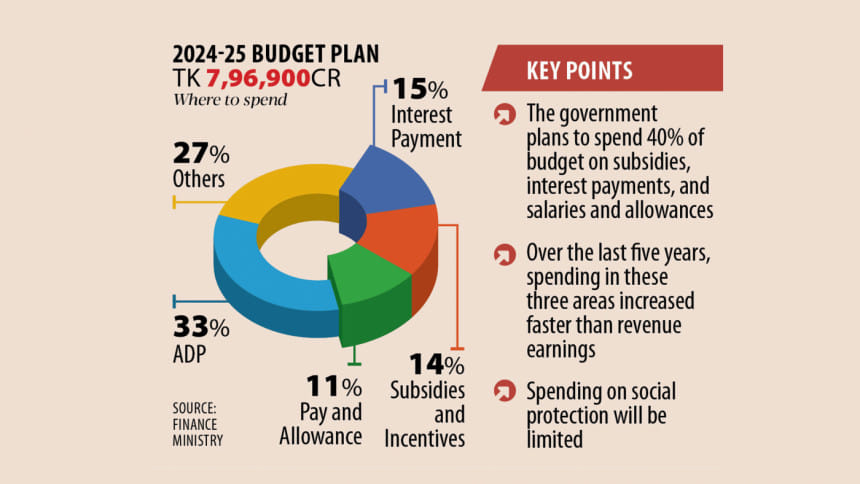

The government has to spend about 40 percent of the next budget on subsidies, interest payments, and salaries and allowances of government employees, which will limit its ability to spend on social safety net, health and education.

According to a finance ministry plan, the government may allocate Tk 3,14,700 crore for the three sectors from the total budget of Tk 7,96,900 crore in fiscal 2024-2025.

Of the allocation, Tk 1,16,000 crore will be spent on interest payments, Tk 1,11,000 crore on subsidies and incentives, and Tk 87,700 crore for paying government employees.

Over the last five years, expenditures on wages, pensions, subsidies, and interest increased faster than the revenue earnings, narrowing the government's fiscal space.

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, said, "If the non-discretionary expenditures eat up most of the budget allocation, then not much is left."

He said they had predicted a sharp rise in expenditures on wages, subsidies, and interest five to seven years ago.

"It took about 10 years for the government to fall into this pit, and it would take another 10 years to get out of it."

However, the country needs to address the problem and for this, a reform initiative is needed, he added.

He suggested bringing down domestic borrowings, subsidies and other unnecessary expenditures, and increasing revenue.

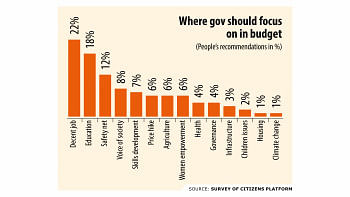

Finance ministry officials said the government was unable to increase allocation for safety net programmes, healthcare, and education due to resource constraints though it intended to spend more in those sectors.

The government spending on interest payments, both foreign and domestic, has been increasing every year.

Interest payment rates have risen in recent years, and the finance ministry projects that it may go up even more.

In the current fiscal year, the government allocated Tk 94,376 crore for interest payments, which crossed Tk 1,00,000 crore in the revised budget for the first time.

The finance ministry is going to increase the allocation by 23 percent in the next fiscal year.

Seeking anonymity, a finance ministry official said the increase in the government's treasury bond interest rate and taka's depreciation could drive up the allocation for interest payments when the next year's budget will be revised.

Finance ministry data shows that in July-January of the current fiscal year, interest payments totalled Tk 60,555 crore, a year-on-year increase of 26 percent.

The payment on the domestic front rose 15 percent to Tk 51,213 crore. Interest payment on foreign loans went up threefold.

The cost of funds, mobilised through the sales of treasury bonds, has been on the rise. This has led to an increase in the interest expenditure.

The interest rate of treasury bonds has gone past 12 percent from 8 percent in June 2023, shows Bangladesh Bank data.

Though the sales of savings instruments such as national savings certificates are currently low and the interest rates against them have fallen, many of the schemes have matured. This means the government's expenses in this segment have also gone up.

As of September 30, the government's outstanding debt stock was Tk 16,55,156 crore.

In the current fiscal year, the government's allocation for subsidies and incentives is Tk 1,11,000 crore.

A finance ministry official said that though a final figure was not fixed, it was likely that the next year's allocation would be close to that of the current fiscal year.

In several years before FY19, the government didn't provide subsidy to the power sector.

From FY19 to FY22, the government subsidy in the sector was between Tk 7,000 crore and Tk 11,000 crore. In FY23, it rose to Tk 22,000 crore.

The subsidy in the power sector stands at Tk 35,000 crore in the current fiscal year. The government is likely to keep the amount of subsidy the same in the next budget.

Though the government hiked the prices of electricity, gas and fuel several times over the last two years, subsidy expenditure in the sector is yet to come down due to huge arrears, said the official.

The government, however, is planning to reduce subsidy in power sector gradually. For this, it could hike electricity price on four to five times a year, the official added.

In the current fiscal year, allocation for government employees' salaries and allowance is Tk 80,463 crore.

Officials said the allocation would increase by 9 percent in the next fiscal year.

However, if pension and gratuity are included, the expenditure in the sector will surpass Tk 1,00,000 crore.

Though the government's expenditures in several priority sectors increased over the years, it could not make allocations for the health and education sectors in line with the Eighth Five-Year-Plan.

Due to resource constraint, the government cannot raise allocation for social safety net significantly.

In the case of old age allowance, elderly people get only Tk 600 a month.

Though the social welfare ministry asked for an increase in the monthly allowances under several safety net schemes, the finance ministry did not raise the allocation due to resource constraint.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments