Banking sector being abused by oligarchs: CPD

Oligarchs are abusing the banking systems to achieve their goals, causing harm to good governance, transparency and accountability in the financial sector, say a number of economists and experts.

There is distrust in the banking sector, which impacts the entire financial sector, they said at a dialogue organised by the Centre for Policy Dialogue at a city hotel yesterday.

Bangladesh Bank's weakness in exerting its authority; influential quarters' pressure on it; frequent policy changes; lack of punitive measures against errant banks; dual policies; and inadequate merger decisions created people's distrust of banks.

A handful of people and companies have monopolised the banking sector, which is a cause for serious concern,

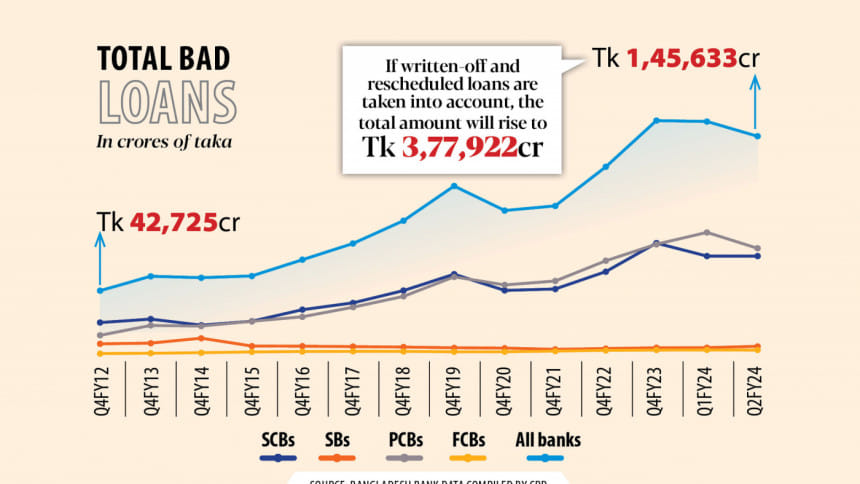

Presenting a paper at the dialogue titled "What Lies Ahead for the Banking Sector in Bangladesh?", Fahmida Khatun, executive director of the CPD, pointed out that non-performing loans (NPL) have more than tripled over the last 10 years.

She further said that stressed assets of banks stood at Tk 3,77,922 crore, which include rescheduled loans, NPLs and loans in special mention accounts that show symptoms of bad asset quality.

In addition, more than Tk 1,77,000 crore cannot be recovered now due to court orders, she added.

WEAK GOVERNANCE

People are now withdrawing money from banks as massive irregularities in the banking sector have eroded their trust, she said.

A handful of people and companies have monopolised the banking sector, which is a cause for serious concern, she said, adding that this usually ushers in a deterioration in governance.

Five of the 10 shariah-based banks were in liquidity crisis and those had been plagued by poor governance since their ownership changed. The banks' financial health deteriorated because of institutional weaknesses, she said.

Mahbubur Rahman, president of the International Chamber of Commerce (ICC), said one person is controlling five to six banks and now that person is at the helm of National Bank too.

The largest shariah-based bank is in a bad shape and nobody is doing anything about it, he added.

PRESSURE ON BB

Former BB governor Salahuddin Ahmed said recent policy measures to hike the interest rate and exchange rate have put pressure on people.

Frequent policy changes by the central bank created volatility in the market, he mentioned.

When all countries devalued their currencies, Bangladesh kept the value of the taka up. Recently it devalued the currency all on a sudden, which impacted the market, he pointed out.

On the policy of loan rescheduling, he said once the businesspeople could reschedule their loans by making 20 percent down payment. Now, they pay only 2 percent.

The former governor said the banking regulator has become a "cooperative society" due to pressure from influential quarters.

Anisul Islam Mahmud, deputy leader of the opposition in parliament, said the forming of asset management companies would not help reduce bad loans.

MA Mannan, chairman of the parliamentary standing committee on the planning ministry, said the central bank should be cautious about giving licences to new banks.

Mohammad Muslim Chowdhury, comptroller and auditor general of Bangladesh, said there was no need to help the ailing banks to stay afloat.

He said offshore banking should come under the scanner.

Public asset management companies should not be formed with the aim of reducing bad loans as they may create more problems than they solve, said Fahmida Khatun in her paper.

Mohammed Nurul Amin, former chairman of the Association of Bankers Bangladesh (ABB), journalist Syed Ishtiaque Reza, among others, spoke.

CPD distinguished fellow Mustafizur Rahman chaired the session.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments