Social safety net allocations inflated

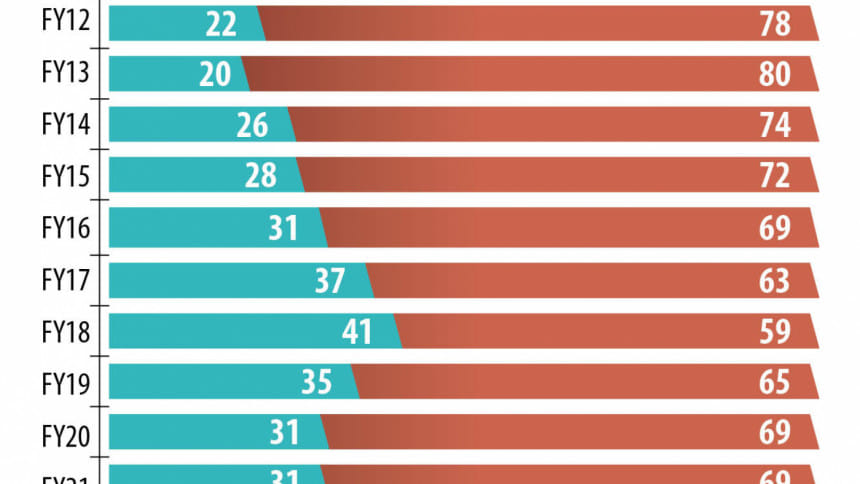

The government's allocation for social security programmes has increased over the last 15 years.

However, an increasing portion of the fund is going for the payment of pensions for retired public servants and their families and for interest payments on savings certificates -- allocations which economists contend are in the wrong category.

Data by the finance ministry showed that the allocation for the pensions and interest payments account for 30 percent of the total social security programme fund of Tk 126,090 crore for the current fiscal year of 2023-24.

The ratio of the funds earmarked for the payment of the pensions was 26 percent in fiscal year 2008-09, according to the data over safety net allocations by the finance ministry.

Economists say the allocation for the pensions and interest payments should not come in the category of social security programmes.

Social safety net is meant for the protection of people who are vulnerable for being financially insolvent. Hence, the inclusion of such items in the list inflates the size of the total allocation instead of serving the people in need.

Mohammad Abu Eusuf, professor of development studies at the University of Dhaka, said the idea of the social safety net was to protect people in need of financial assistance.

Schemes such as old age allowance, employment generation programmes for the most financially insolvent people, and food distribution among low-income people fall into the category well, he said.

"Non-poor people get pensions and interest on savings certificates. So, the allocation for these areas should be shown separately from the allocation for the social safety programmes," he said.

"This will enable people to know the amount of funds truly spent for poor and low-income people," said Eusuf.

Bangladesh has 115 social security schemes and 39 ministries implement the schemes, he said.

If the allocations for the pensions and interest payments are shifted into another category, the overall allocation for social safety net schemes will decline, he said.

In its analysis of the budget for the current fiscal year of 2023-24, the Centre for Policy Dialogue (CPD) in June last year classified the social safety net programmes (SSNPs) into three categories -- acceptable, quasi-acceptable and non-acceptable.

Acceptable schemes are those that should naturally be included in the SSNPs. Quasi-acceptable schemes fall somewhere in the "grey" area and non-acceptable are those that should be excluded from the list, it said.

By analysing the allocation, the CPD said, "The SSNP budget continued to remain artificially inflated. Seemingly unrelated allocations are reported in SSNP list."

The independent think-tank said the share of compatible SSNPs in total social safety net schemes declined from 62.2 percent in fiscal year (FY) 2009-10 to 29.2 percent in FY 2023-24.

Its share as a percentage of the gross domestic product (GDP) fell by more than half from 1.6 percent in FY 2009-10 to 0.7 percent in FY 2023-24, according to the CPD.

Hossain Zillur Rahman, executive chairman of the Power and Participation Research Centre (PPRC), said allocations for the pensions should be excluded immediately.

"It is not social protection per se," he said, adding that there are many programmes that do not fall in the category of social protection.

If the items included in the list of social security are examined thoroughly, the allocation for social safety net will decline to one percent of the GDP, added Rahman, who follows poverty and social protection issues.

The finance ministry says allocations for social security schemes for FY 2023-24 amount to 2.52 percent of the GDP.

He suggested for redesigning the social protection programmes keeping in mind the rise in urban poverty and climate change. He also pointed at the persistently high inflation and recommended increasing allocations for safety nets to help the financially insolvent.

"There are multiple viable opportunities," he said, adding that stipends for primary schools could be hiked and universal health coverage programmes could be expanded.

"But it is not a matter of allocation only, it is a matter of monitoring and innovation," said Rahman.

"The low-income and marginalised population groups are in peril amidst the prolonging inflationary pressure. It demands more targeted support for these groups through social protection programmes," said CPD Senior Research Fellow Towfiqul Islam Khan.

"Surely, fiscal space is limited for the government to dedicate resources to this end. Hence, reallocating resources may be required to extend adequate finance," he said.

"Making it a top priority in the upcoming national budget needs strong political will and commensurate actions," he added.

"The effectiveness of the social protection budget will be determined by putting resources into appropriate social protection programmes. Policymakers should avoid any attempts at an eyewash," said Khan.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments