A temporary tax cut can be a boost

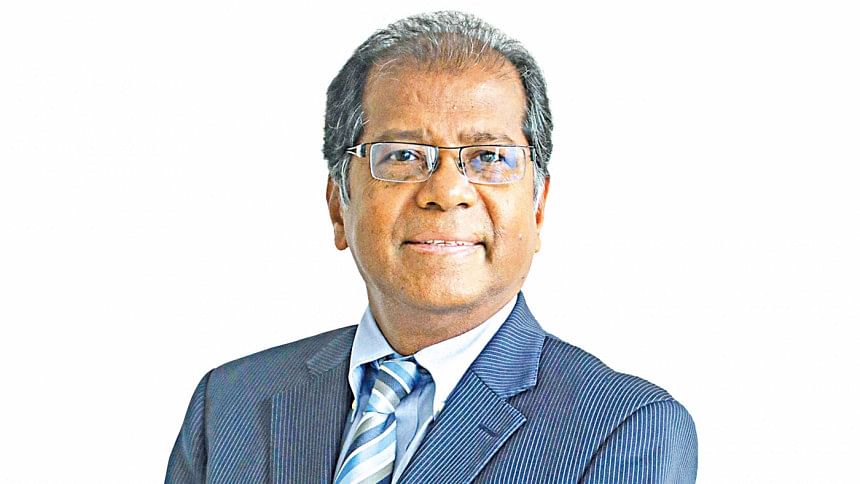

Kanti Kumar Saha

Chief Executive Officer, Alliance Finance

The key challenges facing NBFIs or finance companies are rooted in an image problem due to governance issues of some of the NBFIs. The current Non-Performing Loan (NPL) rate of around 30% is largely due to scams, wrong borrower selection, and the absence of a robust risk management culture. In addition to governance, non-compliance with regulations and human resource issues are also major challenges. The NBFI sector as a whole has failed to attract an adequate number of skilled resources due to ongoing problems and the image of the sector.

Addressing these governance issues should start at the board level. The recent Finance Company Act has possibly, for the first time, addressed some of the governance-related issues, including eligibility criteria for Directors, Independent Directors, CEOs, and CXOs, but much will depend on the fullest implementation and compliance of these regulations. The appointment of Independent Directors for non-listed NBFIs is a good step.

Secondly, supervision needs to be effective in the context of ongoing digitization in the overall financial sector. The use of technology in the NBFI sector is also growing, necessitating staff with IT knowledge and familiarity with core banking solutions.

Thirdly, policies need to be adopted in a manner so that banks and NBFIs can complement each other instead of competing with each other. Few NBFIs can be brought under a separate cell to monitor and support closely for improvement. Sometimes measures taken to address the problems of weaker NBFIs restrict the growth of better players in the industry.

NBFIs also lack liquidity support similar to that available to banks. Guidelines can be made that a specific percentage of investment on minimum capital, allowing the sector to receive liquidity support in emergencies. Government support in these areas is also crucial for sectoral growth.

Profitability in this sector has significantly dropped due to interest rate caps. These factors are interconnected with the capital market. When regulated sectors like banks, insurance, and financial institutions experience decreased profitability, it impacts the capital market too. In the first quarter of this year, available information on several listed NBFIs witnessed significant drops in interest income due to repricing of deposits on a daily basis while loan repricing is allowed only after six months. People in the sector are expecting detailed guidelines on withdrawal of the interest rate cap soon, like banks.

In the absence of savings or current accounts, the cost of funds of NBFIs is much higher than banks, which results in margin pressure as well as reduced profit in an interest rate cap regime. Additional provisions have just aggravated the profitability further due to the increasing trend of NPL. Moreover, businesses are going through various challenges, and borrowers are increasingly failing to repay the money. In this context, a tax cut for an interim period for the sector can be a boost for the profitability trend as well as have a positive impact on the capital market.

Last but not least, drastic reforms of the legal framework to expedite the decision-making process in the money loan court are crucial for the recovery of bad loans. Recent policies on willful defaulters are another good step in this context.

At a glance

- Alliance Finance PLC (AFPLC), although only six years old, is a prominent Non-Bank Financial Institution (NBFI) that obtained its license from Bangladesh Bank in 2017 and has since maintained a strong presence in the financial sector with its product differentiation. The institution has established and nurtured beneficial relationships with several banks, such as Sonali Bank, Janata Bank, Commercial Bank of Ceylon, Woori Bank, United Commercial Bank, Mutual Trust Bank, Midland Bank Limited, etc.

- Through its Structured Finance Department, Alliance Finance has successfully completed 15-year funding arrangements under syndication from World Bank refinancing funds for two infrastructure projects by playing the lead arranger role with an interest rate slightly above 6%. Their commitment extends beyond traditional finance, emphasizing a proactive approach to achieving positive social impact and ecological balance. Prioritizing risk management, Alliance Finance employs thorough credit analysis and forward-looking selection criteria in client selection.

- Alliance Finance is committed to offering user-friendly digital financial services, aiming to enhance convenience and accessibility for its clients. With a commitment to innovation, it has showcased a wide array of products, ranging from corporate finance, SME, and retail banking to structured finance, sustainable finance, women entrepreneur financing, green finance, and nano loans, among others.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments