Fitch lowers Bangladesh rating as external buffers weaken

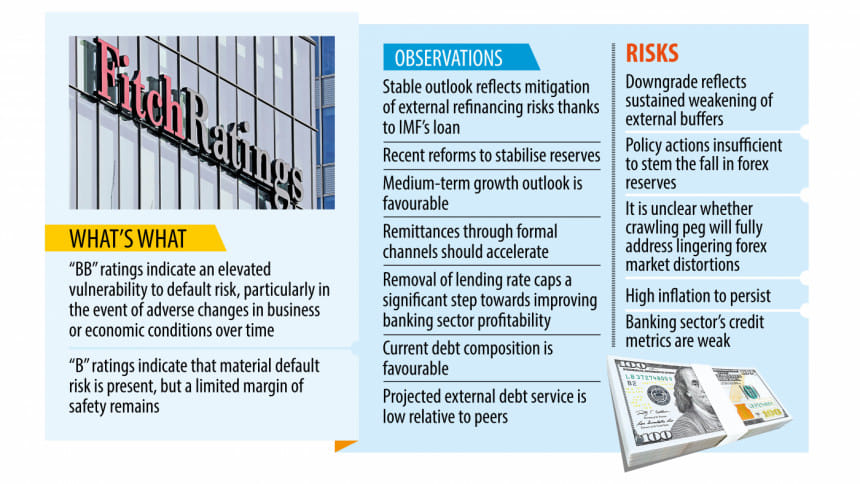

Fitch Ratings yesterday downgraded Bangladesh's long-term foreign-currency issuer default rating to "B+" from "BB-" owing to the lingering weakening of the country's external buffers.

However, the outlook is stable, said the agency in a report.

"BB" ratings indicate an elevated vulnerability to default risk, particularly in the event of adverse changes in business or economic conditions over time. It, however, means business or financial flexibility exists that supports the servicing of financial commitments.

"B" ratings indicate that material default risk is present, but a limited margin of safety remains. It also means financial commitments are currently being met but the capacity for continued payments is vulnerable to deterioration in the business and economic environment.

Fitch said the downgrade of Bangladesh's ratings reflects the sustained weakening of the external buffers, which could prove challenging to sufficiently reverse despite recent policy reforms, leaving the country more vulnerable to external shocks.

"Policy actions since early 2022 have been insufficient to stem the fall in foreign exchange reserves and resolve domestic dollar tightness."

The central bank has raised the policy rate by 375 basis points in the last three years to tame inflation. Still the situation has not come under control owing to external and internal factors and cheaper funds driven by the lending rate cap and market mismanagement.

Similarly, the foreign currency reserves are down substantially due to continued interventions, capital outflows, and the persistent use of informal channels for remittances.

Reserves have fallen by 15 percent from January 2024 levels to $18.4 billion. It is, however, far lower than the $41 billion accumulated in August 2021. "We project reserves to stabilise on recent reforms," Fitch said.

The recent shift to a crawling peg aims to increase exchange-rate flexibility. Whether this will fully address lingering forex market distortions and support significant reserve build-up remains unclear, according to the report.

Fitch said the stable outlook reflects the mitigation of external refinancing risks by a favourable external creditor composition -- the International Monetary Fund (IMF) programme, which aims to improve macroeconomic stability and address banking sector weaknesses, moderate government debt and favourable medium-term growth prospects.

It, however, said uncertainty remains around the implementation of the new forex regime, and to what extent the official rate will be permitted to align with the parallel market rate.

Bangladesh Bank has said the crawling peg is an interim arrangement before moving to a fully flexible market-based exchange rate.

"Further moves to increase exchange rate flexibility may be complicated by persistent high inflation," the ratings agency said.

In Bangladesh, the domestic US dollar scarcity has resulted in effective import restrictions, as authorities manage the allocation of forex. Lower imports from such measures and sustained export growth drove the current account surplus to a Fitch-estimated 1.4 percent of GDP in the fiscal year ending on June 30.

"Greater forex flexibility should ease US dollar shortages, which could drive up imports in the next few years."

According to the US firm, the impact on the current account should be modest, as remittances through formal channels should also accelerate with better alignment between the official and parallel market exchange rates.

Fitch expects high inflation to persist due to domestic supply shortages, import restrictions and a weaker exchange rate.

Inflation in FY24 has so far averaged 9.7 percent, far above the central bank's target of 7.5 percent. It averaged 9.02 percent in the last financial year.

The removal of interest rate caps for banks and non-bank financial institutions could bode well for monetary policy transmission, it said.

It also highlighted the country's low revenue collections.

The low revenue-GDP ratio is a long-standing fiscal weakness. At 8.2 percent of GDP, this is far lower than the 19.5 percent "B" median.

Revenues continue to underperform budget targets owing to prevailing tax exemptions, weak tax administration and challenges in implementing tax reforms.

Several tax reforms are planned under the IMF programme, which was agreed in January 2023. Some measures to increase revenue collection, including tax hikes on tobacco and land registration, have been implemented. These measures pose an upside risk to its revenue forecasts, said Fitch.

The report describes the medium-term growth outlook as favourable, supported by a well-established readymade garment sector, demographic dividend, and stable remittance inflows.

In the near term, however, it expects growth to moderate to 5.3 percent in FY24 due to the US dollar shortage that is likely to weigh on investment and the high inflation-reducing consumption.

The current debt composition was termed as favourable.

The medium-term external debt is owed either to bilateral or multilateral partners, and financing from these sources is likely to continue, supporting ongoing debt service capacity, notwithstanding US dollar shortages.

Projected external debt service is low relative to peers, averaging about 9.2 percent of current external receipts over 2024-2025, against a "B" median of 20 percent. The IMF programme also supports continued access to multilateral and bilateral financing, subject to meeting programme targets.

It said gross government debt would increase gradually to about 40 percent of GDP over the medium term, from about 36 percent in FY23, but still well below the current "B" median of 55 percent.

Budget underperformance owing to a revenue shortfall, high borrowing costs, extension of forbearance measures to the banking sector and potential contingent liabilities owing to weaknesses in the banking sector and debt of state-owned enterprises are risks to the fiscal position.

Speaking about the weak banking sector, it said the sector's credit metrics - asset quality, capitalisation and governance standards - are weak, especially those of public-sector banks.

The non-performing loan ratio was 9 percent in 2023, while that of state-owned banks was about 21 percent.

"These ratios could rise once forbearance measures are withdrawn. The sector could be a source of contingent liability for the sovereign if credit stress intensifies."

The removal of lending rate caps on banks and NBFIs is a significant step towards improving the banking sector profitability, Fitch added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments