Millions of Shopkeepers Using TallyKhata App for Records and Payments

Buying daily essentials from Rahim Store is a routine for many, with products conveniently delivered via WhatsApp or phone call. Two years ago, I received an SMS from the TallyKhata app detailing my purchase. Curious, I asked Rahim about it, and he explained how TallyKhata simplified his business operations by replacing lengthy account books. This introduction to TallyKhata led me to discover its popularity among Bangladeshi shopkeepers.

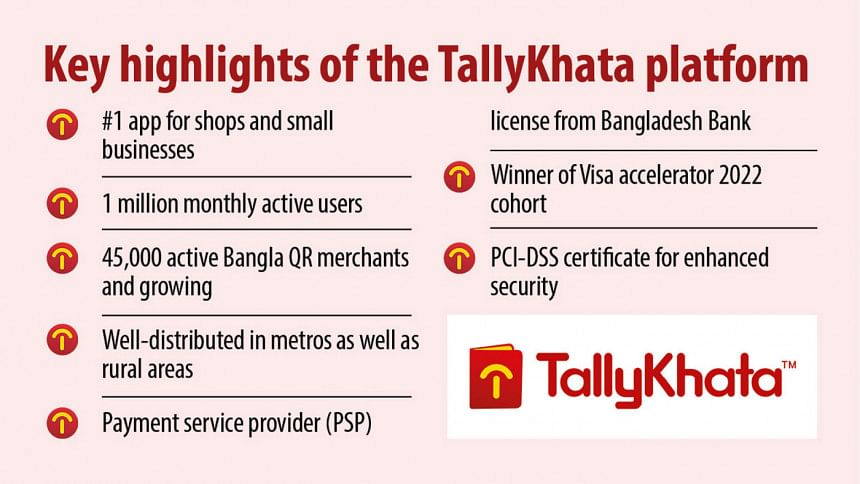

To learn more, I spoke with Dr. Shahadat Khan, TallyKhata's CEO, who highlighted the app's focus on filling the digitalization gap for micro and small businesses in Bangladesh. Launched in 2020 amid the Covid-19 pandemic, TallyKhata quickly gained over a million monthly active users, becoming a staple among shops and small businesses nationwide.

Simplified Business Accounting

TallyKhata is a simple app in the Bangla language. Through this app, a small business owner can easily manage necessary accounts. They can add their customers and suppliers one by one. The app offers two options for recording transactions: Pelam ("received") and Dilam ("given"). To ensure ease of use for all types of users, accounting terms like debit or credit are not used. A transaction can be entered within three to ten seconds.

A small business owner can easily get an overall view of their business through the TallyKhata dashboard. The total receivables, payables, and income and expense statements are all visible at a glance.

Accepting Digital Payments from Customers

In addition to managing business accounts, TallyKhata provides digital wallets and QR codes for shop owners, allowing customers to make payments from any bank or mobile banking app in Bangladesh. Operating under the Bangladesh Bank's Payment Service Provider license, TallyKhata introduced Bangla QR, enabling payments via a single QR code. Shopkeepers can apply for a digital wallet and QR code through the TallyKhata app, using an electronic Know Your Customer (eKYC) process.

Comprehensive Banking and Financial Services Opportunities

TallyKhata is the largest digital platform for micro and small businesses in Bangladesh. Business owners regularly record transactions and accept digital payments here. Millions of business owners have completed electronic KYC on this platform. It is the largest active database of Bangladeshi shopkeepers and micro-businesses.

A significant portion of micro-businesses lack banking facilities due to high customer acquisition costs, product distribution challenges, and lack of client data. TallyKhata aims to help banks address these issues using modern eKYC, big data, and credit scoring technologies. It collaborates with various banks and financial institutions in Bangladesh to deliver comprehensive banking services to shopkeepers and small business owners.

Digitizing the Informal Sector for a Cashless and Smart Bangladesh

TallyKhata is not just an app for managing business accounts and payments; it enables communication with 1 million shopkeepers nationwide. It is especially popular among rural and marginal shopkeepers, enhancing their digital capabilities and facilitating information exchange.

With over ten million micro and small businesses, the informal sector contributes 28% to Bangladesh's GDP and 80% of employment outside agriculture. To achieve a Smart Bangladesh by 2041, integrating these businesses into digital services is crucial, and platforms like TallyKhata are key to this effort.

About the Company Behind TallyKhata

TallyKhata and TallyPay are developed by Progoti Systems Limited (PSL), a FinTech company in Bangladesh focusing on digital financial services and the digitalization of the informal sector. PSL previously implemented the largest digital payment disbursement project in the country via SureCash, benefiting 10 million families.

Dr. Shahadat Khan, the founder and CEO, was a BUET faculty member and completed his PhD in Canada. The company, backed by foreign investment from venture capital firms in Japan, Singapore, Hong Kong, and Canada, including SBI Group and Standard Chartered Bank Ventures, aims to advance Bangladesh's digitalization.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments