Tight budget in austere times

With an aim to restore macroeconomic stability, reduce inflation, and contain pressure on foreign currency reserves, Finance Minister Abul Hassan Mahmood Ali is going to place a Tk 7,96,900 crore budget for the 2024-25 fiscal year tomorrow.

"The upcoming budget will be a tight and cautious one," a top finance ministry official involved with the budget formulation told The Daily Star.

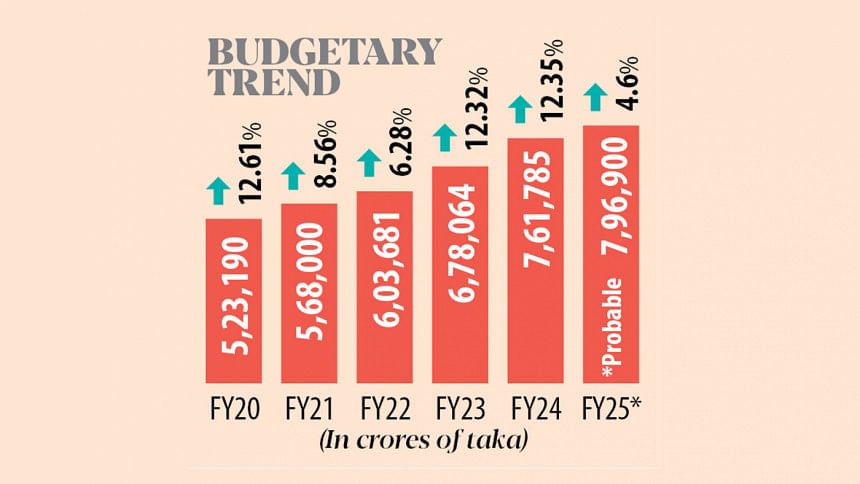

The new budget is likely to be just 4.6 percent bigger than the current one, much lower than the year-on-year average spike of 11 percent seen in the last five years. The current fiscal year's budget was 12.35 percent larger than the previous year's.

Even during the peak of the coronavirus pandemic, which brought the economy to a halt amid countrywide lockdowns, budgets grew around 9 percent.

The finance minister is going to place his first budget at a time when the economy is going through a prolonged economic crisis, driven by both external and internal factors.

The government's fiscal position has tightened owing to lower-than-expected revenue collections. Therefore, it is not possible to raise the budget size as per expectations.

Zahid Hussain, a former lead economist at the World Bank's Dhaka office, said the ongoing crisis has three dimensions: high inflation, the US dollar crunch, and the financial distress.

"It is difficult for the finance minister to handle the situation politically, but it is needed for the economy."

He said those who supported the government during the last election will try to reap the benefits. Therefore, he urged the finance minister to strike a balance between the economic needs and the interests of big players.

"Success will depend on that balance only."

Mostafa Kamal, the previous finance minister, placed his first budget in 2019-20 when it was 12.61 percent bigger than the previous one. His predecessor AMA Muhith presented a 12.59 percent larger budget in 2013-14.

Yesterday, finance ministry officials said the government's prime target is to contain inflation, resolve the dollar crunch and achieve a moderate GDP growth.

Average inflation grew 9.73 percent in the first 11 months of the current financial year, which was 8.64 percent during the identical period a year prior. In 2022-23, the average inflation rate was 9.02 percent, far higher than the average of 6 percent in recent years.

When it comes to the foreign currency regime, Bangladesh has been witnessing one of the worst dollar shortages in recent times, as higher outflows of the American currency owing to escalated commodity prices and money laundering exceeded inflows.

The economic growth was one of the major victims of the current crisis. The country registered a 5.82 percent growth in gross domestic product (GDP) in 2023-24, up from 5.78 percent in FY23. This was, however, lower than in previous years.

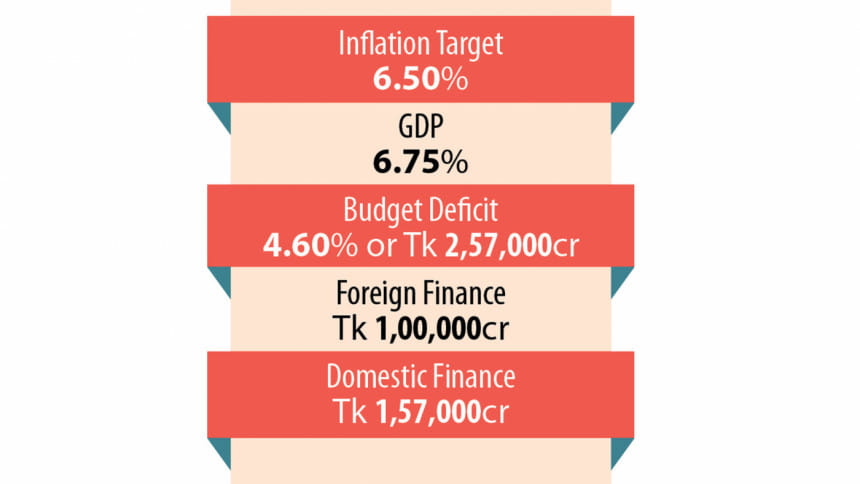

The economic growth target was set at more than 7 percent in the current fiscal year, and the target for next year is likely to be 6.75 percent.

The government has also set an ambitious inflation target of 6.5 percent.

In the upcoming budget, the government is likely to contain the budget deficit to 4.6 percent of GDP, a level last seen a decade ago. The deficit is likely to be Tk 2,57,000 crore.

The government has plans to get foreign loan and grant allocations of Tk 1,00,000 crore. The rest of the Tk 1,57,000 crore of deficit will be met by domestic borrowing.

According to the officials, the bank borrowing target for FY25 will be more or less the same as the current fiscal year's Tk 1,32,000 crore.

"It is to avoid the crowding-out effect for the private sector," said an official.

Zahid Hussain said under the economic circumstances, the budget deficit should be less than Tk 2,30,000 crore.

"It will be good for containing inflation and curbing the foreign exchange pressure. Besides, the private sector will get sufficient loans."

The government has for the first time reduced its funding for the Annual Development Programme.

The highest expenditure for FY25 would likely be for interest payments at Tk 1,29,000 crore. Subsidies may cost Tk 1,12,000 crore while government officials' salaries and pensions may total Tk 1,00,000 crore.

In revenue collection, the government is likely to set an achievable target of Tk 5,40,000 crore, an eight percent increase over the previous year's.

The target for the National Board of Revenue is likely to be Tk 4,80,000 crore.

The budget may include an opportunity for legalising undisclosed wealth by paying 15 percent tax.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments