5G technology remains a pie in the sky. Why

Is 5G merely a vanity, just another technology that offers nothing extraordinary? Or has it emerged as a central cog in transforming the digital space by resolving issues related to low speed and latency?

Despite being launched years ago across the world, firm answers to these questions are yet to be produced. But if you look at statistics, it may surprise you.

Over 1.5 billion people – more than one in every four mobile subscribers globally – now use the fifth-generation technology standard for cellular networks, widely known as 5G.

The technology offers several advantages over previous generations, including faster data speeds, lower latency, and greater capacity to connect multiple devices simultaneously.

Its impact spans industries like healthcare, autonomous vehicles, virtual reality and many more.

Such benefits make it attractive for both consumers and businesses and its widespread adoption indicates significant impact, suggesting that 5G is more than a passing trend.

But for Bangladesh, the launch of this technology, which promises faster speeds and broader connectivity capabilities, remains a far cry.

Although the rollout of 5G was part of the ruling party's election manifesto in 2018, the technology has so far been limited to trial runs.

Globally, operators began launching 5G networks around 2019, with initial rollouts in major urban areas. By 2021-2022, 5G adoption peaked as more operators expanded coverage and consumers embraced the technology.

According to the GSMA, by 2025, 5G networks are likely to cover one-third of the world's population, which would have a profound impact on both the mobile industry and its customers.

But in Bangladesh, sluggish moves to prepare 5G guidelines, operators' reluctance and a lack of readiness are hindering the launch of the technology.

REGULATORY DELAYS

As the election manifesto of Bangladesh Awami League set out the aim to launch 5G by 2021 to 2023, Bangladesh Telecommunication Regulatory Commission (BTRC) formed a committee and multiple subcommittees to issue 5G guidelines ahead of its roll-out.

The committee, which is represented by all stakeholders, including officials from intelligence agencies, academics and policymakers, was tasked with drafting the guidelines so 5G could be launched in Bangladesh by the end of 2022 or 2023.

To do so, the committee had to choose a suitable spectrum for the service and fix the price of the spectrum among others.

Later, the BTRC designated 2.3 GHz, 2.6 GHz and 3.5 GHz spectrum bands for 5G technology-based cellular mobile services, according to the BTRC's documents.

In March 2022, the telecom regulator issued Instructions for Radio Frequency Auction – 2022, announcing it would hold the spectrum auction for 2.3 GHz and 2.6 GHz bands on March 31, eying to roll out services by that year.

In its instruction, the BTRC made it mandatory for operators to launch 5G services within six months from the date of the spectrum auction.

"The Commission shall immediately issue Cellular Mobile Service Operator Licence (unification of 2G, 3C, 4G, 5G and beyond) for further expansion of 5G and beyond cellular mobile services," it said.

"In this regard, the terms and conditions of the said licence will be applicable for the deployment of the networks for 5G and beyond cellular mobile technologies," it said.

The country's four mobile phone operators bought 190 megahertz (MHz) of spectrum for $1.23 billion on March 31, 2022, but the regulator failed to issue guidelines that year.

Finally, in 2024, nearly two years after the 5G spectrum auction and over 4 years after the start of the process of the formulation of the guidelines, the BTRC issued a licensing guideline.

However, the guideline failed to explicitly outline the 5G roll-out obligation and omitted the word "5G" from the headline amid the operators' unanimous stance against immediate 5G roll-out.

WHY ARE OPERATORS RELUCTANT?

In March 2022, market leader Grameenphone bought 60 MHz in 2600 band for Tk 3,361 crore. The same was done by Robi, the second largest operator.

Banglalink took 40 MHz in the 2300 band for Tk 2,241 crore while state-run Teletalk 30 MHz in the same band for Tk 1,681 crore.

The Daily Star spoke to around a dozen officials of mobile network operators and top officials of their parent companies over the past year and all of them expressed reluctance to roll-out 5G.

They said rolling out 5G is not financially viable due to high infrastructure costs, consumer affordability concerns, and uncertain returns on investment.

However, the differences between 4G and 5G networks are substantial. 5G offers significantly faster data speeds, potentially reaching up to 10 gigabits per second (Gbps) compared to 4G's maximum of around 1 Gbps.

5G reduces latency to as low as 1 millisecond (ms), compared to 30-50 ms for 4G, enabling near-instantaneous communication critical for applications like autonomous vehicles and real-time gaming.

But officials pointed out that both 4G and 5G enable users to access mobile data services for quality internet, streaming media, and accessing online content.

"For us, bringing 4G to all, not 5G for a few, is the number one priority," said Kaan Terzioğlu, group chief executive officer (CEO) of Banglalink's parent company Veon.

In an earlier interview with The Daily Star, he added that he was not a big fan of the vanity of 5G.

"I see that mobile internet access in the country is growing but I believe '4G for all' -- the vision that we initiated at Banglalink -- still needs a lot of work," he added.

He also pointed out that almost half of the mobile users in Bangladesh still do not even use 4G.

Currently, over 55 percent of mobile subscribers in Bangladesh use 4G networks.

Sigve Brekke, president and CEO of Telenor, the parent company of Grameenphone, said in a recent interview that Grameenphone has established extensive 4G coverage across Bangladesh and now aims to improve indoor connectivity.

Regarding their 5G launch plans, he noted consumer benefits of 5G are minimal compared to 4G.

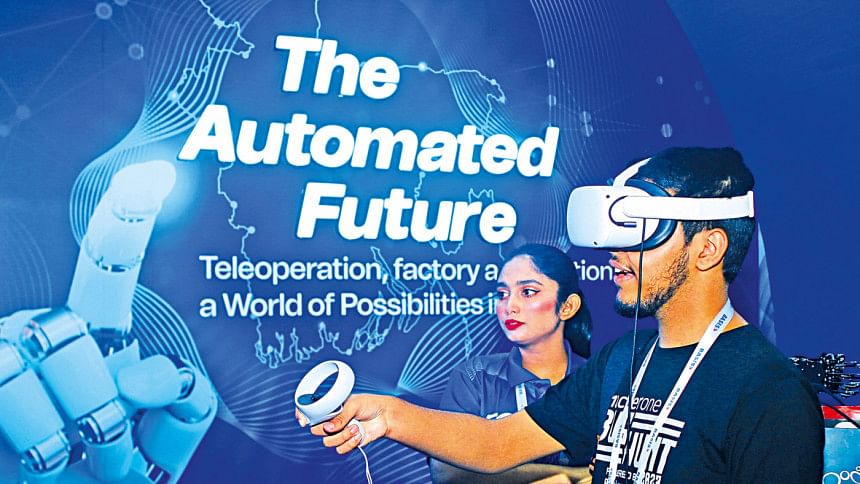

"5G's true value lies in specialised use cases, such as digitising ports, airports, hospitals and industry," he said.

He emphasised the need for specific 5G applications, such as factory automation, to justify its implementation.

This is because simply deploying 5G without targeted use cases is not a viable business model, he added.

Some industry people said Bangladeshi consumers are not ready for 5G. According to the BTRC and official of operators, only 3 to 4 percent of mobile users have 5G devices.

"In order to assure the use of updated technology, the right device is also necessary. Bangladesh's perspective should be strengthened in this regard," Vivek Sood, group chief executive officer of Axiata Group, the parent company of Robi Axiata, told The Daily Star in an interview.

But despite their unwillingness to launch 5G in the near future, the operators have already completed the successful trial run of the technology.

Although Bangladesh became one of the first nations in Asia to launch 2G in the 90s, 3G only arrived in the country in 2013 and 4G in 2018 – a significant delay since the technologies were launched around the world in the early and late 2000s respectively.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments