Govt to bank on crawling peg, global interest rate cuts to rebuild reserves

The crawling peg that has almost made the exchange rate market-oriented as well as the falling global interest rates will help Bangladesh rebuild its foreign currency reserves, the finance ministry said.

The high interest rates prevailing in the advanced economies is one of the major reasons for the dwindling reserves in Bangladesh, said the finance ministry in its medium-term macroeconomic policy statement.

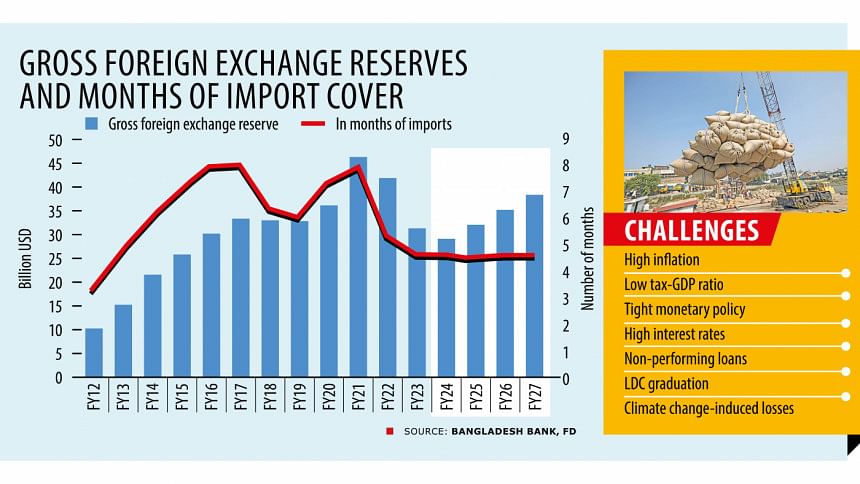

The revised gross forex reserves target for the current fiscal year ending on June 30 was $29.1 billion. It stood at $24.23 billion on June 5, according to the traditional calculation of the Bangladesh Bank. To meet the goal, another $4.87 billion will have to be added to the reserves by this month.

The reserves amounted to $18.67 billion as per the International Monetary Fund's calculation, less than half of the $41 billion seen in August 2021.

The good news for Bangladesh is that central banks around the world are either cutting interest rates or have kept them on hold, a positive development for the countries that saw investors pulling their money out of Asian countries in late 2021, triggering currency depreciation in most of the economies.

On Thursday, the European Central Bank reduced interest rates, the first rate cut in nearly five years. On Wednesday, the Bank of Canada became the first G7 central bank to reduce borrowing costs in the past few years.

Central banks in Switzerland and Sweden have also decreased interest rates this year. The US Federal Reserve will cut its key interest rate in September and once more this year, reported Reuters on Wednesday, citing a poll.

"The interest rates around the world seem to have peaked, and it would come down in the medium-term, which will help rebuild the reserves in Bangladesh," the finance ministry said.

It is also aware that this high-interest rate regime in the advanced countries may continue for a while. Hence, it will be challenging to increase reserves in the coming months.

On May 8, the BB withdrew its traditional fixed exchange rate mechanism and introduced the crawling peg system for spot purchase and sale of US dollars. Under the arrangement, a crawling peg mid-rate has been set to Tk 117 per USD.

"It is expected that the introduction of the crawling peg exchange rate system will help stabilise the exchange rate in the near future. Hence, the reserves are also expected to grow in the following years," the finance ministry report said.

The report has identified seven challenges facing the economy, including higher inflation and classified loans in the banking sector.

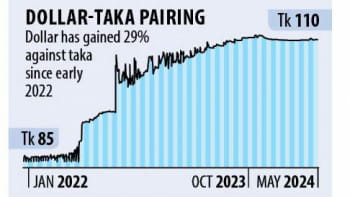

The taka has depreciated against the US dollar since the middle of 2022, primarily due to falling reserves. This depreciation is, in turn, fuelling domestic inflation through increased costs of imports.

The taka against the dollar weakened by 7 percent during July-May of the current fiscal year against a 14.4 percent fall in the identical period of 2022-23. Overall, the taka has lost its value by 36 percent since the Russia-Ukraine war began in February 2022.

According to the report, classified loans and lack of financial discipline have become a concern recently.

"Restoring discipline and painful restructuring, such as mergers, may need to be completed for some banks. The process may be lengthy as well as difficult."

The top priority for the government in FY25 is to contain high inflation.

Last year, it was projected that inflation in Bangladesh would remain around 6 percent in FY24. However, inflation remained high mainly due to the pass-through effect of the sharp depreciation of the taka.

In May, inflation, a measure of the increase in the prices of a basket of commodities and services, edged up to 9.89 percent. The trend is likely to continue at least for some months, the report warned.

Although the developed countries have been more successful in reining in consumer prices through appropriate policy measures, developing countries like Bangladesh are still struggling in this regard, it said.

In order to contain inflation, the government is increasingly tightening monetary and fiscal policy stances and providing necessary support to boost domestic agricultural and industrial production to keep supply stable.

"These factors are expected to ease the current inflationary pressure in FY25 and bring inflation down to 5.5 percent by FY27," the report said.

However, the contractionary monetary and fiscal policies could hurt the economy.

"The tight monetary and fiscal policy stance is making the business environment difficult. If inflation does not come down in the next few months, the high-interest rate prevailing in the market may have adverse impacts on the GDP," the report said.

It said Bangladesh's graduation from the group of the least-developed countries in 2026 will gradually diminish certain benefits, necessitating emphasis on export diversification, increasing productive capacity, and improving the business environment.

It also talked about the tax-GDP ratio, which is lower than in comparable countries.

"This indicates that there is substantial room for reforms and new initiatives in the tax collection system. Designing those reforms may be challenging."

The report projects agricultural and industrial production will remain strong in FY25, and it will contribute to the growth of the economy.

"Growth in advanced countries will remain stable in the medium-term, and it will contribute to the growth of export items from Bangladesh."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments