Universal pension scheme now has 3,03,176 registrations

The number of registrations in the universal pension scheme has crossed the three-lakh milestone in only 10 months of its launch, the National Pension Authority (NPA) said today.

The number of registrations stood at 3,03,176 as of yesterday, according to a press release of the NPA.

Total deposits in the scheme now stand at Tk 86.68 crore and of it Tk 62 crore has been invested at treasury bonds.

Prime Minister Sheikh Hasina inaugurated the universal pension scheme on August 17 last year to ensure sustainable and well-organised social security for elderly people.

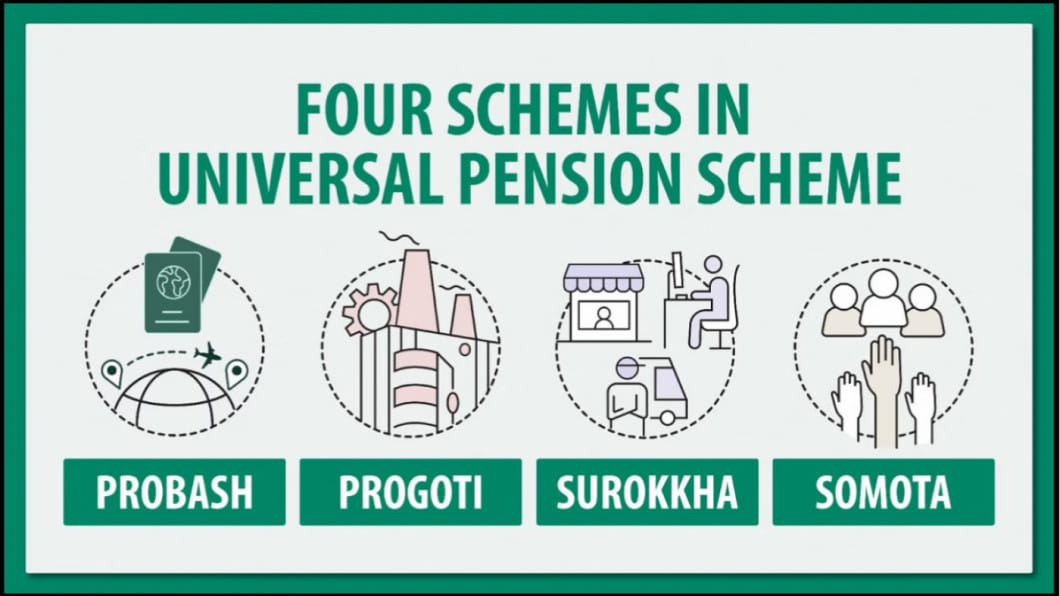

Initially, the universal pension scheme started its journey with four schemes: Probash, Progoti, Surakkha and Samata.

Later, a new scheme Pratyay was introduced for the officers and employees of all self-governed, autonomous, and state-owned organisations, which will come into effect from July 1 this year.

Until yesterday, the number of registrations to Probash scheme reached 799 while Progoti 21,294, Surakkha 56,919 and Samata 2,24,164.

The pension scheme authority said the field administration got involved to deliver the benefits of the scheme to the doorsteps of the people.

Besides, universal pension operations implementation and coordination committees have been formed with the leadership of principal secretary of the Prime Minister's Office (PMO) at national, divisional, district and upazila level.

Furthermore, the PMO officials have been entrusted with department-wise monitoring.

The NPA said currently, two public banks, two private banks and one mobile financial service provider are being involved in collecting the monthly subscriptions of the pension scheme.

To expedite the overall pension scheme operations, the authorities are also taking steps to involve four more public banks, four private banks and one mobile financial service provider in the monthly subscription realisation process.

According to the NPA, in the schemes, beneficiaries aged between 18 and 50 can pay subscription until 60 years of their age and beneficiaries aged above 50 years can pay subscription for 10 years to receive pension until their death.

Any Bangladeshi citizen working or staying abroad can also participate in this scheme.

In case of death of any beneficiary, the nominee of the pensioner will receive pension for the remaining years until the pensioner turns 75.

If the subscriber dies before paying the subscription for at least 10 years, the deposit will be returned to his nominee along with the profit.

Subscriber can withdraw maximum 50 percent of his deposit as loan.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments