Go for recycled garments to boost exports

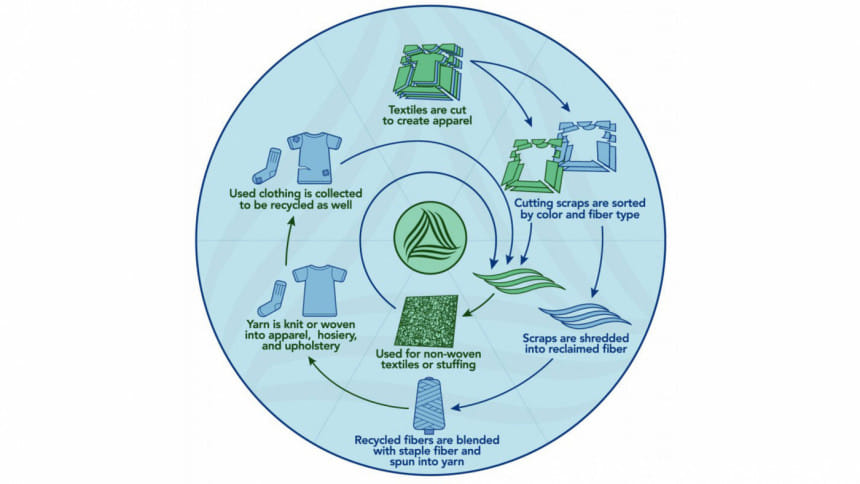

Bangladesh should soon go for producing recycled garment products that meet global environmental safety standards to increase its exports to the European Union (EU), according to speakers at an event.

Changes in trade patterns often bring major shifts to a country's economic structure, technological advancement, government policies and emerging trade theories or agreements, they said.

However, Bangladesh needs to take adequate preparation to this end, they added.

These comments came at a discussion on the impact of EU circular textiles policies on its trading partners, organised by the Business Initiative Leading Development (BUILD) at its office in Dhaka.

The recently introduced EU Strategy for Sustainable and Circular Textiles emphasises transparency, sustainability and circularity across the textile value chain, impacting both the EU and non-EU consumers and companies.

The EU is an important destination for garment and textile exports from Bangladesh.

In fiscal 2022-23, apparel exports from Bangladesh to the EU amounted to $28.6 billion. In fiscal 2023-24, the amount was $25.44 billion, indicating a year-on-year decline of about 6.07 percent.

The EU and UK account for more than 60 percent of Bangladesh's garment exports while apparel products constitute more than 93 percent of the total shipments.

Ferdaus Ara Begum, chief executive officer of BUILD, said Bangladesh needs to devise new strategies and projections for textile exports to the EU. This includes identifying potential growth areas as well as challenges for market entry.

She said Bangladesh also needs to analyse the policy shifts and chart out a detailed scenario to support its textile and garment industries to adapt to the EU's sustainable and circular strategy.

"We need to assess the landscape of the sector before we provide feedback on potential impacts and necessary adaptations," said Patrick Schroeder, senior research fellow of the environment and society programme at The Royal Institute of International Affairs, a British think-tank.

"And we need to figure out strategies for enhancing collaboration between EU and Bangladesh stakeholders to promote a sustainable and circular global textiles sector," he added.

Producer countries like Bangladesh have existing circular practices and entrepreneurship, often in the informal sector having market structures, micro enterprises and trade for pre-consumer textiles (garment waste or Jhut).

"So, the EU should take a proactive, supportive, and collaborative approach with stakeholders to formalise the Jhut sector while preserving livelihoods," he said.

The garments sector in Bangladesh is already facing a crisis given the tight margins and slowdown in global demand. However, local entrepreneurs in the sector would finance the required investment for the developing a circular economy, said Asif Ibrahim, chairman of Chittagong Stock Exchange PLC.

Saleudh Zaman Khan, vice-president of the Bangladesh Textile Mills Association, said producers need to consider developing a supply chain for cotton recycling and form local regulations for recycling.

Chowdhury Liakat Ali, director for the sustainable finance department of Bangladesh Bank, said they have taken various policy initiatives to promote sustainable finance and green banking to reduce greenhouse gas emissions and speed up investments in renewable energy, energy and resource efficiency, the circular economy and eco-projects financing, etc.

He added that the central bank fixes disbursement targets for banks with 15 percent of all loans and investments set for green financing and 20 percent for sustainable financing.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments