What’s in the budget to boost private investment?

The government's target in the proposed budget for 2024-25 on increasing private sector investment is ambitious and will be difficult to achieve, said businesspeople and experts citing high bank interest rates and a shortage of US dollars.

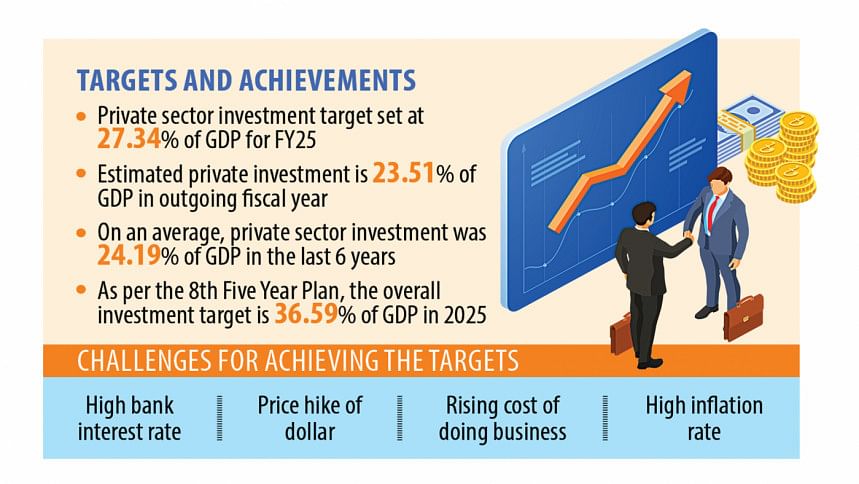

Finance Minister Abul Hassan Mahmood Ali aims to take private sector investment to 27.34 percent of the GDP in the upcoming fiscal year, up from an estimated 23.51 percent in the current year.

The last six years' average was 24.19 percent, which is 3.15 percentage points lower than the target, according to the Bangladesh Bureau of Statistics.

According to businesspeople, opening letters of credit for importing raw materials and capital machinery was still a challenge alongside accommodating an increase in associated prices due to a hike in the price of the US dollar against the taka.

Against this backdrop, making big investments is a big gamble, they said.

The banking sector last month returned to a market-driven interest rate regime with the rate reaching as high as 14 percent. The foreign currency reserves stood at $19.52 billion, as of June 20. Meanwhile, inflation has been persistently high, reaching 9.81 percent last May.

"Now businesses are faced with different drawbacks, including a high cost of business due to high bank interest rates and appreciation of the US dollar," said Ahsan Khan Chowdhury, chairman and chief executive officer of Pran-RFL Group.

"As a result, coming up with investments will be a very big challenge," he said.

He said the present reality necessitated devising ways to continue running business operations rather than going for expansion through fresh investments.

Considering this, it is quite difficult for the business community to bring in big investments, he said.

He suggested focusing on labour-intensive industries at this moment to create employment opportunities.

Local investors do not have sufficient money at hand to make investments and they should lay emphasis on bringing in foreign direct investment (FDI) through joint ventures, he said.

Such joint venture investments are most likely to facilitate the government's plan on achieving the private investment to GDP target, he said.

Asif Ibrahim, chairman of Chittagong Stock Exchange, said, in order to achieve the target, the government could focus on improving infrastructure, streamlining regulations, offering incentives, promoting FDI and investing in education and skills development.

Besides, it needs to ensure political stability, promote innovation and entrepreneurship, and develop the capital market, he said.

These efforts can create a lucrative environment for private investors and contribute to economic growth and development, said Ibrahim.

Unfortunately, investors still face red tape and delays in obtaining licences and necessary utility connections and impediments over logistics, he said.

According to him, there is a lack of coordination among the agencies responsible for facilitating the ease of doing business.

These hurdles need to be overcome to take private sector investment to 27.34 percent of the GDP for FY25, he suggested.

Ashraf Ahmed, president of the Dhaka Chamber of Commerce and Industry, said the proposed budget focused on containing inflation, while the latest monetary policy statement was contractionary in nature, which were constraints for investment.

As private sector credit growth, public investment, balance of payments and FDI remain low, it is unlikely that employment and investment will see significant growth in the coming days, he said.

In fact, persistence of a high bank interest rate and low liquidity from a crowding out effect could even trigger an economic meltdown, he said.

"Unless our policy stances shift after December 2024, it will be difficult to achieve the investment target," said Ahmed.

Ferdaus Ara Begum, chief executive officer of Business Initiative Leading Development, said it would not be possible to reach the private sector investment target if policies were not consistent and friendly towards investment.

She said the investment targets for the private sector have been almost static for long.

In the budget for FY2024-25, the target has been increased to 27.34 percent while it was reduced to 23.51 percent in the outgoing fiscal year from 24.18 percent in FY2022-23, she said.

According to her, even though public sector investment had increased, it could not support private sector investment.

In the government's 8th Five Year Plan, the investment target is 36.59 percent of the GDP in 2025, which is still a far cry, she said.

She said policy consistency for investment was the prime requirement.

The policy continuity for the investors in economic zones and hi-tech parks could contribute a significant amount of investment while creating new employment opportunities, she said.

She also pointed out that investors are facing problems in availing gas connections and electricity while subsidies for electricity and gas were going to be withdrawn in phases as per the suggestions of the International Monetary Fund.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments