FY24: one of the gloomiest years for economy

At the beginning of fiscal year 2023-24, there was an expectation that the country's economy would recover from the shocks of the Covid-19 pandemic and other external pressures.

However, things did not turn out that way as almost all economic indicators remained downbeat throughout the year due to some major issues.

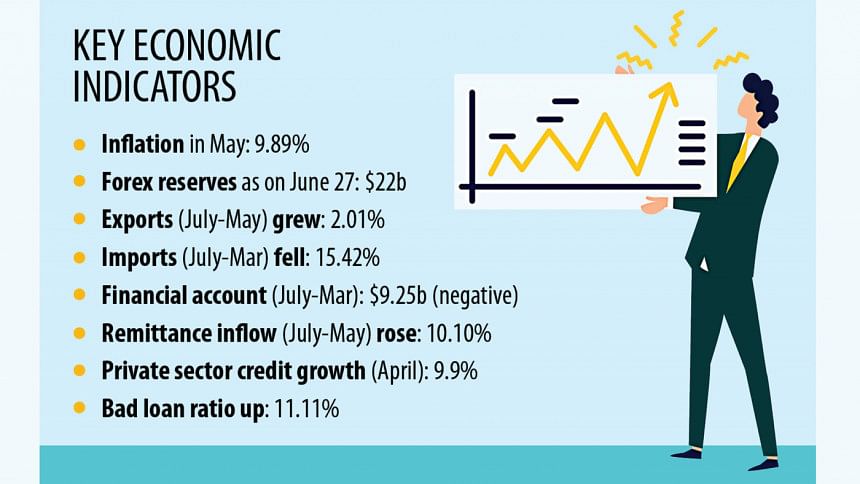

There were concerns over inflation persistently hovering above 9 percent, dwindling forex reserves, lower-than-expected remittance inflow, slow export growth, negative import growth, and a record amount of non-performing loans (NPLs) in the banking sector.

The central bank's liquidity support for weak Islamic banks and hasty merger initiatives and volatility in the foreign exchange market further intensified the crisis in the financial sector in FY24.

One of the fiscal year's biggest setbacks came in the form of a "negative" outlook put in place for Bangladesh by international credit rating agencies Moody's and Fitch.

The consumer price index (CPI) hovered at over 9 percent since March last year and the monetary policy of the central bank could do little to bring it down. However, most countries, including the US and India, succeeded in reining in inflation.

The inflation in Bangladesh on a point-to-point basis stood at 9.89 percent in May, well above the government target of 6 percent for FY24.

As a result, lower and middle-income people bore the brunt of rising prices, amplifying the woes in managing the cost of living.

The central bank adopted a tight monetary policy by hiking the policy rate but it did not provide much success in subduing the skyrocketing inflation because of the lack of a market-based interest rate system.

In April 2020, the BB first introduced a 9 percent interest rate ceiling.

Although that was withdrawn at the beginning of this fiscal year, the banking regulator introduced a new interest rate system based on the six-month moving average rate of treasury bills, abbreviated as SMART, which was another cap.

Finally, in May this year, Bangladesh Bank allowed banks to determine a market-driven interest rate in line with International Monetary Fund (IMF)'s prescription.

Despite a series of government initiatives to address the depletion of the foreign exchange reserves since it began in September 2021, foreign currency holdings did not increase, prevailing as an area of concern in FY24.

After joining the central bank as its governor in mid-2022, Abdur Rouf Talukder said the foreign exchange crisis would be resolved by January 2023.

However, the banking regulator failed to maintain the minimum level of forex reserves as per the IMF target thereafter.

Since August 2021, the forex reserves have fallen by $24 billion. As per the IMF calculation, gross forex reserves stood at around $22 billion on June 26 this year.

The foreign exchange market was volatile throughout the year because of higher US dollar outflow despite austerity measures taken up by the government, including controlling import payments.

There was no good news over exports either, as export growth slowed while import growth remained in the negative territory due to import control measures.

During the July-March period of this fiscal year, import growth stood at 15.54 percent in the negative.

Meanwhile, exports only grew by 2.01 percent during the July-May period. Export growth was at 7.11 percent during the same period of the prior fiscal year.

Exports and remittance earnings are the two major sources of forex inflow.

While remittance inflow rose 10.10 percent in the July-May period of this fiscal year, the inflow fell short of the expected level when compared to manpower exports.

The gap between the official and unofficial exchange rates was also a big reason for slower remittance inflow.

However, the BB recently brought flexibility to the exchange rate by introducing a crawling peg system.

Throughout FY24, the financial account stayed in the negative, standing at $9.25 billion during the July-March period of this fiscal year, showed the BB data.

Private sector credit growth hovered around the 9 percent mark in FY24, which indicates lacklustre private investment scenario in the country.

The record amount of bad loans, which climbed to Tk 182,000 crore at the end of March of this year, or 11.11 percent of total disbursed loans, highly stressed assets in the banking sector and weak banks were major points of discussion over the fiscal year.

The central bank's hasty bank merger initiatives and continuation of its financial support for some weak Shariah-based banks drew heavy criticism, with both being blamed for fuelling inflation.

Besides, external factors like supply chain disruptions caused commodity prices to rise globally.

Mismanagement in Bangladesh's forex market, frequent policy changes by the central bank and a lack of good governance in the financial sector gave a bleak outlook of the country's economy.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments