Economy in FY25: Is there any light at the end of the tunnel?

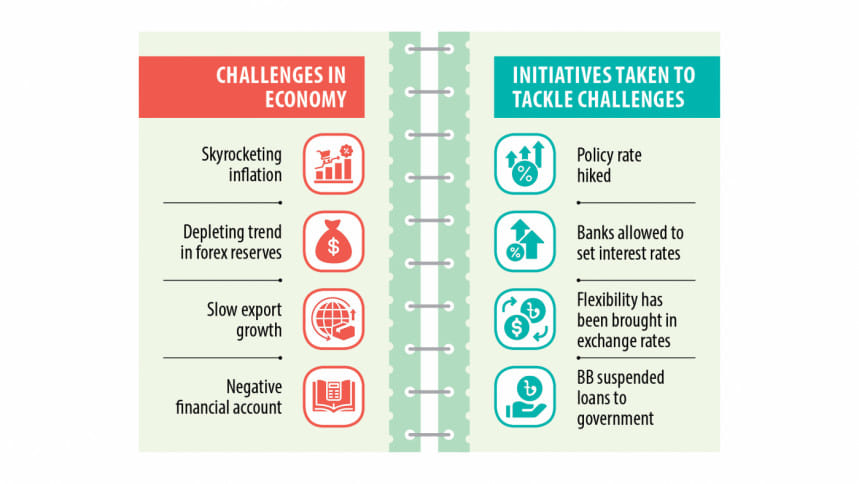

There is hope that the major challenges Bangladesh is facing due to high inflation and the foreign reserve crisis will stabilise gradually in fiscal year 2024-25, but consistency in maintaining a strict policy stance will be imperative to that end.

While most countries, including the US, India and even cash-strapped Sri Lanka, succeeded in controlling inflation, the consumer price index (CPI) of Bangladesh has kept rising.

Inflation in the country has persistently hovered above 9 percent since March last year and the Bangladesh Bank (BB) failed to control it for two major reasons.

The first is that the central bank was very late in its response to rising inflation and the other is that the interest rate cap, which persisted in various forms until May 8 this year, made the government's monetary policy ineffective.

The central bank also injected fresh money into the economy by providing loans to the government, stimulus packages after the pandemic, and liquidity support for some weak Islamic banks, fuelling inflation.

However, positivity is in the air as the central bank has finally adopted some reform initiatives as per the prescription of the International Monetary Fund (IMF) for a $4.7 billion loan programme.

One of the biggest reforms was made by the banking regulator when it scrapped the interest rate ceiling and allowed banks to fix interest rates based on market factors.

In April 2020, the BB first introduced a 9 percent interest rate ceiling. Although that was withdrawn at the beginning of FY24, the banking regulator introduced a new interest rate system based on the six-month moving average rate of treasury bills, abbreviated as SMART, which served as another cap.

Among other reforms, the BB hiked the repo rate or policy rate several times, bringing it to 8.50 percent, in a bid to make money costlier and tame skyrocketing inflation.

Not only that, after huge criticism from different corners, the central bank decided to stop providing loans to the government from FY24.

Another major reform came in the foreign exchange rate as the central bank made it flexible by introducing the crawling peg system.

In May, US ratings agency Moody's projected that Bangladesh's foreign exchange reserves position would stabilise over the next few months despite the country repeatedly failing to fulfil the IMF's reserve target due to a drastic fall in forex holdings over the past two years.

So, there is a scope for all the initiatives taken by the central bank and the government to lead to positive outcomes in the new fiscal year, but consistency in regard to a strict policy stance is important.

The Bangladesh Bank is going to announce the monetary policy for the first half of FY25 in the third week of July, with the main objective of controlling inflation and achieving the GDP growth target set by the government.

Ahead of that, the question on everyone's mind is regarding the kind of policy stance that will be adopted, especially as lower and middle-income people have been bearing the brunt of rising prices.

On a 12-month average between June 2023 and May 2024, the inflation rate stood at 9.73 percent, much higher than the BB's target of 7.5 percent for the outgoing fiscal year of 2023-24.

The government aims to contain the CPI to 6.5 percent for FY25.

In its latest publication, the IMF said the macroeconomic outlook of Bangladesh is expected to gradually stabilise as policy actions start to take hold.

Bangladesh Bank executive director and spokesperson Md Mezbaul Haque told The Daily Star yesterday that the forex market is liquid now due to higher inflows of US dollars.

He added that remittance earnings had been increasing after the flexible exchange rate was introduced.

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, said the dynamism in the economy depended on policy measures.

If the central bank and the government maintain strict policy measures, it will help reduce inflation, as per the economist.

The government has also set high bank borrowing targets for the new fiscal year, but banks are facing liquidity shortages, he said, adding that the central bank will have to be strict about its decision to refrain from granting loans to the government.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments