Customers’ confidence and trust are our capital

The timing of Citizens Bank's launch on July 3, 2022, could not be worse: Bangladesh was reeling from the twin crises of the coronavirus pandemic and the Russia-Ukraine war, and people's confidence in the banking industry eroded owing to loan scams and irregularities.

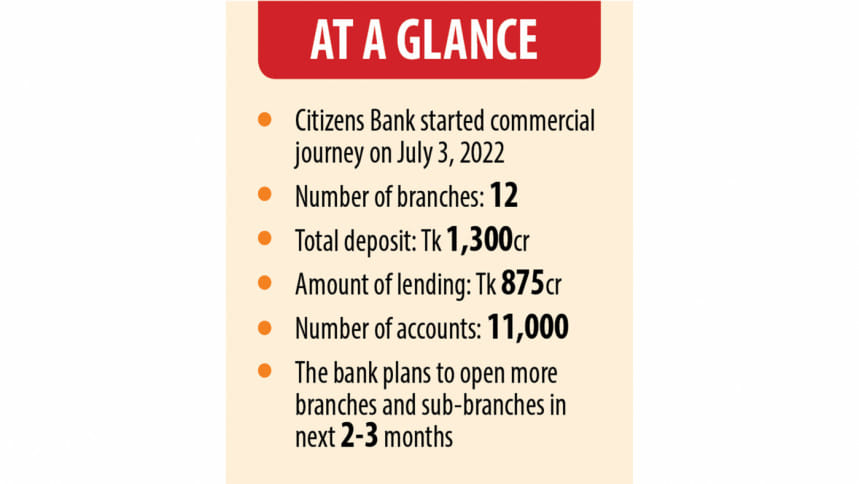

The 61st commercial bank of Bangladesh not only stood the test of time but also successfully expanded its footprint and has kept growing.

"Since the very beginning, we experienced problems in almost every step," said Mohammad Masoom, the founding managing director and chief executive officer of Citizens Bank, during an interview with The Daily Star recently.

He said the pandemic and the war had already hurt the economy. Besides, people's trust in the banking industry has weakened centring loan irregularities in some banks, and the interest rate cap on loans affected the flow of deposits.

"It was challenging for the new bank to increase profitability when both lending and deposit rates were capped," he said.

In April 2020, the central bank introduced the 9 percent lending rate ceiling and the 6 percent deposit rate cap.

Masoom said the macroeconomic crisis and an unprecedented level of inflation, fueled largely by the pandemic-induced challenges, the war, and the foreign exchange reserve crisis, have also had a lot of impacts.

"Amid the challenges, we started our commercial journey with a few people and six branches. However, we dealt with the challenges well and we have increased the number of branches."

"We have growth momentum. We are in the expansion mode," he said, adding that the bank is planning to open more branches and sub-branches in the next three months.

The first thing the bank did was to build a deposit base because the noted banker believes: "Deposits are the bedrock of a bank. The biggest success is that we have around 11,000 clients."

Citizens Bank has a loan portfolio of more than Tk 850 crore. It has a deposit of about Tk 1,300 crore.

He said the most important thing is that the bank has been able to raise capital and the biggest strength has been to maintain compliance thanks to good corporate governance.

"We learned from the mistakes and problems of other banks. We believed in consistent and considerate growth."

Masoom was appointed in January 2021 as the first managing director and CEO of the bank after it obtained the licence from the central bank in December 2020.

As the first CEO, he wanted to put in place a solid foundation. The bank has generated revenues and ensured cost and time efficiency.

"We have also gained the trust of consumers from the very beginning. Their confidence and trust are our biggest capital. If we can maintain this foundation, the bank will prosper."

He said even though the environment is challenging, the bank will have to navigate it with professionalism.

In order to attract savers in the challenging environment, Citizens Bank offered a maximum of 8 percent interest for term deposits. It, however, managed to keep the overall cost of deposits at less than 6 percent.

"This has been a major achievement for a new bank," Masoom said.

The bank is currently focusing on micro, small and medium enterprises (MSMEs) since they are the driver of the economy and generate jobs.

The CEO said there are few willful defaulters in the segment, in a country where intentional defaulting is prevalent, threatening the health of the financial sector.

"MSMEs always try heart and soul to establish themselves thanks to their entrepreneurial zeal, and they try to pay back loans on time."

The bank is also funding the supply chain and is lending to the corporate supply chain, backwards and forward linkage industries.

Masoom, who has been working in the banking sector for more than three decades, also talked about the new market-based lending rate system.

It came on May 8 when the central bank scrapped the Treasury-linked interest rate-setting mechanism known as SMART (Six-months Moving Average Rate of Treasury bill) as it has continued to struggle to contain inflation, put the reserves in a good shape and restore the economic stability.

Between April 2020 and June 2023, the central bank maintained the lending rate cap.

Masoom said the introduction of the market-based lending rate is a good step. "If it works, it will benefit everyone. Now, demand and supply will determine the cost of funds."

Talking about the non-performing loans (NPL), he said NPLs have been the biggest drag on growth in the banking industry. "We are concerned about the banking sector."

"Our balance sheet is clean. We don't have any non-performing loans. I think Citizens Bank will be one of the finest banks in Bangladesh and play an important role in building public confidence."

Masoom is also aware of banks' role in ensuring the welfare of clients. "Clients may face financial debacle, or their financial health may weaken for not having any congenial climate. If we are convinced that our clients are sincere, we have a moral obligation to support them during their rainy days too."

He said in that case, the bank looks at it from a human point of view.

"This is also part of our philosophy. This is why the bank has assumed the name Citizens Bank. Our corporate slogan -- Today, Tomorrow, Together -- says a lot about our mission. Today, we are here; we will be there in the future as well."

He said the informal market has to be curbed to accelerate remittance flows with a view to ending the reserve crisis.

Inflation, which has stayed over 9 percent for more than two years, affects everything, he said. "It affects our competitiveness and people in the lower-income group."

Citizens Bank is working on expanding its footprint through digital banking since the country plans to become a cashless society.

"We are working with information technology companies to make our service cost-efficient. We have introduced the mobile app with all kinds of services. We have cashless cards as well."

"We know there is a need for a cashless society. It has a positive impact on the economy. We are focusing on that."

Still, apart from a digital presence, a bank should have a physical existence, Masoom believes.

"A bank should not only have a materialistic transaction; it should have a human side. We want to stay connected with clients. We want to have a relationship with clients."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments