Financial account turns positive. It’s more about $14b export data correction

The financial account turned positive after more than a year due to a correction of nearly $14 billion anomalies in export figures by the Bangladesh Bank (BB) and the Export Promotion Bureau (EPB).

It may appear to be good news for Bangladesh. It is not. The economy's health remains unchanged and the country continues to struggle with a shortage of foreign currencies to manage its external account or transactions with the rest of the world.

As per the EPB data, exports were $47.47 billion in the July-April period of fiscal 2023-24. It has fallen by $13.8 billion to $33.67 billion after the correction, according to data released by the central bank yesterday.

As a result, the financial account, a key component of the balance of payments (BoP), turned positive.

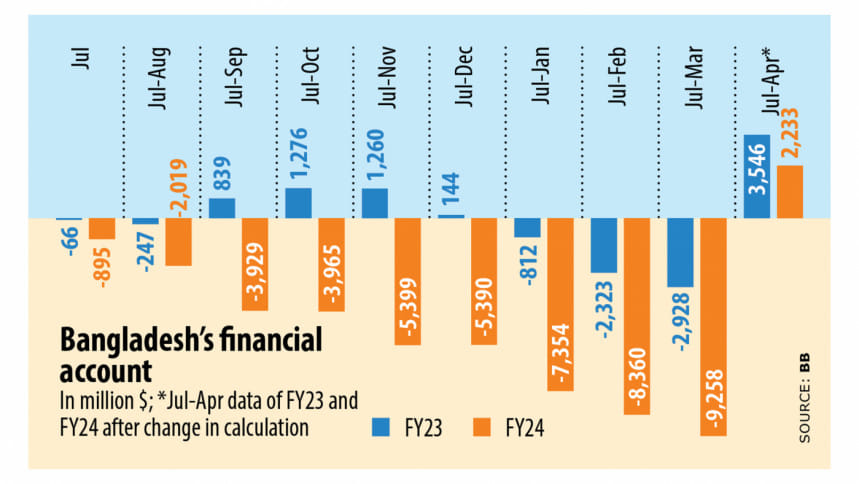

In the July to April period of the just-concluded fiscal year, the financial account stood at $2.23 billion, which was negative for more than a year, according to data from the BB.

A key part of the balance of payments, the financial account covers claims or liabilities to non-residents concerning financial assets. Its components include foreign direct investment, medium and long-term loans, trade credit, net aid flows, portfolio investments, and reserve assets.

On the other hand, the balance of the current account, which records a nation's transactions with the rest of the world, slipped to negative territory in the first 10 months of 2023-24. It stood at $5.72 billion in negative, BB data showed.

A senior official of the central bank told The Daily Star that the change in the BoP had occurred due to the change in accounting method.

He explained the gap between the figure provided by the EPB and the BB has been adjusted. "That's why, the current account balance turned negative while the financial account became positive."

For a long period, there was more than a $10 billion gap between the export data provided by the EPB and the BB, with the former showing a higher shipment compared to the latter, raising questions.

This prompted the International Monetary Fund (IMF) to come up with the observation in December last year that Bangladesh might have experienced capital flight in 2022-23 evidenced by the unusual outflow of funds as well as unrealised export proceeds.

It said the financial account experienced an outflow of 0.5 percent of GDP in 2022-23, compared to inflows historically averaging about 2.5 percent of GDP, signalling capital flight.

Yesterday, officials of the central bank said the EPB publishes figures based on the data from the customs department. Due to procedural reasons, the customs department took into account the same export data more than once in many cases, which is known as double or triple counting.

They said that even when shipments were rejected by the customs, they were still considered while preparing the export data. As a result, the EPB data showed higher exports than the actual sales in the global markets by local exporters.

The gap has been adjusted as per the recommendation of the IMF's $4.7 billion loan programme.

Following the revision, export earnings fell 6.8 percent to $33.67 billion in July-April of 2023-24. It rose 3.93 percent year-on-year to $47.47 billion when the EPB disclosed the data for the same period in May.

Speaking to The Daily Star, Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, said that the revision in the BoP is the result of the change in accounting methodology.

"The financial account turned positive due to the change," he said, adding that it does not indicate that the economy's health has improved.

Bangladesh has been facing an economic crisis for the past two years owing to a sharp fall in foreign currency reserves, driven by higher outflows compared to inflows.

Inflation has surged while the local currency has lost its value by a third.

The economist said that there are some positive signs in the economy, but it will take some time to bring down higher inflation.

BB data showed that trade credit stood at negative $1.68 billion in July-April against a positive $2.43 billion during the same period of FY23. Net FDI rose 0.7 percent to $1.36 billion.

Imports fell 12.3 percent to $52.37 billion and the trade gap was $18.69 billion, down from $23.60 billion a year ago.

The overall balance was $5.56 billion, again a decrease from $8.80 billion.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments