Dhaka Bank looks to spread its wings to fuel growth

Dhaka Bank is increasingly embracing technologies to serve customers digitally and enhancing its lending to small clients as it redesigns its focus to stay relevant.

"Our ultimate target is to become a paperless bank. We want to spread our wings," said Abdul Hai Sarker, chairman of the private commercial bank, during an interview with The Daily Star on Wednesday.

He shared the plans as Dhaka Bank celebrates its 30th founding anniversary today, marking the three-decade of unwavering progress and success.

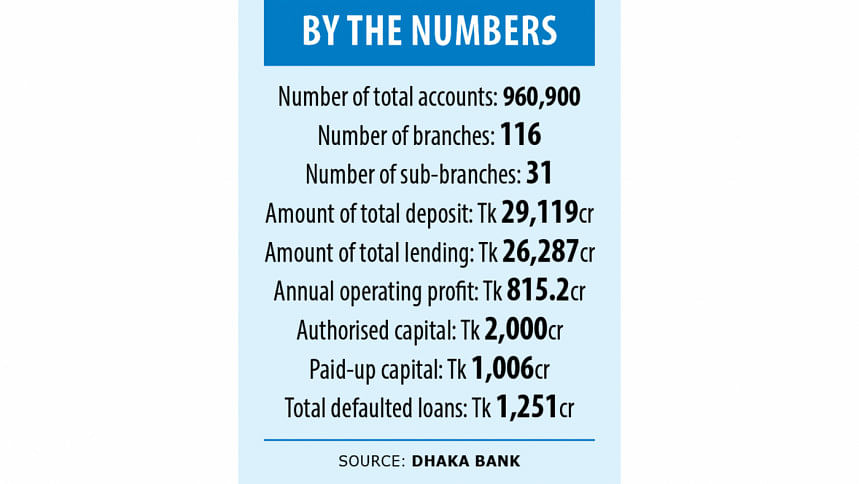

In 1995, the bank started its journey with an authorised capital of Tk 100 crore and a paid-up capital of Tk 10 crore. Now, its authorised capital has surged to Tk 2,000 crore while the paid-up capital jumped to Tk 1,006.6 crore.

It has made its presence vibrant across the country with 116 branches, three SME service centres, 31 sub-branches, and 87 automated teller machines (ATMs). It also has two offshore banking units.

As of June 30, deposits totalled Tk 29,119 crore while lending exceeded Tk 26,287 crore. Currently, 1,951 of its officials and employees are serving 960,900 clients.

"Since we started our journey, we complied with all rules and regulations and consistently ensured quality service for customers. Therefore, we have been able to come to this stage. Our commitment and honesty helped win the trust of depositors," Sarker said.

As of June 30, the total equity (capital and reserves) of the bank stood at Tk 2,244 crore. Its operating profit was Tk 815 crore in the year that ended on December 31.

"We always try to do it as much as possible for the benefit of our customers. We do our best to make them feel resilient," he said.

"We must keep customers always satisfied and always remain connected with them through the services we provide."

In order to cater to stock investors, the bank has set up Dhaka Bank Securities Ltd having six branches. It has established Dhaka Bank Investment Ltd to operate merchant banking activities.

However, the journey for the bank has not been without challenges.

"We faced a lot of obstacles. However, we have been able to overcome them through our leadership and thanks to support from the government and policymakers," Sarker said.

Sarker is a former president of the Bangladesh Textile Mills Association, a former vice-chairman of the Bangladesh Association of Banks, and a former director of the Federation of Bangladesh Chamber of Commerce and Industries.

The industrialist also talked about the bank's journey towards digital banking.

"It has become far easier to secure banking services since the world has become more digitalised. Transformation is taking place everywhere."

The bank is currently bringing about a fundamental change and is moving towards cashless banking.

"If a bank wants to provide paperless service, it will have to ensure all types of digital banking facilities."

Presently, Dhaka Bank is focusing on promoting micro-level customers apart from big clients. "Micro-level customers need cash support. We are providing the financing," he said.

The chairman also recognised the importance of ensuring cybersecurity and is aware of crimes being committed in the digital world.

Globally, there were 2,365 cyberattacks in 2023 with 34.33 crore victims, according to an article of Forbes.

The total cost of damages incurred by cybercrime is expected to reach $10.5 trillion by 2025, said Cybersecurity Ventures 2023 Official Cybercrime Report.

"Cashless and paperless banking is a risky business if we see it from the security aspect. Therefore, we have to ensure security if we want to sustain digital transformation," Sarker said.

Sarker said they are now worried about the defaulted loans. Currently, the bank has a non-performing loan of Tk 1,251 crore.

"It is one of the major problems right now. The owners of four large companies have fled the country taking the money of shareholders and depositors. Now we are bearing the brunt of the wrongdoings."

Dhaka Bank is not the only bank in Bangladesh that is experiencing obstacles stemming from the higher level of bad loans. In fact, the entire banking sector is creaking under the weight of bad loans.

In March, default loans hit an all-time high of Tk 182,295 crore, central bank data showed.

However, Sarker said, the amount of bad loans will be not less than Tk 400,000 crore since a large chunk of NPLs has remained in the banking system indirectly.

In 2019, the International Monetary Fund said the actual size of bad loans was more than double the officially recognised figure.

"It has now become a grave concern for the banking sector," he said.

Since defaulters have run away, banks could not recover the money, Sarker said, adding that lenders faced difficulty in recovering funds owing to complicated legal and policy issues.

He explained when a bank filed a case against defaulters, law enforcers could not produce them before the court as defaulters had left the country after laundering the money they obtained in the form of loans.

However, when banks tried to recoup the funds by selling the mortgaged properties, the defaulters hired lawyers to file writs with courts. "We are not getting the required policy and legal support to this effect," he said.

"Despite the challenges, we have been able to navigate the situation because of our commitment to the bank and depositors."

He urged policymakers to formulate policy in a way that will have a positive impact on the market.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments