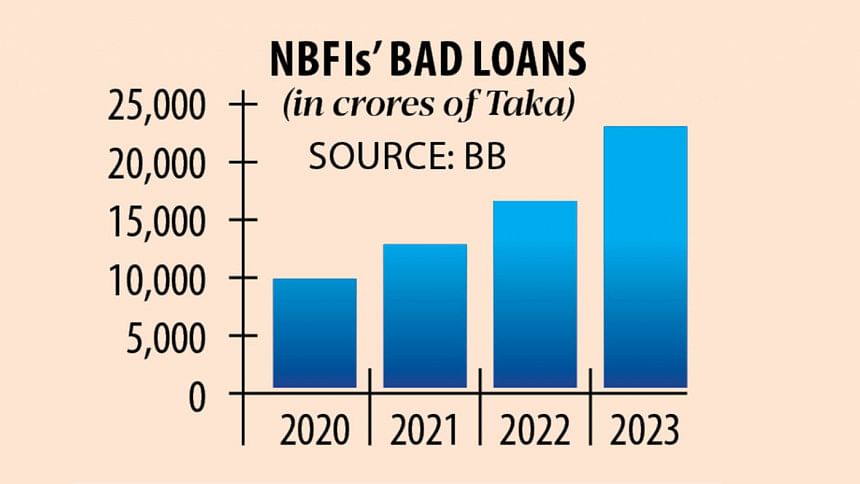

NBFIs’ bad loans surge to a record Tk 23,208 crore

Defaulted loans at non-bank financial institutions (NBFIs) soared 38 percent to a record Tk 23,208.7 crore at the end of 2023, raising concerns over the sector's deteriorating health.

The toxic assets accounted for a record 32 percent of the total disbursed loans of Tk 73,560.5 crore in the sector, up from 31.55 percent a year earlier, according to data from the Bangladesh Bank.

The data on 35 NBFIs' bad loans comes when economists have raised concerns over vulnerabilities in Bangladesh's financial sector due to rising defaulted loans and a lack of corporate governance.

Industry insiders said the central bank is largely responsible for the state of the NBFI sector as its supervision was not strict.

The toxic assets are legacy loans from the large scams and irregularities seen in the sector a few years ago, said Kanti Kumar Saha, chief executive officer of Alliance Finance.

For instance, PK Halder, former managing director of NRB Global Bank, which was later renamed Global Islami Bank, swindled at least Tk 3,500 crore from four NBFIs: People's Leasing, International Leasing, FAS Finance and BIFC, according to a BB probe report.

As a result, the four NBFIs have become ailing institutions with more than 90 percent of their loans going bad.

Saha, also vice-chairman of Bangladesh Leasing and Finance Companies Association (BLFCA), said the loans that were disbursed in the last one or two years are regular.

"Now, most of the NBFIs are trying to do better," he said, adding that the industry is looking to upgrade its manpower for improved performance.

Md Golam Sarwar Bhuiyan, chairman of the BLFCA, said that not only the NBFIs, but the overall economy is now facing multiple challenges, and that is why the bad loans in the sector have increased.

Bad loans jumped after the central bank in 2022 withdrew the deferral facility extended during the pandemic for paying back loans, said Bhuiyan.

Due to the confidence crisis in the sector, deposits in NBFIs fell to Tk 44,304 crore in the January-March quarter from Tk 44,830 crore in the previous quarter.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments