Local pharma lights up hope in cancer treatment

The pharmaceutical sector of Bangladesh has achieved many milestones over the past 14 years. Not only do local companies now meet 90 percent of the country's demand for medicines, but the products are also exported to around 150 countries, fetching hundreds of millions of dollars.

However, among the most significant strides the sector has made is its advancement in the manufacture of life-saving cancer medication.

In the last 14 years, pharmaceutical companies like Beacon, Eskayef, Renata, Incepta, Healthcare, and Techno Pharma produced more than 110 varieties of oncological drugs.

Around 17 local companies are manufacturing anti-cancer drug products. Thanks to their bold initiatives, patients in Bangladesh can now access cancer drugs at affordable prices, which have brought down the cost of treatment.

Monjural Alam, chief executive officer of Beacon Medicare, said the prices of such drugs in Europe and the US are beyond the purchasing capacity of many patients.

"There is a scarcity of life-saving drugs worldwide. When the drugs are available, they are usually beyond the reach of common people. To this end, we have established a facility within our company to serve global patients," he said.

Before 2009, there was scepticism regarding Beacon's ability to manufacture sophisticated cancer drugs. However, the plant has become successful, and patients can buy life-saving drugs at reasonable prices.

Claiming that Beacon pioneered the manufacturing of cancer drugs in Bangladesh, he said it now meets around half of the local demand for cancer drugs.

Before 2010, Bangladesh relied entirely on imports for oncology drugs. This means only patients from financially solvent families could afford cancer treatment due to the exorbitant cost of medicines. Today, it not only meets domestic consumption but also serves as an exporter in the global market.

"This achievement was made possible by the dedication of local pharmaceutical companies and the trust placed by doctors and patients in local products," Alam said.

According to manufacturers, local companies produce around 99 percent of oncology drugs, yet some patients still resort to imported drugs or unofficial imports.

Recently, pharmaceutical companies have been affected immensely due to the supply chain disruptions and the dollar crisis against the backdrop of the Russia-Ukraine war. The situation is improving following the collaborative efforts of the government and drug manufacturers.

It provides medicines worth Tk 3 crore to poor patients annually.

Beacon plans to establish a second oncology plant to meet the increasing global demand for cancer drugs. The company is also considering setting up a palliative care centre to alleviate the suffering of patients.

A relative newcomer to the scene is Eskayef Oncology, which commenced its journey in 2018. However, the company, which boasts advanced technologies, has expanded its footprint beyond Bangladesh in no time.

It is one of the few Asian companies to have secured approval from the European Union Good Manufacturing Practice (EU GMP) to produce anti-cancer medicines. This is recognised by 27 nations of the EU and is considered a passport for entry into the global market.

"This recognition facilitated the entry of our drugs into the EU market and various other countries," said Mohammad Mujahidul Islam, executive director (marketing and sales) of Eskayef.

Eskayef is currently exporting products to over 60 countries.

"Thanks to modern technologies, facilities, and unwavering dedication, Eskayef Oncology is committed to delivering affordable and globally standard anti-cancer products to patients both at home and abroad," he said.

Prof Golam Mohiuddin Faruque, president of the Bangladesh Cancer Society, said Bangladesh has achieved tremendous improvement in cancer treatment and anti-cancer drug manufacturing.

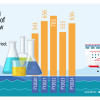

Bangladesh exported cancer drugs worth Tk 1,000 crore in 2023. The amount was around Tk 500 crore in 2019. Local sales of cancer drugs have reached Tk 800 crore to Tk 1,000 crore as demand is increasing by an average of 15 percent each year, according to the manufacturers.

Prof SM Abdur Rahman, chairman of the pharmacy department at the University of Dhaka, said Bangladesh's pharmaceutical companies have set up world-class manufacturing plants equipped with sophisticated machinery, enabling them to produce top-class drugs.

He thinks there is no doubt that Bangladesh's oncology products will dominate the world market, meeting global standards, quality, and cost-effectiveness.

There are areas of concern.

After 2026, when Bangladesh graduates from the group of least-developed countries, local pharmaceutical companies will have to follow patent guidelines while manufacturing drugs, including oncology products. If medicines are produced following the patent rights, the drugs will be costlier in the local market.

To avert the situation, Bangladesh initially tried to extend its Trade-Related Aspects of Intellectual Property Rights (TRIPS) waiver by six to nine years and then up to January 1, 2033. However, at the 12th Ministerial Conference of the World Trade Organisation (WTO) in Geneva in June 2022, global leaders did not extend the TRIPS deadline for graduating LDCs.

Under the current agreement, drug-makers in LDCs can produce any generic medicine without having to follow patent guidelines until January 1, 2033. But the benefit is not applicable to graduating LDCs such as Bangladesh.

Beacon's Alam, however, said it would be applicable for only new molecules, which comprise few drugs. "So, the pharmaceuticals sector will not face significant challenges after graduation."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments