BB, NBR grapple with staff anger

It was not a usual day at Bangladesh Bank and the tax authority. For hundreds of employees, it was a day to air frustration and collective rage.

At the central bank, mid-level employees erupted into wild protests yesterday, demanding the resignations of six senior officials, including Governor Abdur Rouf Talukder and four deputy governors. A video taken by a reporter showed soldiers trying to calm protesters, a rare scene in the banking sector.

As the chaos unfolded at Bangladesh Bank, the governor was nowhere to be seen. He stayed away from work for the second day.

Employees started agitating at the central bank in the commercial district of Motijheel right after they arrived at work in the morning, demanding the resignation of officials who are serving contractually. The governor, deputy governors, and the banking adviser are hired contractually.

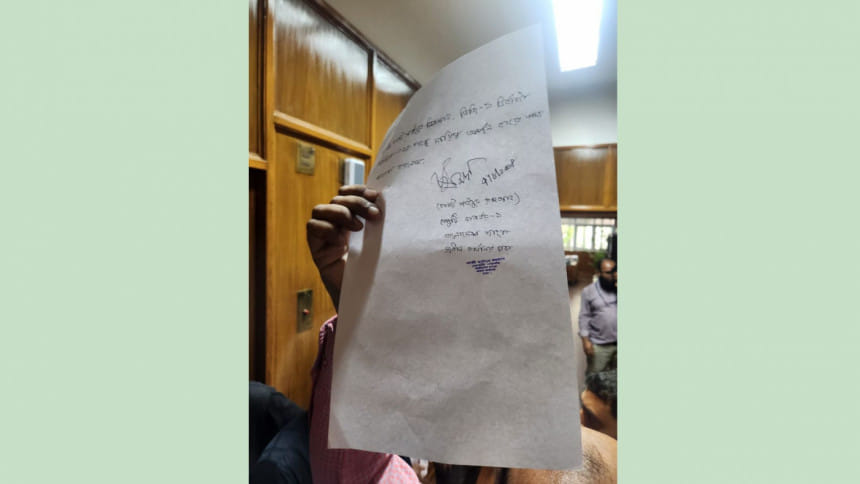

In the face of protests, Deputy Governor Kazi Sayedur Rahman resigned, while two deputy governors -- Habibur Rahman and Md Khurshid Alam -- decided to step down. Banking adviser Md Abu Farah Naser also decided to go, according to officials. Meanwhile, Bangladesh Financial Intelligence Unit chief Masud Biswas was forced to leave his office. He then decided to quit.

At a hurried press briefing, BB spokesperson Mezbaul Haque said some deputy governors decided to resign amid protests and some were forced to step down.

Widespread protests came two days after Sheikh Hasina's sudden exit from Bangladesh amid a popular uprising. The collapse of her government created a power vacuum that led to further violence, alongside the joy and relief on the streets of Dhaka.

Partisan decisions and corruption weakened the financial system, once controlled by Awami League loyalists, during the party's 15-year iron grip on power.

A similar scene of anger played out at the National Board of Revenue, as officials called for the resignation of its chairman, Abu Hena Md Rahmatul Muneem.

Economists say unruly protests are not the way to reform the regulatory bodies and can upend the financial sector.

Another powerful regulator, the Securities and Exchange Commission, passed two days without its boss -- Shibli Rubayat-Ul Islam. The chairman stayed away from work fearing reprisals from colleagues, an official said, asking not to be named.

These activities are not very uncommon during a mass uprising as people vent anger on the high-ups, according to Ahsan H Mansur, executive director of the Policy Research Institute.

"There should be a planned process of streamlining the financial institutions and regulatory bodies. The officials involved in malpractices will face consequences. No one should take the law into their own hands," he said.

"What we saw at the central bank was very disturbing. The central bank's top officials are now completely inactive, which will make the institution inactive," Ahsan Mansur said.

The interim government, which is being installed with Professor Muhammad Yunus as its head, will now decide on the resignations of the deputy governors.

The new government should be formed without delay because it needs time to find eligible people to run institutions, according to Ahsan Mansur.

On top of these protests, a gloomy report came from S&P Global Ratings. It said Bangladesh's political crisis has further undermined sovereign credit support since it lowered its long-term sovereign credit rating on July 30 this year. However, credit metrics may still support the ratings at the current level if the situation stabilises soon.

The protests that led to the abrupt resignation of Hasina on August 5 have exacerbated downside risks to economic growth, fiscal performance, and external metrics, S&P said.

The week was rife with commotions in the corporate world. On Tuesday, employees of Islami Bank Bangladesh staged a demonstration against alleged plundering from the bank by S Alam Group, a corporate giant with ties to Hasina. They also briefly barred some officials from the bank's head office in Motijheel.

The demonstrators alleged that they were deprived of various benefits for over a decade, following changes in the bank's ownership and board. Some employees also demonstrated at the bank's headquarters, demanding the resignation of deputy managing directors and other officials appointed by S Alam Group.

A group of officials at Sonali Bank yesterday called for the state-run lender's managing director to provide incentives and promotions to the officials who were "deprived" of benefits in the past several years.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments