S Alam barred from fund transfer, cashout, LC opening

The Bangladesh Bank yesterday instructed six S Alam-owned banks to stop any money going out of the accounts in the name of the Chattogram-based business giant, its associates' companies and related persons.

However, all types of deposits can be accepted in their accounts, according to the letter from BB's banking inspection department-7.

Islami Bank, First Security Islami Bank (FSIBL), Social Islami Bank (SIBL), Union Bank, Global Islami Bank (GIB) and Bangladesh Commerce Bank (BCB) have already passed on the BB instruction to their branches and sub-branches.

The instruction was given as the central bank has started to reconstruct the board of directors of the banks linked to the business group, said BB spokesman Md Mezbaul Haque,

Once the banks' boards are reconstituted, the instruction to bar any withdrawals from the accounts would be relaxed, he added.

The BB has verbally instructed the other banks to suspend fund transfer and withdrawal requests of S Alam Group, its associates' companies and related persons, The Daily Star has learnt from the managing directors of three leading banks.

Banks have been asked to not renew any investment facilities or stop any new investment. They have been instructed to suspend any new disbursement or withdrawal.

The lenders will not be able to disburse and withdraw any new investment from the investment accounts that are previously approved in their name, the BB letter said.

The banks have also been asked not to open letters of credit (LC) in favour of the companies of the business group and its associates' companies.

However, banks can open LC in favour of the companies at a 100 percent margin.

Banks have also been asked to disallow bill discounts or purchases in their name; not to make any application to the central bank for any refinance scheme; ban credit card transactions; and decline requests for fund transfers outside of Bangladesh in their name.

Founded in 1985 by Mohammad Saiful Alam, a relative of former Awami League politician Akhtaruzzanan Chowdhury Babu and former Land Minister Saifuzzaman Chowdhury, S Alam Group has grown into one of the largest conglomerates in Bangladesh.

For instance, S Alam is one of the four edible oil importers and processors along with TK Group, City Group and Meghna Group. Together, they control 80 percent of the total edible oil market in Bangladesh, according to import data from the National Board of Revenue.

Its subsidiary S Alam Refined Sugar Industries was the third-largest importer of sugar in 2023, accounting for a fifth of the country's demand.

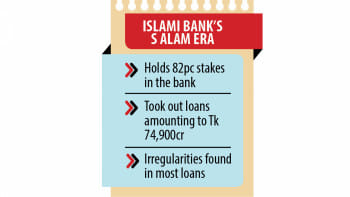

S Alam Group and its associate companies took out Tk 95,331 crore between 2017 and June this year from six banks, with 79 percent of the sum coming from Islami Bank, data showed.

Documents pieced together by The Daily Star show that most of the loans were taken by bypassing banking rules and regulations, in a testament to how the Chattogram-based conglomerate exerted its influence on the country's banking sector.

In a separate letter, the Bangladesh Financial Intelligence Unit (BFIU) on Sunday sought detailed information on the overall banking activities of Alam, his 12 family members and their companies.

The 12 family members include his wife Farzana Parveen, his two older sons Ahsanul Alam and Ashraful Alam, and his brothers Osman Ghani, Abdus Samad, Rashedul Alam, Shahidul Alam, Mohammed Abdullah Hasan and Morshedul Alam, who passed away in May 2020 from Covid-19.

The account details of Ghani's wife Farzana Begum and Samad's wife Shahana Ferdous were sought too.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments