Exports fell in FY24 for lower woven, knitwear shipments

Bangladesh's overall exports fell 4.34 percent year-on-year in FY24 due to lower shipments of ready made garments (RMG), reflecting sluggishness in industrial activities and the economy.

The country's export receipts amounted to $44.47 billion in the previous fiscal while it was $46.49 billion in FY23, according to data released by the Bangladesh Bank on Tuesday.

The central bank said it compiled the export figures provided by the National Board of Revenue (NBR).

The Export Promotion Bureau (EPB) is yet to publish the export data for the entirety of FY24.

In July, the agency under the Ministry of Commerce informed that it would refrain from updating statistics for three months to ensure accurate reporting.

It decided to do so after the central bank released data on the country's balance of payments (BoP), which showed a $14 billion gap compared to the EPB's statistics.

In the latest BoP, the Bangladesh Bank said export value, which is calculated on a Free on Board (FoB) basis for the BoP, stood at $40.8 billion in FY24, down by nearly 6 percent year-on-year.

When products are shipped on a FoB basis, the liability and ownership of the goods lies with the buyer.

The central bank added that the FoB has been adjusted with shipments from the Export Processing Zones (EPZ) in Bangladesh.

When comparing the FoB data to the export data, a gap of $3.66 billion is seen.

A senior official of the Bangladesh Bank said this is because they don't use the FoB method when counting overall exports.

"That's why there has always been a gap between the export statistics used in BoP and overall exports," the official added.

Khandoker Rafiqul Islam, newly elected president of the Bangladesh Garment Manufacturers and Exporters Association, said their exports to both Europe and the US are in the negative as per internal data.

"Business slowed after the beginning of the Russia-Ukraine war as sluggish demand in the West led to stockpiling of previously shipped goods. So, buyers cut back on purchases," he added.

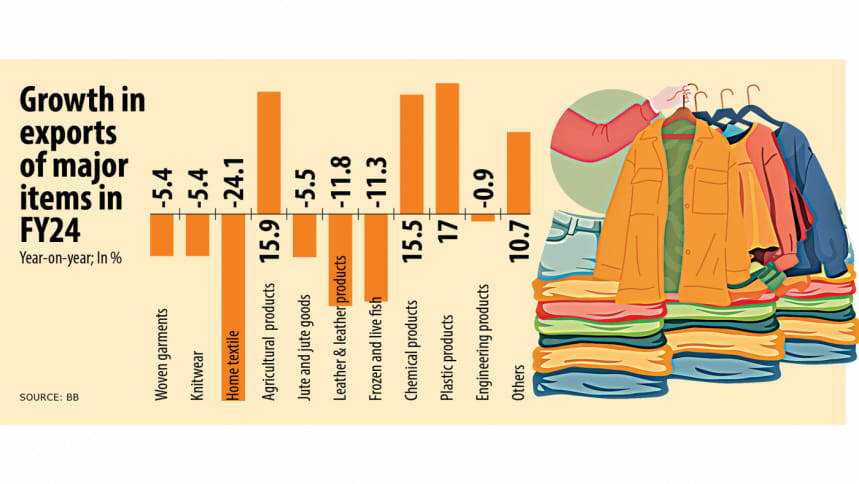

The export data compiled by the Bangladesh Bank showed that exports of woven garments dropped 5.36 percent year-on-year to $16.86 billion in FY24.

Knitwear, the biggest export earner, accounted for 44 percent of total receipts. However, it also posted a 5.35 percent decline to $19.26 billion.

Islam said buyers usually place orders during the months of July and August, but this time they became cautious due to the political changeover stemming from a recent mass uprising.

"The good thing is that we see development," he said, informing that queries from prospective buyers have increased as their previous stocks have reduced.

"So, if the situation returns to normal, exports will likely become positive this year," Islam added.

Central bank data showed that of the top 10 exporting sectors, only three -- agricultural products, chemicals and plastic -- recorded export growth.

Plastic exports registered the highest growth followed by agricultural items and chemicals.

"The government allowed exports of aromatic rice for some days. This is one of the main reasons that exports of agricultural products grew," said Eleash Mridha, managing director of PRAN Group.

He added that freight costs, which soared in the wake of the Russia-Ukraine war, have gradually declined.

"However, the Red Sea crisis is still affecting shipments. But as global commodity prices remain low, exports may grow this fiscal too," Mridha added.

Home textile exporters saw the biggest fall in shipments at 24 percent followed by leather and leather products at around 12 percent and frozen and live fish at 11 percent.

Exports of home textiles, the fourth largest item in the country's export basket, brought home $782 million in FY24 compared to $1.08 billion in FY23.

Leather and leather products, the third biggest export item, recorded $1.03 billion in export earnings last year. It brought in $1.17 billion in FY23.

Arifur Rahman, general manager of ABC Leather Ltd, said the war affected demand for leather products, especially in Europe. However, the demand in Japan remains unchanged.

Meanwhile, the demand for artificial footwear is rising as they are comparatively cheaper than leather shoes, Rahman added, citing that the price of leather shoes ranges between $18 and $22 whereas a pair of artificial ones costs just $3 to $10.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments