BB’s strange bid to save Orion plant

Three state-run banks far exceeded their limits to salvage a coal-fired power plant project of an Orion Group subsidiary, which was stalled for six years, with Tk 10,579 crore in loans thanks to policy relaxation by the Bangladesh Bank under the now-ousted Sheikh Hasina government.

However, the loans, on top of Tk 6,244 crore liabilities of Orion companies with the banks, were not disbursed and the conglomerate decided to turn the project into a solar power plant.

Orion Group companies have borrowed a total of Tk 8,457 crore from banks, including Tk 616 crore from Mercantile Bank, Tk 357 crore from Social Islami Bank and Tk 1,240 crore from AB Bank as of June this year.

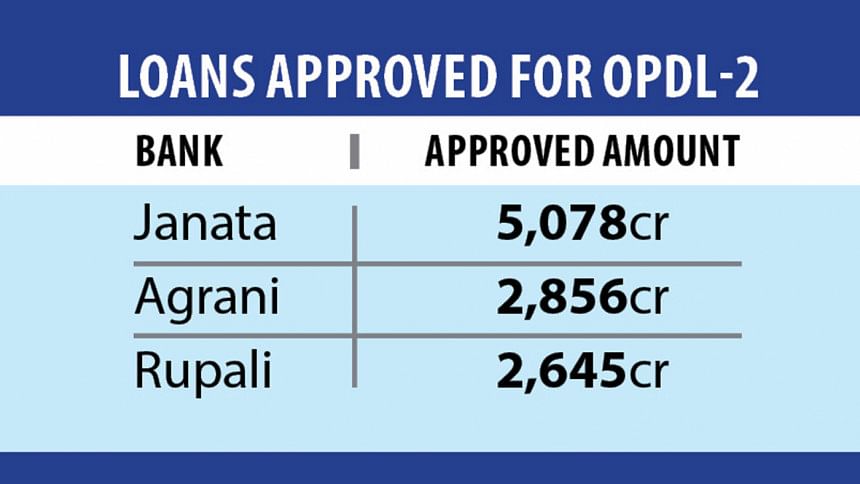

The group looked to Agrani, Janata and Rupali banks for the syndicated loan approved last year for the project at Moheshkhali in Cox's Bazar under Orion Power Dhaka-2 Limited (OPDL-2) after its bid for foreign funds had failed, officials of the banks and Orion said.

Awami League's pick Abdur Rouf Talukder was the governor when the central bank had in November 2022 relaxed section 26-kha (1) of the Bank Company Act-1991, which states loans given by a bank to a single borrower shall not exceed 25 percent of the bank's capital.

The central bank relaxed the rule for coal-based power companies for the next five years. It gave the no-objection certificates (NOCs) for the OPDL-2 loans from August to October last year.

Bangladesh Bank spokesman Md Mezbaul Haque has recently told The Daily Star that the banks, not the regulator, are responsible for deciding whether a client will get loans upon assessment of the company's credit risk.

Mezbaul said the central bank only checks the legal issues, and the regulator issued NOCs to those banks because there is a scope in the law.

"Coal-based power companies were exempted from the single borrower exposure limit to speed up electricity generation," said the BB spokesman.

Before joining the central bank as its governor following the Awami League's ouster and Rouf's resignation, economist Ahsan H Mansur had told The Daily Star that the exemption from the single borrower exposure limit for these types of power plants was avoidable. "We do not need coal-based power plants, we need renewable energy."

Approving such projects on political grounds is "not good news" for governance in the banking sector, he had said. "The state-run banks have no accountability and governance. That is why they [coal-based power producers] took large amounts of loans from these lenders."

A senior Bangladesh Bank official who monitors the state-run banks told The Daily Star that the three lenders approved the loans at a time when a major portion of their credit was already concentrated with some large borrowers, which is "very risky".

A lender's risk increases when a single customer gets a large portion of loans, sometimes even more than the client's capital, he added.

For instance, seven large borrowers, including AnonTex, Crescent, Ratanpur, and S Alam groups, account for 57 percent of the total defaulted loans at Janata Bank.

Even after this, scam-hit Janata Bank approved a Tk 5,078 crore loan for Orion Power, which is 219 percent of the lender's Tk 2,314 crore paid-up capital – far exceeding the 25 percent ceiling relaxed by BB. Orion Group was already one of the top borrowers of Janata, with Tk 2,875.85 crore loans taken until June this year.

Janata had the highest Tk 48,000 crore defaulted loans as of June this year, up from Tk 5,818 crore in 2017. It faced a Tk 2,750 crore capital shortfall until December last year, having been put in deep trouble by Anontex, Beximco and S Alam Group.

Md Abdul Jabbar, who was appointed as the bank's managing director and CEO in April last year, told this newspaper recently that the loan for the power project had been approved before he took charge.

Janata Bank has yet to disburse the loans, said Jabbar. "I'm trying to run this bank smoothly. I want to protect the bank from further deterioration of its health."

Agrani Bank approved a Tk 2,856 crore loan for OPDL-2, which is 138 percent higher than the lender's Tk 2,072 crore paid-up capital. The state-run bank approved the new loan to the company despite Orion Group subsidiaries having a Tk 2,250.63 crore liabilities with the lender.

Rupali Bank last year approved Tk 2,645 crore for the company and the amount is 569 percent of the bank's paid-up capital of Tk 464.70 crore. Orion Group subsidiaries' outstanding loans at Rupali Bank stood at Tk 1,117.48 crore until June this year.

Agrani Bank was the lead arranger for the loans, but Janata Bank approved the highest amount followed by Rupali Bank despite their worsening financial health, caused by high defaulted loans and capital shortfalls, showed the lenders' meeting minutes.

Defaulted loans at Agrani stood at Tk 20,864 crore or 28 percent of disbursed loans as of March this year, up from Tk 14,806 crore during the same period last year, BB data show. The bank also faced Tk 4,450 crore capital shortfall as of December last year.

Contacted, Md Murshedul Kabir, managing director and CEO of Agrani Bank, declined to comment.

Zaid Bakht, who recently resigned from the post of chairman of the bank, told this newspaper that the loan had been approved long ago by "maintaining due diligence" with the central bank's permission.

A senior official of the bank, seeking anonymity, said Agrani Bank approved the loans because the government had cleared Orion's plant and signed an agreement to purchase power from it.

Rupali Bank's defaulted loans stood at Tk 10,357 crore as of March this year, which is 21 percent of its disbursed loans, BB data show. It faced a Tk 2,193 crore capital shortfall last year.

The bank's Managing Director and CEO Mohammad Jahangir could not be reached for comment.

Salman Obaidul Karim, managing director of Orion Group, told The Daily Star on Thursday that they secured approval for a syndicated loan from Agrani, Janata, and Rupali Bank "based on the coal project's financial credibility without any undue influence".

He explained that significant investments were made for the coal project from Orion's equity, including for land procurement, land development, and basic and detailed engineering, in collaboration with "internationally reputed" engineering consultants.

However, recognising the long-term benefits for Bangladesh's economy and energy sustainability, the conglomerate decided to pivot to a solar project, he said, adding that this decision, made during the previous government's tenure, reflects the firm's "commitment to the country's well-being over short-term profitability".

The Orion Group managing director said they requested the banks to cancel the loans approved for the coal project and to approve a new loan for the solar project. Rupali Bank cancelled its portion of the loan in April, effectively cancelling the entire syndicated credit, he said.

If disbursed, the tenure of the project loans would be 15 years, including a one-year grace period, while the project was expected to be completed in three years, industry insiders said.

Orion had initially planned to implement a 635 MW coal power plant at Gozaria in Munshiganj but it later moved the project to Moheshkhali in Cox's Bazar with hopes to supply electricity for 25 years from 2026.

The funds initially allocated for land development in the coal project have been reallocated to the solar project on the land given by the government, ensuring a smooth and responsible transition, Salman said.

The company has also applied for a new loan for developing a renewable power plant on the Munshiganj land where it had initially planned the coal project, he said.

"The cancellation during the previous government's tenure demonstrates that no special favours were sought or received."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments