Assess loan exposure to influential people

The Bangladesh Bank (BB) has instructed the recently restructured banks to identify and assess their loan exposure to politically exposed and important persons as they might fail to repay the loans.

A politically exposed person is an individual who has been entrusted with prominent public functions. It includes ministers, members of parliament, senior executives of state-owned enterprises, and directors or members of the board of international organisations.

The central bank also sought details of the securities and collateral against the loans.

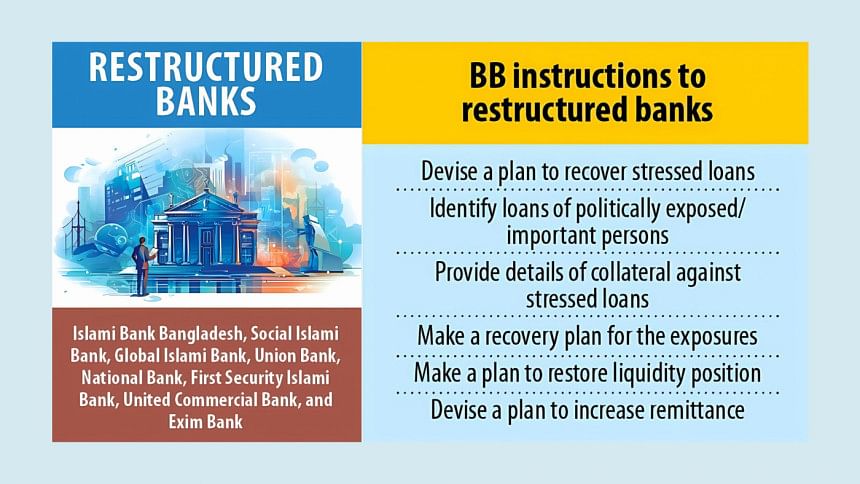

After Ahsan H Mansur was appointed to the post of central bank governor on August 14, the Bangladesh Bank reconstituted the boards of Islami Bank Bangladesh, Social Islami Bank, Global Islami Bank, Union Bank, National Bank, First Security Islami Bank, United Commercial Bank and Exim Bank.

Most of these lenders were controlled by the Chattogram-based S Alam Group.

Founded in 1985 by Mohammad Saiful Alam, a relative of former Awami League politician Akhtaruzzanan Chowdhury Babu and former land minister Saifuzzaman Chowdhury, S Alam Group has grown into one of the country's largest conglomerates.

Bank documents show that the S Alam Group and companies associated with it took out loans amounting to Tk 95,331 crore between 2017 and June this year from the six banks, plunging them into a severe liquidity crisis.

Of the sum, around 79 percent or Tk 74,900 crore came solely from Islami Bank. It accounts for 47 percent of the lender's total outstanding loans as of March this year.

The central bank's instruction came a few days after its governor said that the banking regulator would take over the shares and assets of borrowers like S Alam against their liabilities and sell them in order to return depositors' funds.

A senior central bank official told The Daily Star on condition of anonymity that the BB governor would meet with the newly formed board of directors of restructured banks.

He added that the new board members would have to present specific plans to recover stressed loans, restore liquidity and increase remittance inflows.

Mohammed Nurul Amin, newly appointed independent director and chairman of Global Islami Bank's board, told The Daily Star that the central bank asked for a strategic plan and roadmap for loan recovery, restoring liquidity and raising remittance inflows.

The BB also asked the banks to submit a plan to mitigate the negative balance in their current accounts with the Bangladesh Bank.

It further sought detailed plans to meet the cash reserve ratio (CRR) and statutory liquidity ratio (SLR) requirements.

Five banks, namely National Bank, First Security Islami Bank (FSIBL), Social Islami Bank, Union Bank and Global Islami Bank, have a negative balance in their current accounts with the central bank.

As of August 7, the five banks and Bangladesh Commerce Bank's combined current account deficit with the Bangladesh Bank stood at Tk 14,621 crore.

If their cash reserve ratio deficit is considered, their total shortfall is Tk 20,774 crore, according to central bank data.

The shortfall in the lenders' current accounts with the BB means they are in deep crisis, a senior official of the central bank said on the condition of anonymity.

Generally, banks maintain a current account with the central bank for different clearing and payment systems and have to keep a hefty balance in the account.

In theory, the central bank can restrict banks from clearing and payment platforms if they have a current account deficit, the BB official said.

The central bank provided special liquidity support to those lenders for over a year to mitigate their negative current account balance. However, that support was suspended by the banking regulator recently.

Those restructured banks were also asked to submit a plan to increase remittance inflow in the country.

Remittances sent by Bangladeshis living abroad soared nearly 39 percent year-on-year to $2.2 billion in August after Sheikh Hasina resigned from her post as prime minister and fled the country on August 5.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments