Salman loses grip on IFIC Bank

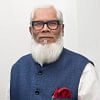

The Bangladesh Bank yesterday constituted a new board of directors at IFIC Bank after dissolving the previous board, effectively bringing an end to Salman F Rahman's grip on the private commercial bank.

Salman, who served as the private investment affairs adviser to former prime minister Sheikh Hasina, had been chairman of the bank since 2015.

According to the circular, the central bank appointed two directors and four independent directors to the new board.

Md Mehmood Husain, former managing director of National Bank, Ebadul Islam, former executive director of Bangladesh Bank, Sajjad Zahir, a professor of economics at BRAC University, and Kazi Md Mahbub Kashem, a chartered accountant, have been appointed as independent directors.

Meanwhile, Md Golam Mustafa and Md Monzorul Haque, additional secretary and joint secretary respectively to the Finance Division, were made directors as government representatives.

The government owns 32.75 percent of the bank's shares.

Similar to how Mohammad Saiful Alam, owner of Chattogram-based conglomerate S Alam Group, weaponised his political influence to seize control of Islami Bank and several other Shariah banks, Salman, the vice-chairman of Beximco, used his connections to assert dominance over IFIC Bank.

Ultimately, both of them received the same wake-up call.

In recent weeks, Alam lost the control he had forcibly gained over six Shariah-based banks after the boards were reconstituted by the central bank.

The banks had been suffering from a severe liquidity crunch after S Alam Group and its associated companies took out Tk 95,331 crore between 2017 and June this year. Around 79 percent of the sum was withdrawn from Islami Bank alone.

Now, IFIC Bank has been liberated from Salman's influence through a similar reconstitution of the board.

Salman, a major shareholder of the bank, is currently in jail in connection with several cases filed over various irregularities during the Awami League's 15-year regime.

His son, Shayan Fazlur Rahman, lost his directorship at IFIC Bank due to loan defaults on August 13, just over a week after the fall of the Awami League government.

Allegations are rife that Salman misappropriated thousands of crores through loans and bonds from the bank after taking charge.

Salman's Beximco Group also owed Tk 25,000 crore to Janata Bank as at the end of June, which is about 950 percent of the lender's paid-up capital.

As much as 72 percent of Beximco's outstanding loans with Janata have been classified as default loans, according to Janata Bank documents.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments