S Alam sons: They used fake pay orders even to legalise black money

Ashraful Alam and Asadul Alam Mahir, two sons of controversial businessman Mohammed Saiful Alam, deprived the state of Tk 75 crore in taxes by legalising Tk 500 crore in undisclosed income, documents obtained by The Daily Star have revealed.

They even brazenly resorted to irregularities and exploited a bank controlled by S Alam Group, of which Saiful is the chairman, according to letters from tax officials to their higher authorities and the two brothers.

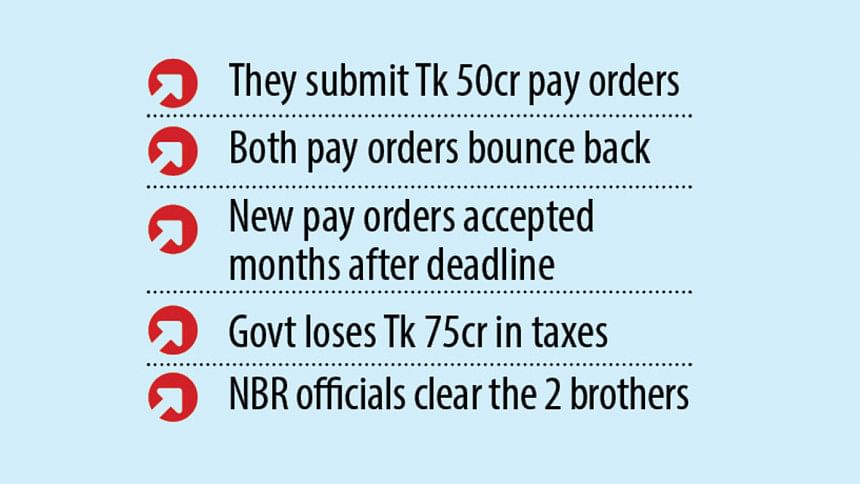

Ashraful and Asadul first used two pay orders, each worth Tk 25 crore, in a failed bid to whiten the black money within the fiscal year 2020-21, the documents show.

Their second attempt to make the payment again months after the expiry of the facility that fiscal year succeeded, which means the first two pay orders were erroneous.

Tax officials, however, gave them a clean chit, and the opportunity to whiten the black money after the deadline.

The Awami League government allowed legalising income from unknown sources by paying a 10 percent tax from July 1, 2020, to June 30, 2021.

A total of 2,311 taxpayers used the facility to whiten Tk 1,663 crore of black money in cash and bank deposits that financial year, according to the National Board of Revenue (NBR).

Tax officials said that if the maximum tax rate of 25 percent was taken into account at the individual level, the tax officials could have collected at least Tk 125 crore of income tax against the Tk 500 crore of undisclosed income of Ashraful and Asadul.

S Alam's two sons got the opportunity to legalise the black money in the tax file by paying only Tk 50 crore.

According to their tax returns, Ashraful and Asadul showed their net assets at Tk 250.15 crore and Tk 250.21 respectively in tax year FY21.

Ashraful's tin certificate mentions his status as "Bangladeshi without NID" while Asadul's as "Foreigner (non-Bangladeshi)".

S Alam, his wife Farzana Parveen and their three sons Ahsanul Alam, Ashraful and Asadul renounced their Bangladeshi citizenship on October 10, 2022, vernacular daily the Samakal reported last month.

The Bangla newspaper also said the family got approval for permanent residency in Bangladesh as foreign nationals on the same day.

Most of the family members had already been identifying themselves as foreigners or non-Bangladeshis in the tax files a year before they were granted permanent residency in Bangladesh as foreign citizens in October 2022, tax officials said.

The officials working under the circle, where the family submitted the returns, did not raise any questions on these issues.

Chattogram Tax Zone-1 Commissioner Md Samsul Arefin told The Daily Star on September 4 that he had no idea what happened before he joined in February.

"But recently I kept these two files in my custody for safety. After reading these two files, it seems that all sorts of procedures have been followed.

"But it is mysterious that two pay orders were not cashed within five to six months in a circle. It cannot be said if there was any irregularity without re-examining the entire matter," he added.

The 10 percent tax under the Income Tax Ordinance of 1984, which allowed individuals to legalise undisclosed income without facing any question, is only payable by pay order or by automated challan.

Ashraful and Asadul first applied for the facility with two pay orders on June 29, 2021, a day before the expiry of the facility.

The pay orders from the Khatunganj branch of Fast Security Islami Bank Limited (FSIBL) bounced after being submitted to Sonali Bank on July 1 for encashment and no money was deposited to the state coffer.

Tax officials then tried to contact FSIB and the two brothers several times but there was no response, officials said.

However, after nearly four months, Ashraful and Asadul submitted two new pay orders on October 18, 2021, to the same branch of the bank. That money was encashed on December 28, 2021.

Although the law had no opportunity to whiten black money after June 30, 2021, Assistant Tax Inspector Aminul Islam accepted and encashed these two new pay orders.

To justify the late collection, Joint Commissioner AKM Shamsuzzaman and Inspector Lokman Ahmed helped the two brothers make the first two pay orders appear correct by concealing the dates of the last two pay orders.

Shamsuzzaman issued a notice against the duo under section 120 of the Income Tax Ordinance 1984 as to why they delayed the payment of the taxes on June 27, 2022.

Three months after the issuance of the notice, Shamsuzzaman on September 29, 2022, suspended the notice based on an inspection report by Inspector Lokman.

Lokman submitted the report on July 3, 2022, stating that the first two pay orders were correct. He attached a statement from FSIBL's Khatunganj branch Manager Mohammad Helal Uddin to back his claim.

However, Lokman did not mention the date of the four pay orders submitted in two rounds.

FSIBL branch Manager Helal told The Daily Star on September 8, "We have informed the tax officials about the two pay orders that they wanted to know."

However, he did not give any answer when asked about the time when the money was deposited in these two pay orders.

Tax officials said that this happened because the matter was settled between the two parties.

Regarding the delay in receiving the pay orders, Assistant Tax Inspector Aminul who accepted the last two pay orders, confirmed to The Daily Star on September 10 that the money from the first two pay orders was not deposited after submission.

"Then we informed them (the two brothers) and they took some time and later gave two more pay orders," he said.

"Later, the joint commissioner issued a notice under section 120 of the Tax Ordinance since the money was not deposited within the stipulated time. I heard that the issue has also been settled," Aminul said.

He also claimed that he did not personally benefit from these incidents.

Joint Commissioner Shamsuzzaman hung up the phone, saying it was a "wrong number" when contacted for comments, although the tax officials' directory and other tax officials confirmed that it was Shamsuzzaman's number.

Inspector Lokman declined to comment.

Md Riazul Islam, Syed Mohammad Abu Daud, and Md Iqbal Bahar had served as commissioners in the tax zone in that time.

Riazul has been living abroad with his family since his retirement in 2022.

Contacted, Daud and Bahar said they were not informed about the matter by the circle, let alone receive any financial benefit from it.

"I was in charge of this tax zone both during the cashing of two pay orders from the circle office and later the issuance of the section 120 notices from the ranch office of the zone," Daud said.

He said he did not provide any advice to the relevant officials about such illegal activities nor did he benefit financially.

"I am surprised that even after the pay orders bounced, the matter was not reported to me as a commissioner," added the official, currently serving as a member of the NBR's International Tax Division.

Ashraful and Asadul did not receive calls for comments.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments