BB hikes policy rate further

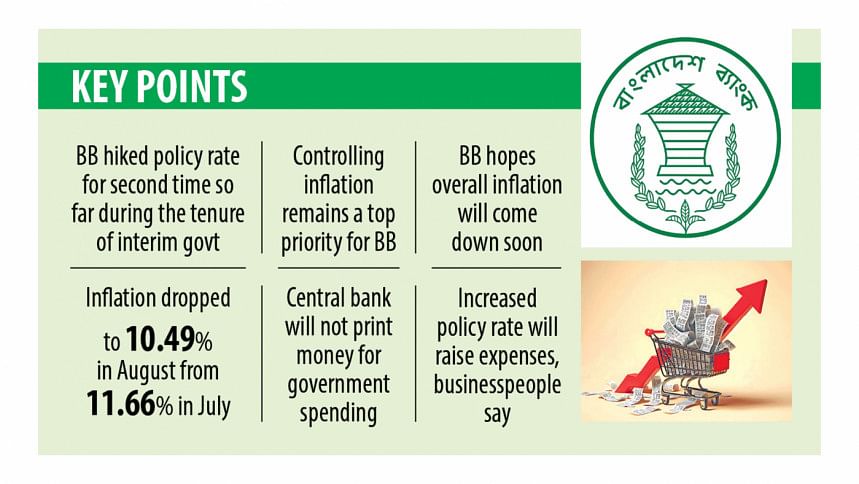

The Bangladesh Bank (BB) yesterday further hiked the policy rate, a key tool of the monetary policy, as the interim government prioritises cooling off the red-hot prices of essential items.

The policy rate at which commercial banks borrow from the Bangladesh Bank was raised by 50 basis points to 9.50 percent. It will be effective from today.

In May of 2022, the policy rate stood at just 5 percent. It was raised 9 times since, with the last increase coming in the last week of August.

The increase in the policy rate will make bank borrowing costlier, which is expected to compel people to cut back on their spending and curtail demand, subsequently bringing down inflation.

The central bank also hiked the upper limit and lower limit of the policy rate corridor for managing liquidity by commercial banks.

As a result, the interest rate of the standing lending facility (SLF) will rise to 11 percent from 10.50 percent and the standing deposit facility (SDF) to 8 percent from today.

This means banks can lend at a maximum of 11 percent and borrow at a minimum of 8 percent from the interbank money market.

For businesses, the excessive use of policy rate hikes in the battle against inflation could be worrying.

In reaction to the central bank hike, top business leaders said the move would translate to higher production costs, lower competitiveness and fewer new jobs.

The hike comes a day after Bangladesh Bank Governor Ahsan H Mansur announced that the policy rate would be increased this week and once more next month.

"There is no doubt that the monetary policy is already quite tight," the governor said. "Yet, we will increase the policy rate by this week and will do it again next month."

A senior official of the Monetary Policy Department of the central bank told The Daily Star that the central bank hiked the policy rate to 9.50 percent, which was decided at the 5th meeting of the Monetary Policy Committee (MPC) held on August 25.

At that meeting, the MPC outlined the priority list, placing the most focus on controlling inflation, said the official, adding that the Bangladesh Bank will also avoid the new high-powered money issuance for government spending and stop illegitimate liquidity support to Islamic banks.

The committee is optimistic that overall inflation will come down to tolerable levels in the coming months.

The MPC's optimism is based on the downward trend in global commodity prices, recent exchange rate stability and above all, the fine-tuning of BB's policy rate.

In a roundtable yesterday, the central bank governor said the BB would not print any new money or sell any dollars from the country's foreign exchange reserve to resolve problems in the financial sector.

At the roundtable, AK Azad, former president of the Federation of Bangladesh Chambers of Commerce and Industry (FBCCI), urged the governor not to increase the policy rate and interest rate, saying that such a step would impact businesses adversely and reduce the country's export earnings.

At the programme, Monzur Hossain, research director of the Bangladesh Institute of Development Studies (BIDS), said he did not disagree with the monetary policy stance to control stubbornly high inflation.

He, however, doubted whether it would be possible to reduce inflation, which has been hovering above 10 percent for the past two months, to around 6-7 percent through only monetary tightening.

He said it is important to create scopes for businesses to expand even amid the contractionary monetary regime.

Ashraf Ahmed, president of the Dhaka Chamber of Commerce & Industry (DCCI), said while a policy rate hike may reduce inflation in the short term, it can also reduce credit flow to businesses.

"As a result, entrepreneurs will have to sustain higher interest costs and face difficulty in getting liquidity support, which can lead to higher production costs, lower capacity and competitiveness and a possible negative impact on employment opportunities," the DCCI president told The Daily Star.

In recent times, the private sector has been facing many obstacles due to an inadequate supply of gas and electricity along with labour dissatisfaction in industrial areas. The DCCI president feared reduced credit flow could exacerbate challenges.

"We hope the central bank can activate various programmes to support lending to cottage, micro, small and medium enterprises as soon as possible," he said.

"We also hope the central bank will return to lower rates as soon as practical and reduce taka rates in a manner similar to the reduction of US dollar rates."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments