16 NBFIs face total provision shortfall of Tk 1,954cr

Sixteen non-bank financial institutions (NBFIs) faced a combined provision shortfall of Tk 1,954 crore till June this year, reflecting that their financial health had worsened.

Lenders face provision shortages when they have a high amount of non-performing loans (NPLs). It ultimately impacts their net profit. When a lender faces provision shortfalls, it indicates poor financial management practices.

NBFIs are required to maintain provisions ranging from 0.25 percent to 5 percent against general category loans, 20 percent against classified loans in the substandard category, and 50 percent against classified loans in the doubtful category.

They must set aside 100 percent against classified loans in the bad or loss category.

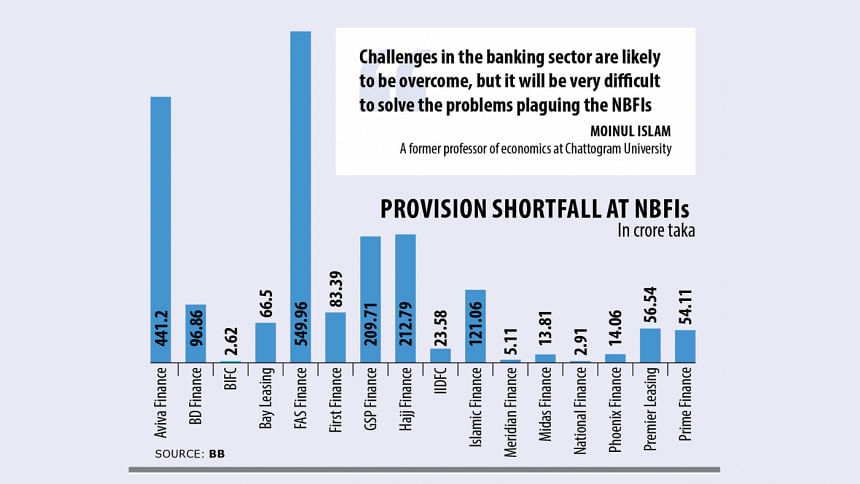

The 16 non-banks are: Aviva Finance, BD Finance, Bangladesh Industrial Finance Company (BIFC), Bay Leasing, FAS Finance, First Finance, GSP Finance, Hajj Finance, Industrial and Infrastructure Development Finance Company (IIDFC), Islamic Finance, Meridian Finance, Midas Finance, National Finance, Phoenix Finance, Premier Leasing, and Prime Finance.

Till June, the 35 NBFIs in the country were collectively required to set aside about Tk 16,023 crore as provision but managed Tk 14,122 crore, Bangladesh Bank data shows.

Since many banks also have surplus provisions, their combined provision shortfall stood at around Tk 1,901 crore.

The growing amount of bad loans in the sector is the reason for the large provision shortfall, said Md Golam Sarwar Bhuiyan, chairman of the Bangladesh Leasing and Finance Companies Association (BLFCA).

Central bank data showed that soured loans at the NBFIs in the country totalled a record Tk 24,711 crore till June of 2024.

Their total disbursed loans amounted to Tk 74,533 crore in the same period, meaning NPLs accounted for a record 33.15 percent of the money that they had lent.

Soured loans increased by Tk 4,760.11 crore or 24 percent year-on-year in June this year from Tk 19,951.17 crore in the same month last year.

Bhuiyan, also the managing director of IIDFC, told The Daily Star that his company would meet the provision shortfall and it would be reflected in September's quarterly report.

Most NBFIs get some time from the central bank to meet any such shortfalls, he added.

The BLFCA, a forum of the chief executives of leasing and finance companies, recently met with the central bank governor seeking liquidity support and policy measures aimed at restoring people's trust in NBFIs.

Consumer confidence in the NBFIs hit a nadir a few years ago when the sector was rocked by massive irregularities and scams due to a lack of corporate governance.

For instance, PK Halder, former managing director of NRB Global Bank, which was later renamed Global Islami Bank, swindled at least Tk 3,500 crore from four NBFIs, namely People's Leasing, International Leasing, FAS Finance and BIFC, according to a central bank probe report.

As a result, the four NBFIs have become ailing institutions, with more than 90 percent of their loans turning sour.

Till June, FAS Finance faced the highest provision shortfall of around Tk 550 crore. The company had bad loans amounting to Tk 1,820.89 crore, which accounts for 99.89 percent of its total disbursed loans.

Aviva Finance fell short of provisioning guidelines by Tk 441 crore after the central bank recently reconstituted its board of directors to free it from the grip of the scandal-hit S Alam Group.

The company's NPLs stood at Tk 2,354 crore, which accounts for 84.55 percent of its disbursed loans.

There are more finance companies in the country than needed and the sector is totally ignored, said Moinul Islam, a former professor of economics at the University of Chattogram.

Challenges in the banking sector are likely to be overcome, but it will be very difficult to solve the problems plaguing NBFIs, the economist said.

"The government and the central bank should enhance monitoring of the sector. Otherwise, it will create a big hole in the financial sector," Islam said.

Among others, GSP Finance's provision shortfall stood at Tk 209 crore, Hajj Finance at Tk 212 crore, Islamic Finance at Tk 121 crore, BD Finance at Tk 96 crore, First Finance at Tk 83 crore, Bay Leasing at Tk 66 crore, Premier Leasing at Tk 56 crore and Prime Finance at Tk 54 crore, BB data showed.

BIFC, IIDFC, Meridian Finance, Midas Finance, National Finance, and Phoenix Finance had a combined provision shortfall of Tk 62 crore.

Fahmida Khatun, executive director at the Centre for Policy Dialogue (CPD), told The Daily Star that everyone's eyes were glued to the banking sector, but no one paid attention to the NBFIs.

"The governance of NBFIs has deteriorated and must be corrected now," she said, adding that the sector needs further development for the sake of the country's economy.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments