High inflation a concern for stability

Bangladesh has been grappling with elevated inflation for the past two and a half years, significantly straining the daily lives of its population.

Despite expectations that the country's political shift on August 5 would alleviate the situation, inflation has continued to rise to what many now consider intolerable levels, according to economist Selim Raihan.

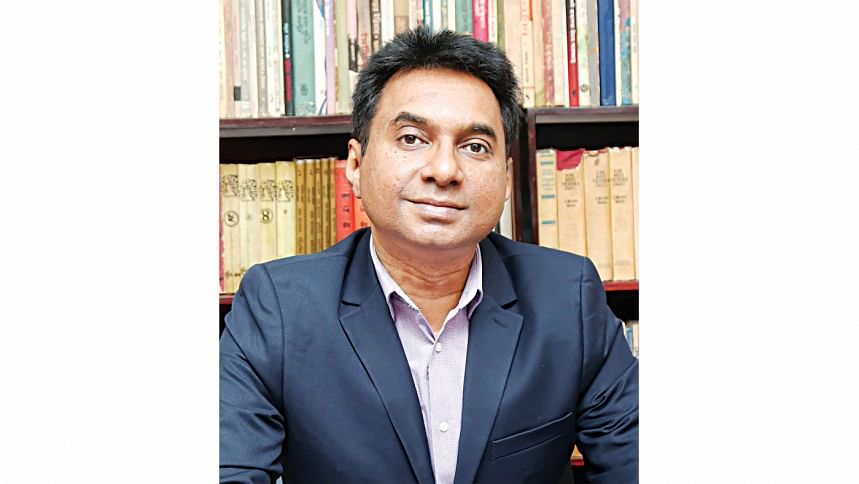

In an interview with The Daily Star, Selim Raihan, the executive director of the South Asian Network on Economic Modeling (Sanem), said that the high inflation has raised concerns about its potential impact on the country's economic and political stability.

Raihan, also an economics professor at Dhaka University, identified six major factors driving inflation in the country.

"The first and most critical is a supply crisis, where essential goods are not adequately available in the market. This shortage has created a supply-demand imbalance, driving prices higher across the board," he said.

The economist pointed out that a key challenge in this regard is the lack of accurate data on supply and demand, which makes it difficult to address these imbalances.

Besides, the credibility of government data is also in question as a whole, further complicating the fight against inflation.

Another contributing factor is the lack of market competition, with certain traders exploiting the situation by hoarding goods and creating artificial shortages to manipulate prices.

This practice has worsened under the current inflationary pressures, said the Sanem executive director.

"The absence of timely and appropriate monetary and fiscal policies has also exacerbated the problem," Raihan said. "The coordination between key institutions, such as the Bangladesh Bank and the National Board of Revenue (NBR), has been insufficient, hindering effective inflation control."

The devaluation of the local currency Taka over the past two years is another significant factor.

The sharp depreciation increased the cost of imports, particularly that of essential commodities, and is thereby contributing to the inflationary pinch. Although adjustments in import duties could have mitigated these effects, no such measures were taken, he said.

Additionally, the rising fuel prices have increased the cost of production, transportation and distribution, further intensifying inflationary pressures, he added.

Raihan emphasised that addressing this prolonged inflation crisis requires coordinated efforts across different government sectors.

However, such coordination has been lacking both under the previous government and the current interim administration. Against this backdrop, he outlined several areas that require immediate attention if inflation is to be brought under control.

"One of the most important steps is the collection and analysis of accurate market data," Raihan said.

"Reliable statistics on the demand and supply of essential commodities are crucial for understanding where shortages exist and for implementing corrective measures," he added.

Raihan stressed that government agencies must cooperate with experts to ensure effective data management. If shortages are identified, he suggested that the government should make arrangements for imports to prevent further price hikes.

Maintaining a stable supply of goods in the market was another key recommendation of the economist.

He said natural disasters, such as the recent floods, have disrupted food production in Bangladesh, leading to inflationary pressure on food prices.

Raihan advised that authorities should keep adequate stockpiles of essential goods and, when necessary, resort to imports to fill supply gaps.

He also recommended that special measures be taken to address crop losses during natural calamities.

Raihan further called for streamlining the import process for essential commodities. He argued that the government should plan imports well in advance of forecasted disasters to avoid shortages and ensure smooth operations without unnecessary bureaucratic delays.

This would help maintain price stability, he commented.

To enhance market stability, Raihan suggested the formation of an integrated platform under the leadership of the Ministry of Commerce. This platform would include the Bangladesh Bank, the revenue board, and other relevant ministries, such as the Ministry of Food and Ministry of Agriculture. Regular meetings would allow these bodies to assess market conditions and take required actions.

"Such coordination is essential for a unified response to inflation."

He also highlighted the need for better coordination between monetary and fiscal policies.

Raihan proposed that the Bangladesh Bank set clear monetary policies while the NBR develops fiscal policies that complement these efforts. This might involve adjusting interest rates or offering tax concessions to help control the price pressure.

Raihan underscored the importance of improving the country's law and order situation, particularly to curb extortion from essential-laden trucks, which have disrupted supply chains and raised transportation costs, adding to inflationary pressures.

With the August political changeover, Raihan said new extortion networks have emerged, further impeding efforts to stabilise the market.

As such, Raihan called for stringent measures for traders engaged in hoarding and market manipulation.

He urged the government to take strict action against those creating artificial shortages and monitor the market regularly.

He also recommended empowering the Bangladesh Competition Commission to effectively tackle market irregularities, ensuring that traders are held accountable.

Without these reforms, Raihan warned it would be difficult for the interim government to restore economic stability amid the ongoing inflation.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments