Trust distinguishes MTB from other banks

In the competitive local banking landscape, Mutual Trust Bank PLC (MTB) differentiates itself by offering trust to its customers, says Syed Mahbubur Rahman, managing director and chief executive officer (CEO) of the bank.

"We offer more than just financial products -- we offer trust in our services and commitment to our customers," Rahman said.

"Trust remains the cornerstone of MTB's operations," the CEO told The Daily Star on the eve of the bank's 25th anniversary today.

Initially based on wholesale banking, Rahman said the bank has now moved towards inclusive banking by offering a diverse range of products and services to meet customer needs across all segments.

"Over the past 25 years, we have built a strong and trusted brand through dynamic, innovative and inclusive services that have promoted mutual trust with our customers," he added.

"Our success lies in strong corporate governance, a visionary board and a skilled workforce."

He said there are dozens of banks in Bangladesh, all offering almost similar products.

"So, how do we differentiate ourselves? Apart from offering trust, we stand out through our processes and services and seek to elevate that distinction further. We are committed to continuous innovation, not only in technology but also in our operational processes."

According to the CEO, MTB takes pride in a strong governance system, an effective board of directors, and a skilled workforce. The board consistently strives to implement plans that benefit both the bank and its clients.

Rahman said that with over 300 application programming interfaces (APIs), MTB is a leader in digital banking and enables customers to have seamless access to customised services.

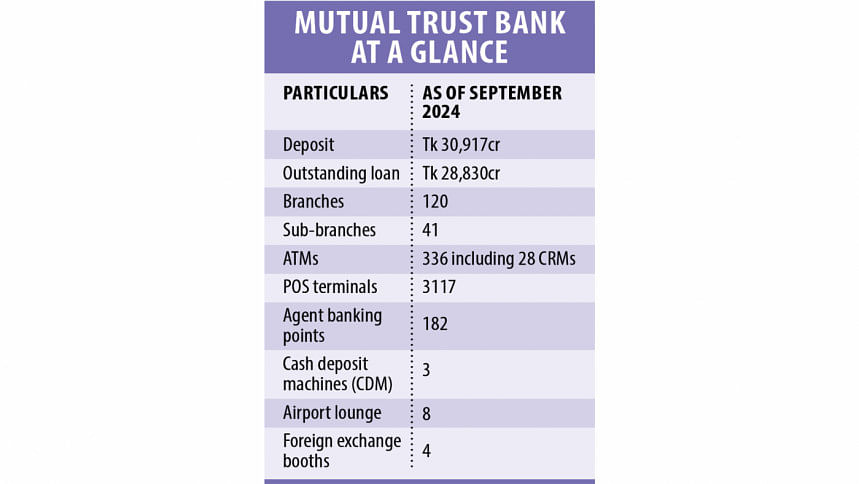

He added that the bank has a robust network of automated teller machines (ATMs) and agent banking platforms to facilitate greater customer convenience.

Currently, MTB's deposit portfolio stands at over Tk 308 billion, with advances reaching Tk 290 billion. The bank maintains a capital adequacy ratio exceeding regulatory requirements.

Beyond the numbers, Rahman said the commercial lender's strength lies in its customer account base of over 1.3 million.

In 2024 alone, MTB became one of the top recipient banks for remittances and nearly doubled its foreign trade business while meeting regulatory standards. The bank's focus on cottage, micro, small and medium enterprises (CMSME), particularly women-run enterprises, is unmatched.

"We are proud to lead where it matters most," added the MTB CEO.

The bank's commitment to excellence was recognised with numerous local and global awards in 2024, spanning categories such as banking services, sustainability, digital innovation and corporate governance.

For Rahman, these awards affirm their achievements, but the bank views those as just the beginning of greater things to come.

Rahman also commented that a key component of MTB's strategy is its collaboration with fintech partners to build a cashless ecosystem. As part of this effort, the bank has launched a pilot project in Sirajganj to test cashless transactions in collaboration with a local fintech.

According to him, transitioning to a cashless economy is not without challenges, but it is essential for tackling issues like corruption and black money.

Customer service has been a priority throughout MTB's journey. The bank has been providing airport lounge services for almost a decade, showing its commitment to customer comfort.

Rahman said MTB's Visa card portfolio, including virtual debit cards and an enhanced mobile application, reflects the bank's drive to improve customer experiences.

Looking ahead, MTB wants to evolve its agent banking model beyond traditional transactions, creating a more integrated service structure that caters to diverse customer needs.

Regarding the current challenges faced by the banking sector, including rising non-performing loans (NPLs) and liquidity constraints, Rahman credited MTB's strong governance practices for the bank's resilience.

He said MTB has taken proactive measures such as building foreign currency reserves and providing interbank liquidity support to navigate these headwinds.

"As we move forward, MTB remains committed to our core values: trust, innovation and progress," Rahman concluded.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments