More Experts in Islamic Economics & Banking Needed

TDS: What is the current state of Islamic banking in Bangladesh?

Farman R Chowdhury (FRC): The total bank deposit in the banking sector is BDT 17,340.30 billion, out of which the Islamic banking system has reached BDT 4,394.65 billion, accounting for around 25% of the total banking deposit. The total investment in the banking sector is BDT 20,854.49 billion, with Islamic banking investment amounting to BDT 4,569.94 billion, which represents around 22% of the total investment (loans and advances) in the banking sector.

Total export receipts by the Islamic banks are BDT 321.31 billion, while total import payments by the Islamic banking system are BDT 504.36 billion. On the other hand, total remittances mobilized by the Islamic banks stand at BDT 258.97 billion.

The number of branches of Islamic banks, including the Islamic branches of conventional commercial banks, increased to 1,703 at the end of March 2024. Simultaneously, the number of Islamic banking windows rose to 646 at the end of March 2024, up from 624 at the end of December 2023. Total employment in the Islamic banks stood at 51,272 at the end of March 2024.

TDS: What types of Shariah-compliant services does your bank offer?

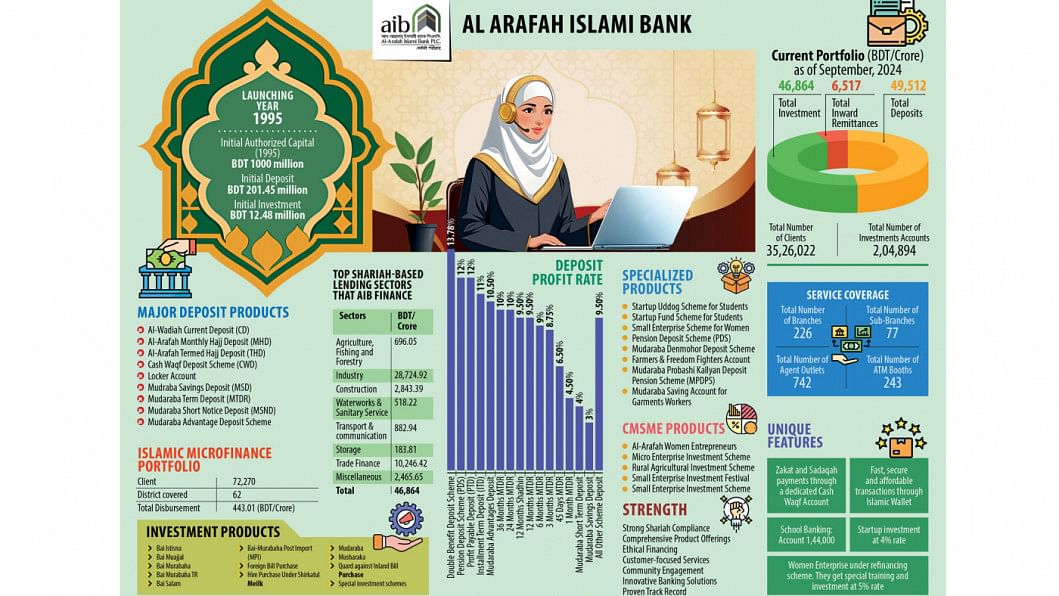

FRC: Banks mainly perform two types of interest-free Shariah-compliant activities: collecting deposits and providing investments. Islamic banks offer different deposit modes, such as Al-Wadiah Current Deposit accounts and Mudarabah Savings Deposit accounts. Investment modes include Bai mechanisms (Bai-Muajjal, Bai-Murabaha, Bai-Salam, Bai-Istisna), sharing/partnership mechanisms (Mudarabah, Musharakah), and Ijarah/leasing mechanisms (HPSM).

TDS: What challenges does Islamic banking currently face that need to be addressed?

FRC: There are several challenges that need to be addressed within the Islamic banking sector. Firstly, there exists a significant gap between the law and its practical implementation. Inconsistencies in Shariah interpretations across various banks can lead to a lack of credibility in Islamic banking. Additionally, there is a shortage of banking professionals who possess both technical finance expertise and a deep understanding of Islamic jurisprudence.

Furthermore, while conventional banks can access interbank markets and central bank liquidity windows, Islamic banks struggle with liquidity management due to their inability to utilise interest-based instruments. The current offerings of Islamic banks in Bangladesh are largely limited to basic financing modes, such as Murabaha and Ijarah, which restricts their competitive edge and reduces the range of financial products available to customers.

Moreover, there is a lack of understanding among Bangladeshi consumers regarding Islamic banking, resulting in a disconnect between potential customers and the services provided by these banks, which hinders market penetration. Islamic banks also face tough competition from conventional banks, which have larger capital bases, a wider array of products, and established infrastructures, making it difficult for Islamic banks to compete effectively in terms of pricing and service delivery.

Additionally, Bangladesh's Islamic banks are less connected to the global Islamic finance network, limiting their opportunities for cross-border investments and international market growth.

TDS: Do you have any plans to add more features to the Islamic banking channel at your bank to enhance customer service?

FRC: Firstly, developing a financial literacy program is an excellent strategy to boost customer service. Banks should transition from merely being lenders to becoming financial advisors by providing comprehensive services.

A bank's customer base provides valuable data. CRM technology enables extensive information collection for targeted marketing and improved sales opportunities. Moreover, the financial services industry has been slow to adopt self-service capabilities that allow customers to access support 24/7. Therefore, banks should offer more self-service options to improve customer service further.

Additionally, Islamic banks ought to enhance their customer service by seamlessly integrating multiple digital and physical channels, creating an omnichannel customer experience

Finally, as the financial services landscape is constantly evolving, organizations must remain updated and adaptable to emerging trends. This necessitates continuous improvement, integration of solutions, and embracing digital transformation.

TDS: What are the prospects for the overall growth of Islamic banking in the country?

FRC: Shariah-based banks in Bangladesh must connect with traditional banking infrastructure to provide smooth customer service and efficiently promote Islamic banking while ensuring compatibility and interoperability to guarantee its swift expansion.

Like Malaysia's success in the Sukuk issuing market, Bangladesh must grow its Islamic bond market. Bangladesh can spread awareness of Islamic asset management with the help of foreign organizations and assistance. Innovation and market share may be increased by creating supporting organizations and establishing research and development facilities.

One of the biggest issues facing Islamic banks in Bangladesh is the lack of Shari'ah scholars with expertise in Islamic economics and banking. Additionally, the Shari'ah board needs to have a significant impact on the bank's strategic and operational planning.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments