Develop Islamic Capital Market and Insurance (Takaful)

The Daily Star (TDS): What is the current state of Islamic banking in Bangladesh?

Syed Ibne Shariar (SIS): The Islamic banking system has been playing a significant role in mobilising deposits and financing various economic activities in Bangladesh since its inception. According to the latest published report from Bangladesh Bank for the period of January-March 2024, the Islamic banking system represents more than 26 percent of total deposits and 28 percent of total investments in the banking sector. Other segments of the Islamic financial sector, such as the Islamic capital market, Islamic insurance (Takaful), and microfinance, have also contributed a lot ; however, these need to be further developed with supportive policies and their implementation. The total manpower as of March 2024 is around 51,272 in full-fledged Islamic banks and conventional bank branches and windows. Islamic banking has established itself as the best alternative to meet the growing financial needs of individuals, institutions, corporates, and others.

TDS: What types of Shariah-compliant services does your bank offer?

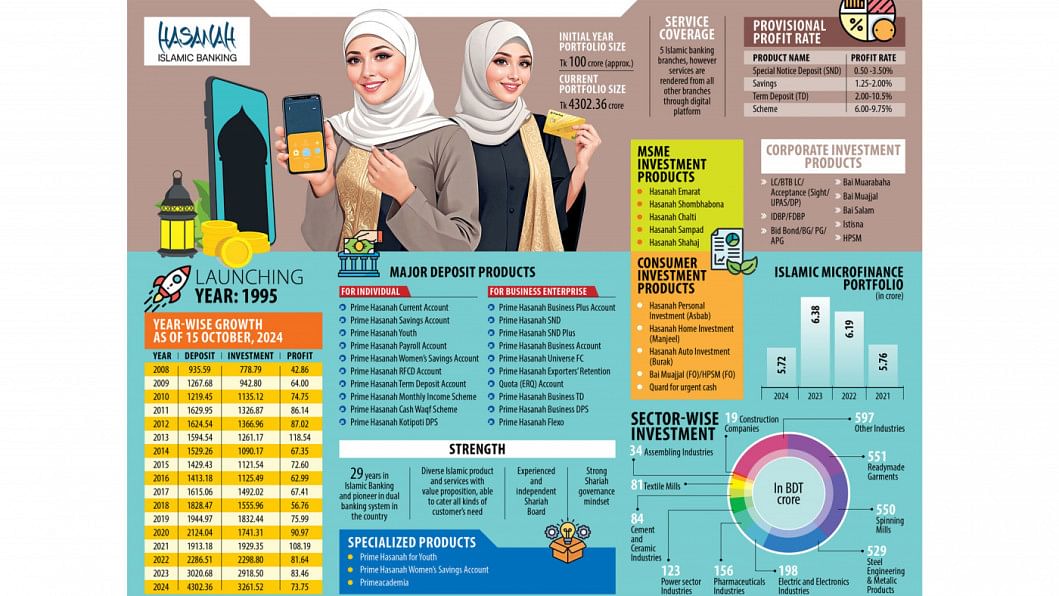

SIS: Prime Bank commenced its journey in 1995 with a commitment to serve as "A Bank With A Difference," embracing the integration of conventional banking practices alongside Islamic banking operations guided by Shariah principles.

At Prime Bank, we take great care in ensuring that every Islamic banking product and service is thoroughly vetted by our esteemed Shariah Supervisory Committee. This diligent oversight helps us stay true to the Maqasid (core objectives) of Shariah-compliant Islamic banking, striving for integrity and compliance at every level of our operations.

With a deep sense of responsibility, we aim to serve as a Shariah-compliant "financial wallet" for our retail, MSME, and corporate clients. Our innovative solutions, such as Primeacademia and Prime Bank Islamic Payroll, reflect our commitment to offering market-leading, Shariah-compliant products. Primeacademia, a comprehensive bundle of Islamic banking solutions tailored for educational institutions, is a unique offering that benefits institutions, teachers, students, and guardians alike. Additionally, to meet the specific needs of employees, we have recently introduced Islamic Payroll.

Prime Bank is also dedicated to fostering inclusion, particularly through our "Neera" Women Banking segment, which now offers specialized Islamic banking products and services designed for women.

We proudly provide these services across 146 branches (including five full-fledged Islamic branches), sub-branches, over 100 agent banking outlets, and through our digital platform, MyPrime.

TDS: What challenges does Islamic banking currently face that need to be addressed?

SIS: Islamic banking is currently facing several challenges that require thoughtful attention and timely action.

1. Recent failures of a few Islamic banks have negatively impacted public perception, which needs to be carefully managed and corrected through education and transparency.

2. There is a widespread misconception that Islamic and conventional banking are largely the same, and this mindset needs to be addressed.

3. At the governmental level, there is an absence of clear policy, strategy, and a roadmap for the development of Islamic banking over the next five years. A cohesive plan is essential for guiding the industry forward.

4. Finally, industry leaders have not yet been given sufficient opportunities or platforms to play a more significant role in shaping the future of Islamic banking.

TDS: Do you have any plans to add more features to the Islamic banking channel in your bank to enhance customer service?

SIS: Prime Bank is thoughtfully introducing a new Card Management System (CMS) aimed at enhancing the efficiency of card management, ensuring quicker processing and smoother delivery for our valued Islamic banking customers. Additionally, we are working to enrich our MyPrime internet banking platform with more user-friendly features, allowing customers to easily open schemes and term deposits directly from their smartphones.

TDS: What are the prospects for the overall growth of Islamic banking in the country?

SIS: The Islamic financial sector should consider focusing on the following key areas:

• Reaching new customers: It is essential to extend financial services to underserved communities, particularly through microfinance projects, supporting women entrepreneurs, and meeting the financial needs of government agencies. By doing so, we can help uplift those who need it most.

• Enhancing financial inclusion: Islamic banks have a unique opportunity to play a more impactful role in promoting financial inclusion. By offering innovative modes of finance, we can attract unbanked populations and bring them into the financial system, helping them secure their futures.

• Fostering growth in Islamic capital markets and insurance (Takaful): There is also a pressing need to place greater emphasis on the Islamic capital market and Takaful. These sectors hold great promise for driving further growth in Islamic banking and expanding its reach.

• Encouraging expertise and compliance: Increasing the number of AAOIFI fellows, who ensure the implementation of Shariah standards within Islamic banking, is crucial for maintaining the ethical foundation of the industry.

• Adopting technology for convenience: Embracing technological advancements is essential for making Islamic banking more accessible and convenient for all customers.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments