All banking products should be Shariah-based

The Daily Star (TDS): What is the current state of Islamic banking in Bangladesh?

Mohammad Ali (MA): Most Bangladeshis are religious, with older generations generally showing a stronger inclination towards Islam. Those who are over 40 usually possess savings. In this context, the combination of financial capacity and ideological factors expands our customer base. Thus, Shariah law is important here.

Pubali Bank is performing well in conventional banking, so it did not necessarily need to launch an Islamic window. However, leading stakeholders within our organization decided to adopt the initiative to adhere to Shariah law and government regulations. For Islamic banking to be successful, there has to be consensus regarding rules and policies.

Matters such as name-lending undermine related processes. Islamic banking need not be conducted solely for the realization of Islamic products. However, what is essential are moral and idealistic values, as such principles may eventually improve the overall state of Islamic banking in Bangladesh.

Islamic banking must be conducted within the confines of nationally recognized legislation. Our Parliament has yet to enact laws dedicated exclusively to this sector. This must be done immediately to provide guidance to believers in the system (e.g., customers and institutions). Musharakah and Murabaha are financial procedures that will then find renewed meaning in an otherwise fast-paced, interconnected business world.

I would like to mention three recommendations: (1) All products should be Shariah-based; (2) leaders of Shariah-based institutions should be ideal examples; (3) nationally valued Shariah laws must be enacted for Islamic banking.

TDS: What types of Shariah-compliant services does your bank offer?

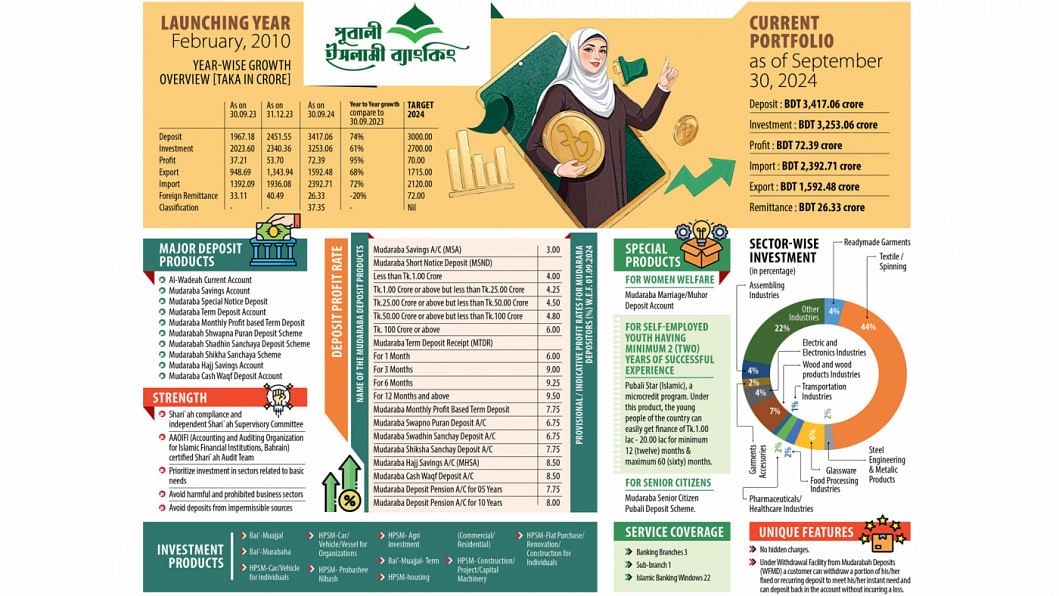

MA: We offer all types of services. Naturally, this is a requirement of modern times. Programs for retired persons, options for senior citizens, pension schemes, Mudaraba Term Deposit, Mudaraba Savings, and Murabaha Savings are some of the pathways we offer. These are deposit-related. When it comes to making investments, we have Bai'-Muajjal, Musharakah, Murabaha, and Post Shipment Import Finance.

TDS: What challenges does Islamic banking currently face that need to be addressed?

MA: Shariah boards exist in many banks. The Central Shariah Board for Islamic Banks of Bangladesh (CSBIB) must not function without a degree of influence from the Bangladesh Bank. Here, regulatory processes need to match those of the Bangladesh Institute of Bank Management (BIBM). Thus, coordination must be done in a hierarchical manner to avoid disruptions of any sort. There is a need for the CSBIB, due to its expertise in Shariah law, to be authoritative regarding inspections (when and where required). In case of non-compliance issues, the CSBIB may then provide guidelines and suggestions for improvements in the future. Examples include both "false loan" and "false deal," which highlight the importance of due diligence and regulatory oversight in banking and finance to prevent fraud and maintain the integrity of financial systems.

TDS: Do you have any plans to add more features to the Islamic banking channel in your bank to enhance customer service?

MA: We are currently trying to reach people from all parts of the country with branches available everywhere. Through such locations, we are attempting to raise awareness about Islamic products. Some of our locations have been converted to meet the demands of faith-oriented customers. Our year-on-year growth indicates that large groups of Bangladeshis long for financial transactions that are backed by Islamic principles. A 97% profit only adds to this narrative.

TDS: What are the prospects for the overall growth of Islamic banking in the country?

MA: The future of Islamic banking in the country is positive. From a demand-based outlook, about 90 percent of Bangladeshis follow Islam. A large percentage of elderly persons who have retired, possess deposits, are landowners, or have sold their properties view Islamic banking as the correct financial pathway. The truth is that many are forced to rely on conventional banking, even if they do not necessarily want to. I believe that the money supply in Islamic banking will always sustain itself in Bangladesh, due to demand. Some Islamic nations do not even have conventional banking, with Islamic banking being the preferred method.

We are also part of the Muslim community. The Islamic banking customer base is expanding today, and sermons at mosques definitely play their part. This is a reality that can be related to Islamic banking's market reach. As it has happened, many customers are looking to sacrifice their profits for the sake of moral values.

Banks around the nation need to be made aware of the changes taking place in consumer tastes, and if required, policies must support causes such as the fusion of both conventional and Islamic banking. This will only benefit the people, our economy, and the financial world within our borders.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments