Private credit growth slows to three-year low

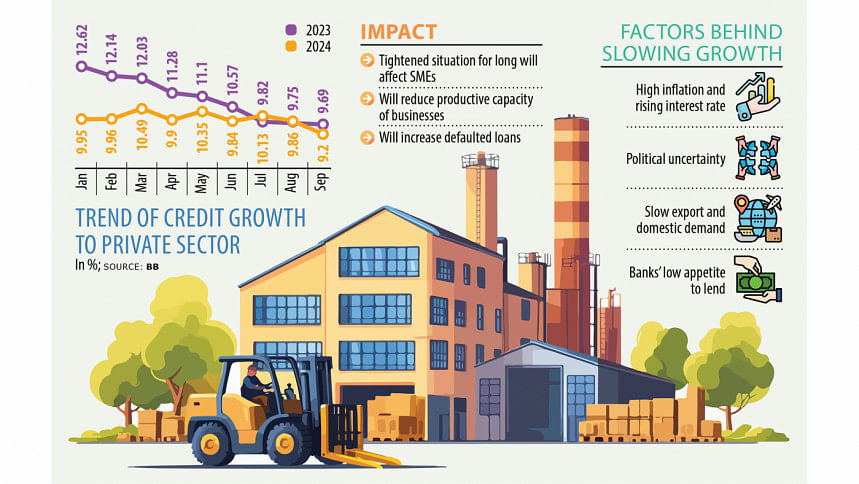

Private sector credit growth decelerated to the slowest pace in three years in September due to uncertainty in the investment environment following the recent political changeover.

Private sector credit growth cooled off to 9.20 percent in September from 9.86 percent the month prior, as per the latest data of the Bangladesh Bank.

September's credit expansion was the most sluggish since September 2021, when it stood at 8.77 percent.

The current investment environment, banks' go-slow strategy after the political changeover, persistent inflation, an increasing lending rate, and lacklustre loan recovery weighed on credit growth, industry insiders said.

September's growth was 0.60 percentage points lower than the BB target of 9.80 percent.

Private sector credit growth has slowed due to several local and global factors, according to Syed Mahbubur Rahman, managing director of Mutual Trust Bank.

Besides, persistent inflation, uncertainty in the investment climate, the weak law-and-order situation and the lack of uninterrupted power and gas supplies are also liable for the slowdown, he said.

Inflation in the county has been hovering above 9 percent since March 2022 and stood at 10.87 percent in October, according to data from the Bangladesh Bureau of Statistics (BBS).

Rahman, also a former chairman of the Association of Bankers Bangladesh (ABB), said the law-and-order situation is improving gradually.

"Banks are currently very conservative about lending due to the uncertain situation. At the same time, some banks have lost their capacity to lend," he added.

Echoing those sentiments, Sohail RK Hussain, managing director of Bank Asia, told The Daily Star that investment and expansion projects have slowed due to various factors, including rising costs as a result of the devaluation of the local currency against the US dollar.

Currently, the government is managing the balance of payments and tackling inflation by reducing the demand, which is necessary given the current situation.

"For instance, we imported goods worth $7 to 8 billion in a month in 2022, but it has now come down to only $5 billion," he explained. "When you reduce demand, the need for money also comes down."

He expressed optimism that things would get better if positive signs persisted.

"Remittance earnings have increased and if it continues to grow hand-in-hand with increased export earnings, then the difficult situation will be overcome soon."

Industry insiders added another reason for the slowdown in credit growth, pointing to repeated hikes to the policy rate, which has caused lending rates to increase.

On October 22, the Bangladesh Bank raised the key policy rate by 50 basis points to 10 percent, making borrowing costlier for the 11th time since May 2022, when it stood at just 5 percent.

The measure is aimed at taming inflation, with spiralling prices causing a headache for the interim government after it came to office on August 5.

Ashraf Ahmed, president of the Dhaka Chamber of Commerce and Industry (DCCI), said credit growth was slowing due to the contractionary monetary regime, which is restricting money supply and discouraging investment through high interest rates.

"This is likely to help in reducing inflation in the short term, but will reduce the productive capacity of the economy if maintained for a long time," he said.

"In addition, we may see higher non-performing loans due to high interest rates, which can put pressure on existing capital of the banking system.

"Our request would be to reverse the contractionary monetary policy as soon as inflation is under control."

Khondaker Golam Moazzam, research director of the Centre for Policy Dialogue (CPD), said rising interest rates were dampening the appetite for loans.

"It appears that the private sector is not interested in investing now. Many think that the business environment is not suitable for investment. Besides, a slowdown in exports and domestic demand amid persistent inflation as well as the liquidity crisis in the banking sector affected credit demand," he added.

"So, the economy is going to slow. This is planned to some extent as the government aimed to stabilise the macroeconomic indicators. There is also a kind of uncertainty, which is likely to squeeze the economy further," Moazzem said.

He added that it would be vital to protect existing businesses and jobs, saying: "If such a situation continues for a long time, small and medium industries will suffer."

The World Bank last month said Bangladesh's economy grew 4 percent in FY25 due to significant uncertainties following recent political turmoil.

The economy grew 5.82 percent in FY24, according to provisional data from the Bangladesh Bureau of Statistics.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments