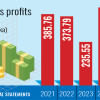

Walton’s Q1 profit falls 26%

Walton High-Tech Industries PLC's profit plunged in the first quarter of 2024, owing to higher financial costs and foreign currency losses.

Walton's net profit stood at Tk 149 crore in July-September this financial year, a 26 percent drop year-on-year.

The profit slump weighed on its shares, which declined by 3.30 percent to Tk 497.80 on the Dhaka Stock Exchange as of 12:06 pm today.

Walton attributed the profit decline to Tk 45.85 crore in foreign currency losses, higher interest expenses, and rising sales and distribution costs.

The company said its net revenue rose marginally to Tk 1214 crore, up from Tk 1203 crore a year earlier.

However, its operating profit margin slid slightly to 21.38 percent from 22.58 percent in the previous period.

Besides, the finance costs of the company surged to 10.12 percent of sales from 5.22 percent, according to Walton's unaudited financial statements.

Walton said adverse impact of currency devaluation and heightened interest rates on short-term loans were the main drivers behind the elevated finance costs.

Earnings Per Share (EPS) of the company fell to Tk 4.92 in July-September, down from Tk 6.67 in the same period last year, it said.

Net operating cash flow per share of Walton dropped to Tk 3.92, a significant decline from Tk 16.68, due to extended credit terms provided to customers.

Walton said that this strategic credit extension aims to strengthen their distribution network and ensure market stability.

"Payments to suppliers and the government exchequer increased to accommodate higher material purchases necessary for sustaining sales growth," Walton said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments