Social Islami Bank has no ‘untraceable’ loans

Social Islami Bank PLC stands out among crisis-hit banks with no "untraceable" loans, a factor that will catalyse its swift recovery, according to M Sadiqul Islam, the new chairman of the Shariah-based lender.

Following the fall of the Sheikh Hasina-led Awami League government on August 5, the Bangladesh Bank dissolved the S Alam Group-dominated board of Social Islami Bank, along with more than ten other banks, and formed a new board. M Sadiqul Islam, a professor at the Department of Finance at the University of Dhaka, was appointed as an independent director and chairman of the new board.

In a recent interview with The Daily Star, Islam emphasised that all loans of Social Islami Bank are traceable, a significant advantage compared to other struggling banks. Despite this, the bank is grappling with a liquidity crisis, with some branches unable to repay depositors.

"Our primary task is to address the liquidity shortfall, as it is unacceptable for branches to be unable to repay depositors," Islam stated, attributing the crisis to loan irregularities. The bank's investment-to-deposit ratio (IDR) exceeds 100 percent, but the liquidity shortfall is gradually improving.

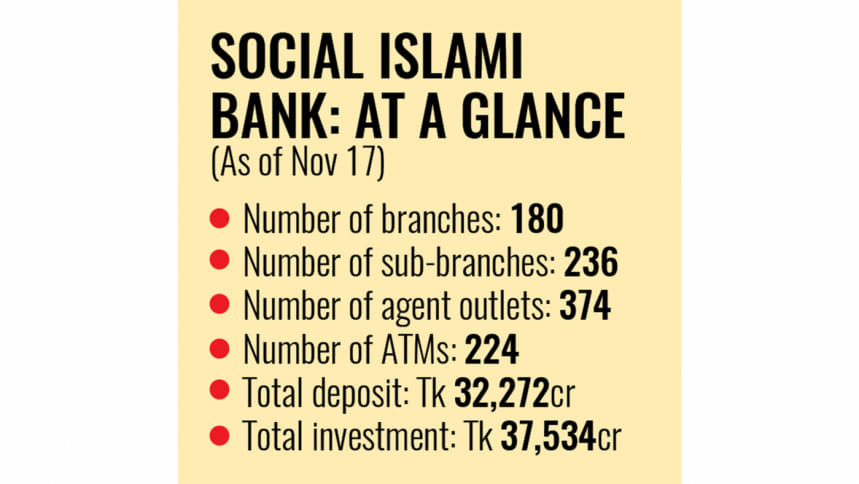

As of November 17, the bank's total deposits stood at Tk 32,272.45 crore, while total investments were Tk 37,534.59 crore. Islam said the bank's loan exposure to the S Alam Group is relatively low at Tk 6,400 crore, compared to other banks where the Chattogram-based conglomerate holds majority shares. The bank's exposure to the Sikder Group is Tk 2,000 crore, and efforts are underway to recover these loans.

Islam expressed confidence in recovering loans from the S Alam Group, as its units are operational. By October, the bank had recovered Tk 1,075 crore from borrowers and is in contact with large borrowers for further recovery. However, the bank has no immediate plans to file cases against borrowers, as this could hinder their ability to secure loans from other banks and potentially shutter their businesses.

"Sometimes loans cannot be recovered even by selling mortgages. Loans must be recovered by keeping businesses running. If businesses can operate, they will create jobs and we will get our money back," Islam said.

Bringing discipline to the bank is the second priority of the reconstituted board. Last month, the bank sacked 579 employees appointed by the former board controlled by the S Alam Group. "The bank had excess manpower, almost twice what was needed, as the previous board appointed many officials without following any criteria. Those appointments were illegal," Islam said, adding that the terminations were necessary to reduce operating costs and improve the bank's financial health.

The new strategy focuses on shifting from high-cost deposits to low-cost ones and setting a lending strategy targeting SMEs and micro-financing, as their repayment attitudes are better than large businesses. The bank launched a campaign in early November to mobilise deposits, addressing liquidity crises in around 40 branches and sub-branches. "The situation is gradually improving," Islam said.

Social Islami Bank operates 180 branches, 236 sub-branches, 374 agent banking outlets, and 224 ATM booths. The Shariah-based lender's campaign, titled "Building a Stronger Tomorrow," runs from November 3 to December 20, 2024, aiming to increase deposits and strengthen recovery initiatives.

Discussing loan irregularities during the previous board's tenure, Islam highlighted significant anomalies, such as violating the single borrower exposure limit and exceeding the investment-to-deposit ratio. "There are foreign dues related to letters of credit that must be paid now. If we do not settle these overdue payments, the bank will be blacklisted," he warned.

The bank's current account deficit with the central bank was Tk 3,400 crore, high relative to the bank's size. An internal audit revealed significant loan irregularities and anomalies, prompting the board to plan for an external audit.

Islam identified inflationary pressure as a major economic challenge, noting that the central bank has no option but to increase the policy rate. "When interest rates rise, demand for domestic credit falls. This is the reality," he said.

While the economy is slowing, it is not in recession, but a quick recovery is unlikely due to significant capital outflows. "It will take at least two years to improve the economic condition," he said.

Islam criticised the central bank for enabling banking sector irregularities and scams over the past few years, attributing these issues to political influence. He also noted that the actual amount of non-performing loans is much higher than reported.

"The country's financial sector will take three to five years to recover from the current fragile situation," he commented.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments