Banks reel from liquidity crisis despite rising deposit rates

Despite rising interest rates on deposits and various efforts by the central bank, Bangladesh's banking sector continues to face a liquidity crisis that has hamstrung some lenders.

The primary causes of the crisis include a high volume of non-performing loans (NPLs), slow deposit growth, slow loan recovery and a lack of confidence in the banking sector due to rampant scams, especially at Shariah-based lenders.

The Bangladesh Bank has also taken measures to find a way out of the crisis, but they have failed to ease the liquidity pressure facing lenders.

After the interim government assumed office, the new central bank governor said no new money would be printed to provide liquidity support. Instead, commercial lenders were allowed to borrow from the inter-bank money market against a BB guarantee.

However, with lenders scrambling to borrow from the inter-bank money market to meet daily operational needs, the situation has only worsened.

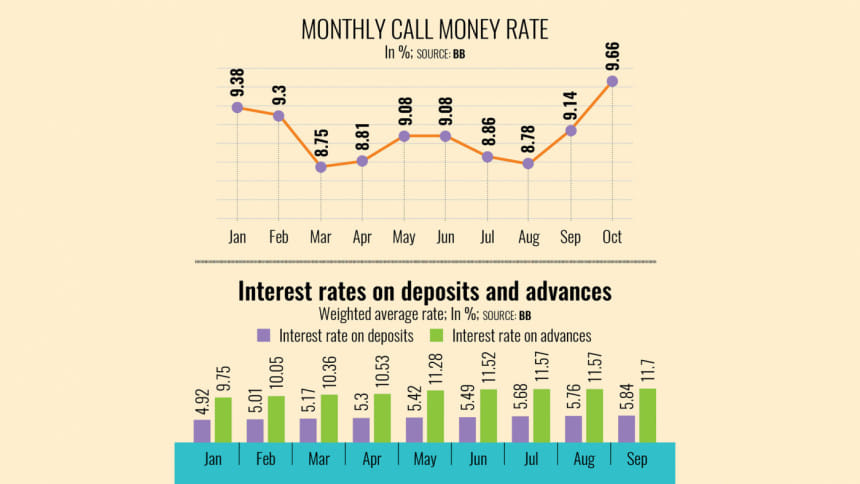

The rush for funds saw the interest rate in the inter-bank money market surge to an all-time high of 13.50 percent for 90-day term loans on November 23, signalling a deepening financial crisis.

Similarly, the average overnight interest rate in the call money market stood at 10.04 percent in November, up from 8.19 percent in the same month last year.

Anis A Khan, a seasoned banker, explained that the problem stems from a mismatch between assets and liabilities.

Although assets, especially in Islamic banks, have increased, a significant portion consists of distressed assets that are unlikely to be recovered.

"This has created a liquidity gap as funds from these bad loans are not being recycled into the banking system for new lending," he said.

Additionally, the absence of laundered money and the possibility that funds are being hidden outside the banking system exacerbate the liquidity crisis.

These issues are driving up interest rates in the inter-bank money market, forcing lenders to borrow at higher costs.

The volume of NPLs in Bangladesh's banking sector reached nearly Tk 285,000 crore in September, accounting for nearly 17 percent of total outstanding loans.

With more capital locked in bad loans, many lenders, particularly Shariah-compliant ones, are finding themselves unable to meet depositors' demands or extend new loans.

This limits the money available to manage daily operations and fund new lending.

"This money, which escaped the banking system in the form of NPLs, has not returned. So, lenders are struggling to make up for those lost funds," said Syed Mahbubur Rahman, managing director and CEO of Mutual Trust Bank.

Furthermore, instances of financial mismanagement under the previous Awami League administration have worsened the crisis.

For example, Beximco Group took a Tk 25,000 crore loan from state-run Janata Bank, equivalent to about 950 percent of the lender's paid-up capital. However, around Tk 19,000 crore turned sour by the third quarter of this year, pushing the lender's bad loans to a record Tk 60,000 crore.

Meanwhile, S Alam Group and its associated companies borrowed Tk 95,331 crore from six banks between 2017 and June 2023. Islami Bank alone financed 79 percent of the amount.

This figure is equivalent to 5.78 percent of the total banking sector's outstanding loans as of March.

The fate of these loans is hanging in the balance as the whereabouts of the owner of the conglomerate, Mohammad Saiful Alam, have remained unclear since the political changeover in August.

These factors have eroded public trust in the banking system, leading to reduced deposits and increased demand for withdrawals.

In a bid to increase the deposit base, some lenders have raised interest rates on deposits to as high as 13 percent to attract customers.

However, if the overall banking environment does not improve, people may once again choose to keep their money outside the system, exacerbating the liquidity crisis, according to Khan, also a former chairman of the Association of Banks, Bangladesh.

Another contributing factor to the liquidity crunch is the central bank's monetary policy tightening.

In late October, the central bank decided to hike the repo rate to 10 percent in order to tame demand by making money expensive for lenders.

It marked the 11th hike in the repo rate since May 2022.

This measure is designed to rein in inflation, but the higher cost of funds has squeezed banks' profit margins, pushing them to offer higher rates on deposits and loans.

These higher rates, in turn, reduce demand for loans, further restricting liquidity.

Khan also pointed out that deposits are largely impacted by overall inflation, which in Bangladesh has hovered above nine percent since March of 2023.

"When people do not have money on hand, deposits will naturally fall."

Further compounding the liquidity issues is the fact that the rules for commercial banks to borrow from the central bank have been tightened. The banking regulator now only allows commercial banks to borrow from it once a week whereas it used to be twice a week in the past.

Additionally, those with political affiliations to the previous regime, which was ousted by a mass uprising on August 5, are refraining from keeping their money in the banking system.

This is because the Bangladesh Financial Intelligence Unit has cracked down on the bank accounts of those alleged to have engaged in irregularities under the watch of the past government over the past 15 years.

Moreover, those who have fled the country in fear of consequences after the political changeover are selling their assets at relatively cheap prices and siphoning the money abroad through illegal channels, Khan added.

Experts suggest the solution to the crisis lies in improving the overall business climate, boosting tax collection, increasing production and restoring confidence in the banking system.

Without such reforms, both private and foreign investment will continue to decline, prolonging the liquidity crisis for at least six months to a year, they said.

Husne Ara Shikha, executive director and spokesperson of the central bank, said the banking regulator is yet to take any further measures to provide liquidity support to crisis-hit lenders other than the loans from the inter-bank money market.

Mohammed Nurul Amin, chairman of Global Islami Bank, told The Daily Star that the central bank recently met with representatives of six crisis-hit banks to discuss their liquidity situation.

He also said the BB has plans to provide a healthy amount of liquidity to mitigate the crisis.

So far, crisis-hit lenders have received Tk 6,850 crore in liquidity support from sound lenders since the appointment of a new central bank governor.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments