Building Wealth Through Savings

In Bangladesh, where financial literacy remains a challenge for many, banks play a pivotal role in shaping and improving savings habits among individuals. While earning a steady income is crucial, the importance of saving consistently is often overlooked, leaving many vulnerable to financial instability. Recognizing this, banks in Bangladesh have developed a range of innovative savings products and services designed to encourage disciplined saving, regardless of income level or background.

Savings, a core component of personal finance, enables individuals to achieve their financial goals, plan for retirement, avoid debt, and, crucially, build resilience against crises. "Those who practice sound financial management are better prepared to meet future obligations and handle unforeseen crises. Strong financial habits contribute to greater stability and security," explained Dr. Muhammad Shahadat Hossain Siddiquee, a professor of Economics at the University of Dhaka.

Among the popular savings schemes offered by banks are Fixed Deposits (FD), Monthly Savings Schemes (MSS), Double/Triple Benefit Deposit Schemes, Pension/Retirement Savings Schemes, Special Savings Schemes for Women, Islamic Savings Schemes, children's accounts, and Student Savings Accounts.

"The saving habits of the Bangladeshi population are currently under pressure due to a number of economic factors. Inflation and the rising cost of living have reduced people's ability to save. A decrease in disposable income directly impacts both short-term and long-term saving goals, which in turn affects their financial well-being," stated Ali Reza Iftekhar, Managing Director & CEO of Eastern Bank.

EBL offers a variety of deposit schemes with interest rates of up to 10%. For example, EBL Confidence allows monthly deposits ranging from BDT 500 to BDT 20,000, with tenures spanning from 1 to 15 years. EBL Millionaire and EBL Kotipoti are DPS schemes designed to help individuals achieve BDT 1 million or BDT 1 crore, respectively, with flexible tenures and initial deposits starting from as little as BDT 0. The EBL Multiplier offers the opportunity to double your deposit in 4 to 6 years, ensuring secure and rapid growth.

There are numerous instances where individuals feel uncertain about the best saving options for their hard-earned money and, as a result, choose to hold onto cash instead. The key to selecting the right investment options lies in carefully considering the duration of financial products, mainly FDs and DPSs, and determining an affordable monthly installment.

"At MDB, we always stress the importance of financial literacy so that people can make informed decisions. The MDB Family Support Scheme, with the option to withdraw interest monthly, is an excellent choice for those who have a few lacs in cash but are uncertain about the best investment option for them. Senior citizens, in particular, find this scheme attractive as it allows them to save for retirement while receiving monthly benefits," said Md. Rashed Akter, Head of Retail Distribution at Midland Bank. The bank also offers a range of diversified deposit schemes, including Deposit Pension Schemes (DPS) and term deposits (FDR).

"MTB's high-yield savings options include fixed deposit accounts offering competitive interest rates, recurring deposit schemes, and specialized savings accounts for children and seniors, all of which come with bonuses and interest top-ups," stated Syed Mahbubur Rahman, Managing Director & CEO of Mutual Trust Bank (MTB). The bank's flagship deposit schemes, such as MTB Deposit Double and MTB Millionaire Plan, offer attractive returns to their customers.

During a discussion on the savings products offered by City Bank, Arup Haider, Deputy Managing Director & Head of Retail Banking, mentioned, "In addition to the common Fixed Deposit Receipts (FDRs) provided by other banks, we offer products tailored to various segments of society, including different economic statuses, ages, genders, and professions, through our savings accounts and Deposit Pension Schemes (DPS). One widely used and beneficial saving method is setting aside money for planned goals, such as education, medical treatment, travel, or Hajj. The goal-based DPS plan allows for flexible tenures and installment amounts, which are customized by back-calculating the required sum, unlike regular DPS schemes that typically offer fixed amounts in multiples of BDT 500." Furthermore, City Bank offers Monthly Interest-Paying Fixed Deposit Accounts, which provide monthly payouts alongside additional benefits for savers. The bank's Insurance Banked DPS scheme allows monthly deposits from BDT 500 to BDT 10,000, with tenures ranging from 5 to 50 years.

"Besides offering FDRs, DPS, bonds, Sanchaypatra, and a variety of Probashi Banking products, we also cater to Non-resident Bangladeshis (NRBs), allowing them to invest in Bangladesh through Probashi Banking. Additionally, we provide life and general insurance services through our Bancassurance partners," said Md. Mahiul Islam, Deputy Managing Director & Head of Retail Banking at BRAC Bank. Non-resident Bangladeshis can invest by transferring funds through remittance partners such as Tap Tap Pay, Terra Payment, Merchantrade, BRAC Saajan Exchange Company, Western Union, Ria, MoneyGram, and more.

In addition to offering competitive interest rates in specialized savings schemes, some banks provide additional benefits tailored specifically for women. These include early encashment options on FDRs, waivers on issuance fees, and facilities catering to shopping and travel needs. Special discounts are available on annual locker rent, and the Deposit Pension Scheme offers further advantages. Some schemes are linked with insurance benefits, primarily for minors and women, which cover accidental insurance, critical illness treatment, and more.

The TARA Golden Benefits Savings Account, aimed at female senior citizens aged 50 and above in Bangladesh, includes rewards, vouchers, discounts, and insurance facilities. TARA Uddokta, a current account designed for women entrepreneurs, requires a minimum deposit of just BDT 1,000. It offers high interest rates, reduced fees, exclusive cashback deals, and special insurance pricing. The TARA Triple Benefit Savings Account provides higher returns compared to regular savings accounts, while the TARA Flexi DPS, a flexible deposit scheme with tenures ranging from 1 to 10 years, offers perks such as an overdraft facility of up to 95% of the savings amount (for tenures over 1 year), credit card access, and early encashment options.

'Achol,' a women-focused DPS account from Bank Asia, offers higher interest rates than standard savings accounts. Women aged 18 and above can choose tenures ranging from 3 to 12 years, with monthly installments ranging from BDT 1,000 to BDT 20,000. With attractive interest rates, this plan ensures significant growth, with a BDT 1,000 deposit growing to over BDT 41,000 in 3 years and BDT 269,000 in 12 years. The account has no hidden charges, and an SOD (loan against deposit) facility is available. Additionally, monthly deposits can be made online without incurring extra fees.

EBL Women Confidence offers flexible monthly deposit options ranging from BDT 500 to BDT 100,000, with tenures spanning from 1 to 15 years. The EBL Women Millionaire scheme is a specialized Deposit Pension Scheme (DPS) designed for women to save towards BDT 1 million, with flexible tenures ranging from 2 to 14 years, and an initial deposit starting from BDT 0 or BDT 1 lac.

MTB's Angona schemes are designed to empower women with financial independence. The Angona General Account offers daily interest, paid monthly, with no minimum deposit requirement. The Angona Premium Account, on the other hand, requires a deposit of BDT 500,000 and offers premium services. The Angona DPS is a monthly savings plan that features flexible installments and attractive interest rates. Additionally, the Angona Vitii Fixed Deposit caters specifically to women entrepreneurs, providing higher interest rates and supporting business growth with loan and renewal options.

Banks now offer a wide range of products to help parents plan and save for their children's future, from newborns to college students, addressing the specific criteria essential for young adults. Notable options include BRAC Bank's Future Star Account, City Bank's Newborn savings accounts and DPS, EBL Little Star DPS, EBL Child Future Plan, and MTB Junior.

"The banks are becoming increasingly customer-centric, as customers now prefer comprehensive, one-stop solutions for their banking and financial needs. In response to these evolving trends, BRAC Bank has introduced the Relationship Manager (RM) concept, where a dedicated official serves customers, assisting with account opening, FDR, DPS, credit cards, personal loans, and more," explained Md. Mahiul Islam from BRAC Bank, outlining the role of RMs in managing all banking and lifestyle services.

Some of the promising school banking products include MTB Graduate, MDB College Savers, and MDB School Savers, all of which promote financial inclusion and literacy. Additionally, banks such as City Bank and EBL provide services like student file assistance for those wishing to study abroad.

According to Bangladesh Bank's guidelines, School Banking Accounts (SBAs) can be converted into general savings accounts once students turn 18. As of now, approximately 87.93% of these accounts have been converted to general savings. To encourage savings among the youth, irrespective of their location or profession, banks have introduced savings schemes with minimal deposit requirements. These products allow young people to accumulate funds through affordable monthly installments, offering convenience nationwide.

To further appeal to younger customers, banks have added features like zero maintenance fees, free online banking, and Shari'ah-compliant financing options. The market share of Islamic banks has been steadily increasing; by March 2024, they accounted for 26.23% of deposits and 28.24% of investments, up from 25.35% and 28.92% in December 2023. In addition to offering a wide range of conventional banking products, many commercial banks also provide Islami Shari'ah-compliant products, such as Midland Bank's Saalam.

"Beyond regular Islamic schemes, we focus on youths and the unbanked population through our products to promote savings. Our Student Deposit Scheme, which offers daily profit facilities, requires minimal paperwork and comes with zero maintenance costs," said S. M. Mohiuddin, Head of Retail Banking at Shahjalal Islami Bank. The most popular deposit products at this bank include the Mudaraba Monthly Scheme with daily profit and the Mudaraba Double Benefit Scheme (MTDR), added Mohiuddin.

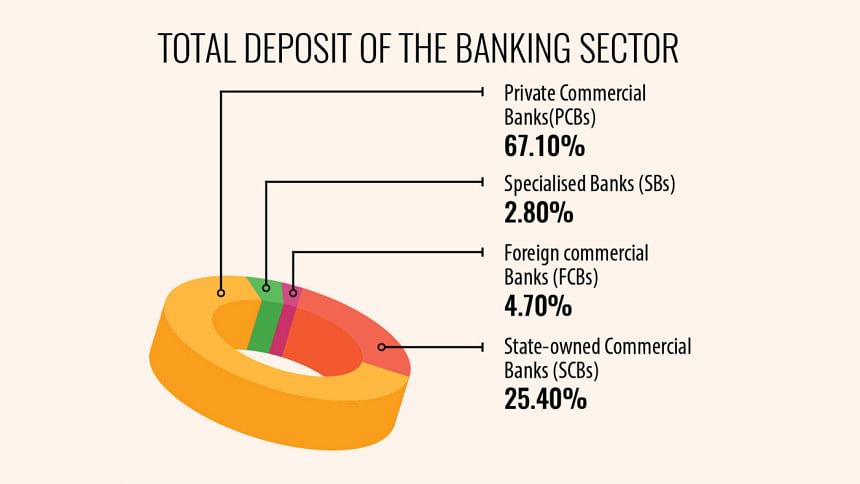

According to a Bangladesh Bank (BB) report, Private Commercial Banks (PCBs) dominate the school banking sector, holding 71.69% of the accounts and 79.90% of the deposits, amounting to BDT 19,231.75 million as of the April-June period. Both accounts and deposits have increased by 3.60% and 11.26%, respectively, compared to the previous quarter.

"A significant portion of the population continues to save through informal channels. Over the years, the role of banks has evolved significantly, transitioning from basic service providers to comprehensive financial advisors. This shift has been driven by changing customer expectations, technological advancements, and the growing need for a more inclusive financial ecosystem. At MTB, we have embraced this transformation by prioritizing customer-centric solutions, building trust, and offering personalized services," said Syed Mahbubur Rahman, MD & CEO of Mutual Trust Bank.

Banking professionals advise individuals to consider several factors before investing in a bank, including the institution's financial health ratings, its nonperforming loan (NPL) ratio, and its bancassurance offerings.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments