Bespoke Banking: Retail Loans to Match Your Goals

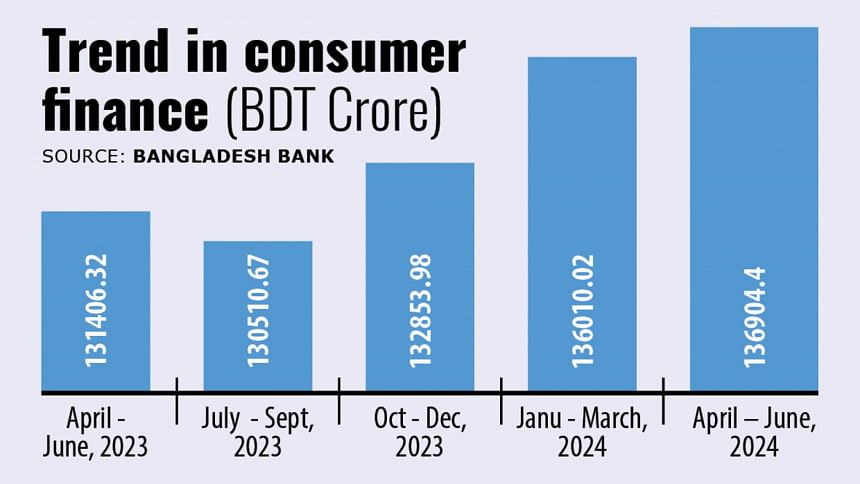

With the burgeoning consumer class in Bangladesh, banks are expanding their retail banking portfolio, offering a wide range of loan products to meet diverse needs of individual customers. From unsecured any purpose loans to specialized loans for financing your education or housing, these products serve as critical tools for economic empowerment, providing you with the financial leap to build your envisioned future. Whether you are a first-time borrower or looking for refinance, banks are there to offer you advisory services too so that you can make the right choice for securing your fiscal freedom.

"Consumer financing not only empowers individuals, but also reduces the asset portfolio concentration risk. Instead of giving big corporate loans to a few big companies or industrialists, diversifying the loan portfolio by giving small loans to the millions of citizens working in the private sector or others is more sustainable for the economy and banking sector as well," said Arup Haider, DMD & Head of Retail Banking at City Bank.

Demystifying loan types

Retail loans, also known as consumer loans broadly refer to the loans offered to individual customers. According to Bangladesh Bank's Prudential Regulation, 2004, 'consumer financing' means any financing allowed to individuals for meeting their personal, family or household needs. It primarily covers personal loans, home loans, auto loans and loans through credit cards. Under the broad category of personal loan, consumer finance can cover professional loan, education loan, marriage or travel loans, targeting particular segments of customers.

"Personal loans are marketed under various names: doctors' loan, teachers' loan, marriage or education loan. This is used for attracting customers. At our bank, we call it any purpose loan and don't differentiate according to purpose or customer-segment wise," mentioned Haider.

The Banking Regulation and Policy Department (BRPD) of Bangladesh Bank divides all types of loans into four categories: continuous loan, where transactions may be made within a certain limit and have an expiry date for full adjustment, such as credit card, secured overdraft or cash credit hypothecation (CC Hypo). This type of loans entitle multiple disbursement and multiple payment, where interest will be calculated on the outstanding balance. Demand loans, usually applicable for businesses, become repayable on demand by the bank. Fixed-term loans are repayable within a specific time period under a specific repayment schedule. The customers will get the money in one installment, then they can repay it on a monthly/quarterly basis, for instance, personal, home and auto loan. Finally, there is short-term agricultural loan or micro-credit.

According to the mentioned Prudential Regulation, the following loan products cover 80% of consumer financing needs in Bangladesh, which are auto loans, consumer durable loans, loans for professionals, unsecured personal loans and credit cards. Any Bangladeshi individual with the means to repay bank loans, including salaried executives, government officials, employees of reputed NGOs, international aid agencies, and UN bodies, as well as tax-paying businessmen, self-employed individuals, or other reliable income earners, is eligible for these loans.

Financing solutions as unique as you are

Whether you are aspiring to build your dream house, launch your own business, or planning a long-awaited getaway to your dream destination, banks are here to support your endeavors. With a wide range of tailored loan products, they cater to your unique needs while ensuring financial feasibility. These loans are designed with flexible terms and repayment options, offering solutions that align with your goals and financial capacity. From home loans and business financing to personal loans for any purpose, banks provide the tools to turn your plans into reality. With the right guidance and financial partnership, achieving your dreams has never been more accessible.

Personal loan

Personal loans are given for miscellaneous personal financial requirements. This is an "any purpose" loan which means the applicants do not have to declare the purpose for which they are taking the loan, hence there will be no hypothecation over the asset to be purchased. Almost all banks offer this loan for meeting various customer needs, e.g, marriages in the family, advance rental payments, hospitalisation or other emergency medical needs, trips abroad, purchase of miscellaneous household appliances or furniture.

"BRAC Bank offers personal loans up to BDT 20 lac to individual customers as per Bangladesh Bank guidelines. We now provide fully digital personal loan to salaried account holders, which is disbursed without any paperwork within a few minutes after filing application. The bank has already completed disbursement of 25,000 Digital Loans to the customers," mentioned Md. Mahiul Islam, Deputy Managing Director & Head of Retail Banking at BRAC Bank. He further added that personal loans have the largest share in their consumer loans portfolio (including credit card) of BDT 9,000 crore.

BRAC Bank's personal loan of up to BDT 5 lac does not require a guarantor and has a processing fee up to 0.50% of the loan amount and a supervision charge of 1% annually. Any confirmed employee having minimum monthly income of BDT 25,000 and total work experience of 1 year is eligible for this loan. Similarly, City Bank offers collateral free personal loans from BDT 2 lac to 20 lac with no hidden charges and a tenure of 12 to 60 months. However, their requirement for minimum monthly income starts at BDT 40,000.

Under personal loan scheme, Eastern Bank offers EBL Assure, any purpose lifestyle loan facility for any legitimate purpose with life insurance coverage; EBL Executive Loan, financed against the monthly income of any creditworthy individual and EBL Women's loan, any purpose unsecured EMI based loan for the salaried and professional female personnel. Ali Reza Iftekhar, Managing Director & CEO, Eastern Bank added, "EBL offers the best any purpose lifestyle loan, loan to salaried, self-employed/professionals and landlord/landlady. Moreover, EBL Digi Loan allows customers to apply for secured (cash backed) personal loan facility via online portal."

Moreover, there are personal loan schemes meant for professionals only (doctors, engineers, IT professionals, lawyers, management consultants) to support their small scale purchase of different equipment, tools and small machinery, or set up of an office/chamber. In this regard, Md. Rashed Akter, Head of Retail Distribution, Midland Bank said, "We offer any purpose loan up to BDT 20 lac depending on the income ratio for doctor, engineer, teacher or any other salaried service-holders."

Housing loan

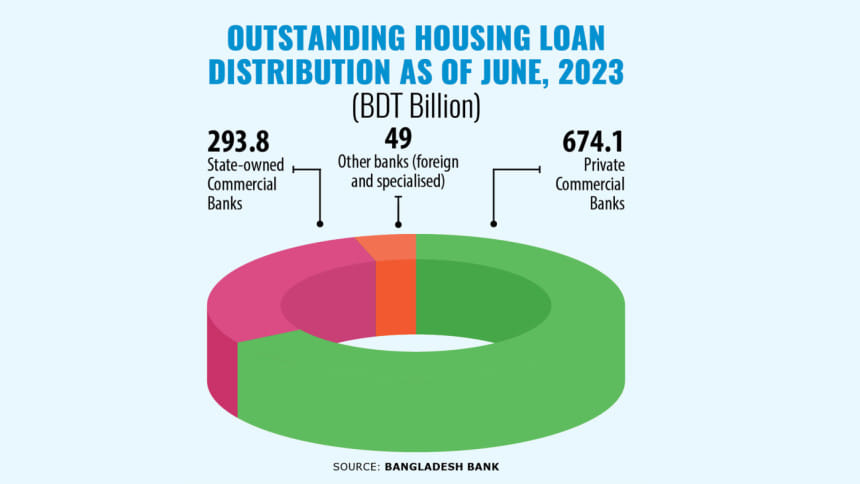

Home loans can be taken either for purchasing a new flat, constructing a house or renovating an existing home. Banks including City Bank, BRAC Bank, EBL, MTB offer up to 2 crore under their home loan scheme with a maximum repayment tenure of 25 years. The financing limit is up to 70% of the property value. Banks offer the home loan against the monthly income of any creditworthy individual, with different banks requiring a varied amount of minimum monthly income depending on the profession of the loan taker- that is the earning requirement is different for salaried executives, self-employed/professional, businessmen and landowners.

City Bank also offers the same home loan under their shariah-compliant pathway, City Islamic, considering customers looking for a halal solution for their housing investment. Similarly, EBL offers DMF Home Finance, MTB offers Yaqeen Home Finance and Midland Bank has MDB Saalam Home Finance for customers looking for shariah-compliant options.

Moreover, Midland bank has 'MDB Amar Bari' loan scheme specially targeting the semi-urban and rural customers. It finances BDT 5 lac to 50 lac with repayment tenure of 3 years to 10 years, facilitating construction, renovation/extension completion of existing tin-roof/tally-roof/concrete roof with brick walled residential house (semi-pacca) owned by the loan takers. Shahjalal Islami Bank has similar product offerings, as S. M. Mohiuddin, Head of Retail Banking at Shahjalal Islami Bank mentioned, "We provide housing investment up to 2 crore for buying a new flat, or construction of a new house. Another unique housing finance is the Semi Pacca Housing Investment Scheme, where we offer up to BDT 50 lac to landowners so that they can build a brick-walled house with tin-roof."

Auto or bike loan

This loan is provided for purchasing non-commercial new and reconditioned vehicles for personal use only. "It is investigated before giving an auto loan whether the taker is a 'rent a car' businessman. Since the financing is intended for personal use only, if found otherwise, the loan is not disbursed," commented Haider from City Bank. City, BRAC, EBL, Prime and Midland Bank offer car loans up to BDT 40 lac with a tenure of 12 to 72 months. Banks can finance only up to 50% of the car value due to a central bank's regulation.

For purchasing brand-new motorcycles for personal use, EBL offers 'Two Wheeler Loan' up to BDT 4 lac with a 60 months tenure, while Prime Bank provides up to BDT 5 lac for 36 months. City Bank also offers 'Second Hand Auto Loan', considering customer inclusion from different socioeconomic backgrounds.

Loans for youths

Banks have tailored loan schemes for their youth customers as well, especially for financing their education or small business ventures. BRAC Bank's student banking service scheme 'Agami' provides a comprehensive financial solution for school, college and university going students with student loans, study-abroad credit cards and student file services.

EBL has Edu Finance with three types of loan facilities for students: unsecured loan up to BDT 20 lac, secured loan and overdraft facility up to BDT 25 lac (or 90% of the security fixed deposit). All three schemes have student file services available and no personal guarantor is required for overdraft and secured loan.

Shahjalal Islami Bank has 'Education Investment Scheme' (EIS), offering maximum 5 lac for students studying in Bangladesh and 10 lac for students abroad with 5 years tenure. The scheme provides financing for graduation, post-graduation, job-oriented professional or technical courses by reputed universities and courses offered by reputed Private Accredited Educational Institutions.

Prime Bank offers student file service for financing students going for education abroad, offering up to BDT 20 lac for 5 years. It supports financing for undergraduate, post-graduate, prerequisite language courses for higher degrees and professional diploma or certificate courses abroad. Besides specialized offerings, personal loans are perfect for young people to finance their education or small business since the minimum age requirement for these loans start at 22. On this note, Akter from Midland Bank mentioned, "Apart from financing education of the youth customers, we provide unsecured personal loans for small entrepreneurs up to 10 lac."a Shahjalal Islami Bank has 'Education Investment Scheme' (EIS), offering maximum 5 lac for students studying in Bangladesh and 10 lac for students abroad with 5 years tenure. The scheme provides financing for graduation, post-graduation, job-oriented professional or technical courses by reputed universities and courses offered by reputed Private Accredited Educational Institutions.

Prime Bank offers student file service for financing students going for education abroad, offering up to BDT 20 lac for 5 years. It supports financing for undergraduate, post-graduate, prerequisite language courses for higher degrees and professional diploma or certificate courses abroad. Besides specialized offerings, personal loans are perfect for young people to finance their education or small business since the minimum age requirement for these loans start at 22. On this note, Akter from Midland Bank mentioned, "Apart from financing education of the youth customers, we provide unsecured personal loans for small entrepreneurs up to 10 lac."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments