Power and energy: A system designed for corruption

No less than $3 billion changed hands as kickbacks in awarding power plant projects during Sheikh Hasina's autocratic rule, according to a white paper on the state of the economy.

The white paper, submitted to Chief Adviser Prof Muhammad Yunus at his Tejgaon office yesterday, also highlighted irregularities in other areas of the power and energy sector with the tagline "A System Designed for Corruption".

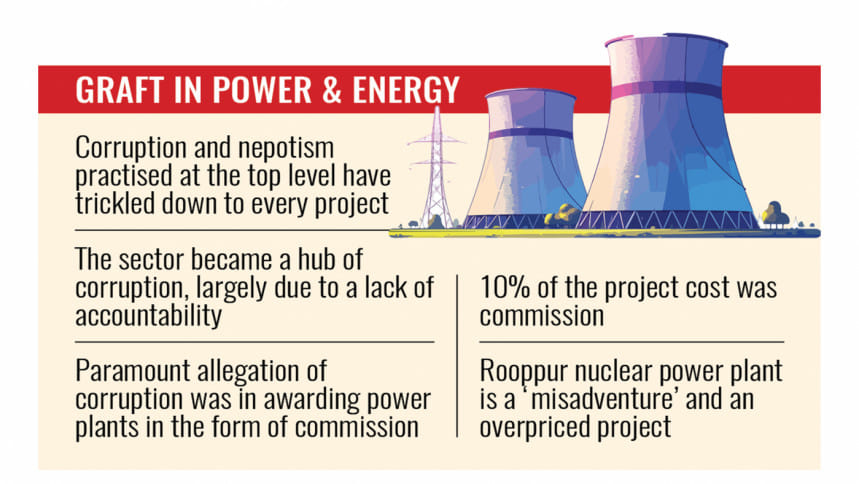

The corruption and nepotism practiced at the top level trickled down to every project, the report said, adding that the paramount allegation of corruption was in awarding power plant projects in the form of commission.

"With an investment of $30 billion in power generation since 2010, at least $3 billion changed hands as kickbacks," the white paper said.

The report estimated that 10 percent of the project cost was spent as commission.

The report also termed the 2,400-megawatt (MW) Rooppur Nuclear Power Plant as a "misadventure" and overpriced.

Bangladesh is constructing its first-ever nuclear power plant in Pabna's Rooppur at a cost of $12.65 billion, with Russia providing $11.385 billion as credit.

With an initial expense of $550 million, the total cost amounts to $13.2 billion, the report said.

The unit cost of Rooppur stands at stands at $5,500/kWe, which much higher than a similar power plant in India's Kudankulam, the unit cost of which is $3,350/kWe, the report said.

"In the name of fuel diversification, the choice of nuclear was a misadventure. With the same kind of investment, 6,000 to 8,000 MW of renewable, gas or coal power plants could be installed," the report observed.

The power and energy sector in Bangladesh has become a hub for corruption, largely due to a lack of accountability stemming from the Special Provision Act of 2010, which allowed immunity to both government officials and political leaders, the report said.

The Prime Minister's Office (PMO) is the most powerful political institution in the country.

Throughout the period of the past government, the Ministry of Power, Energy and Mineral Resources (MPEMR) had no full-time minister.

Instead, the Prime Minister held additional responsibility as the Minister for MPEMR since 2009.

Under her leadership, ruling political party members, lobbyists, private business, and independent power producers became major stakeholders in this sector, bypassing due processes.

The report said the previous government portrayed a rosy economic future with hyped up growth figures promising energy security based on imported fuel.

Now, 65 percent of the country's primary energy needs to be imported at an annual cost of $10 billion and by 2030 this will rise to $20 billion. This will put pressure on the foreign exchange reserves.

Terming Bangladesh as a Low-Emitting Energy Poor (LEEP) country, with a per capita energy consumption of just 465 kWh (kilowatt hour) per year compared to the global average of 3,000 kWh, the report said that the deposed Awami League government has disproportionately increased the generation capacity without considering demand.

"Despite the forecasts in the 2010 and 2016 Power System Master Plans (PSMP), which projected peak power demand to be 33,700 MW and 27,100 MW respectively, the government inflated the targets for 2030 and 2040 to 40,000 MW and 79,000 MW (later revised to 60,000 MW) under the "Revisiting PSMP 2016" plan.

The government justified this revision by citing ambitious economic growth and lofty expectations for the future.

This approach resulted in a tailored plan by the Power Division that permitted uncontrolled expansion of generation units, facilitating corruption and improper allocation processes through the Quick Enhancement of Electricity and Energy Supply (Special Provisions) Act 2010.

Citing the peak summer demand of 17,000 MW in 2024, the report said that if 10 percent of the capacity is reserved for standby power and another 10 percent allocated for maintenance, the total required generation capacity for supplying the remaining 80 percent is 25,500 MW.

Consequently, the country has maintained nearly 5,000 MW of excess capacity, which is 20 percent more than necessary, leading to significant capacity charges that burden consumers.

With installed capacity far exceeding actual needs and the sector's heavy reliance on imported primary fuels, the entire economy is at risk, particularly as Bangladesh struggles with foreign exchange shortages necessary to finance essential imports, the report said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments