Businesses call to curb red tape, corruption to spur investment

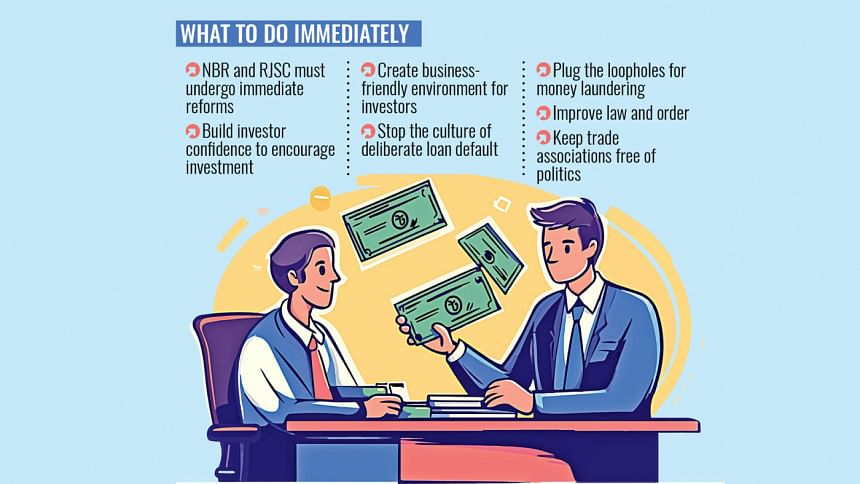

Investment barriers at the National Board of Revenue (NBR) and the Office of the Registrar of Joint Stock Companies and Firms (RJSC) must be addressed immediately to bolster investor confidence and increase investment growth, according to experts and top business leaders.

The laws concerned must be amended right away in order to end the culture of bribery and establish corruption-free service organisations, they suggested.

"Facilitation of trade and investment must be a priority. A trade and investment commission with active participation from the private sector is required," Ashraf Ahmed, president of the Dhaka Chamber of Commerce and Industry (DCCI), said while speaking with The Daily Star recently.

He added that many reforms could be implemented immediately, such as those that can be initiated through executive orders or require changes in the rules rather than the law.

However, some major reforms will require changes to existing laws. So, they will require approval from parliament.

According to Ahmed, numerous laws must be updated to reflect changing global circumstances and business needs. This includes the Companies Act 2014, Export Import Control Act 1950, Foreign Exchange Regulation Act 1947, Competition Act, Income Tax Act, Customs Act, and VAT Act.

Ahmed said amending and updating these laws is required to create a conducive environment for investment.

However, many reform opportunities which will not require changes in the law also exist, such as automation of filing procedures for the RJSC, Chief Controller of Import and Export or customs.

Mohammed Amirul Haque, managing director of Premier Cement Mills, stressed the need for a platform that will focus on trade and investment as well as address problems and bottlenecks faced by entrepreneurs.

He alleged that the inconsistent policy governing the adjustable advance income tax of investors was discouraging investment by increasing the business cost by around 10 percent.

Haque added that entrepreneurs would have to keep a 35 percent profit margin to sustain the businesses in line with the existing income tax law.

This type of bottleneck indirectly encourages the siphoning of money, he alleged.

Asif Ibrahim, former president of DCCI, said the business community hopes the burning issues in the private sector of Bangladesh will now get due priority from the interim government.

Ashik Chowdhury, executive chairman of the Bangladesh Investment Development Authority (Bida), said he met over 300 chief executive officers over the past 50 days to identify the challenges faced by businesses and was focusing on addressing the barriers.

"Basically, I am doing this to bring necessary changes and reforms to create a business-friendly environment," he said.

According to Chowdhury, everybody acknowledges that corruption occurs at the NBR, posing a major obstacle to doing business transparently and smoothly.

Zaved Akhter, president of the Foreign Investors' Chamber of Commerce and Industry (FICCI), said although no reform commission has been formed regarding investment, all the reforms that have been taken will ultimately support investment and business.

Bangladesh is the only country in the world where investors raise capital for investment from the money market, he said, while investors in other countries raise capital from the stock market. Reforms are needed in this area, he suggested.

However, he said initiatives taken to change the structure of the stock market would undoubtedly support the investment.

Investment reforms should come mainly from the Bida, where everything can be done under one umbrella, he said, adding: "If the initiatives taken by the BIDA can be implemented, the confidence of investors will increase."

He added: "I am extremely confident that these changes will help create an environment for doing business."

Mohammad Hatem, president of the Bangladesh Knitwear Manufacturers and Exporters Association, said a zero-tolerance policy must be formulated immediately and implemented to improve the state of law and order.

Additionally, he advocated for trade associations to be free of politics.

M Masrur Reaz, chairman and chief executive officer of the Policy Exchange of Bangladesh, said think tanks have already conducted a lot of research on how to build an investment-friendly environment and attract FDI.

"All the barriers have been detected. We just need the Bida or another high-powered government entity to address the issues by implementing the recommendations," he said.

In order to boost the confidence of foreign investors, he emphasised the importance of improving the ease of doing business.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments