Six private banks see bad loans nearly triple in a year

Defaulted loans at six private commercial banks nearly tripled in one year till September 2024, according to central bank data, which bankers term "alarming".

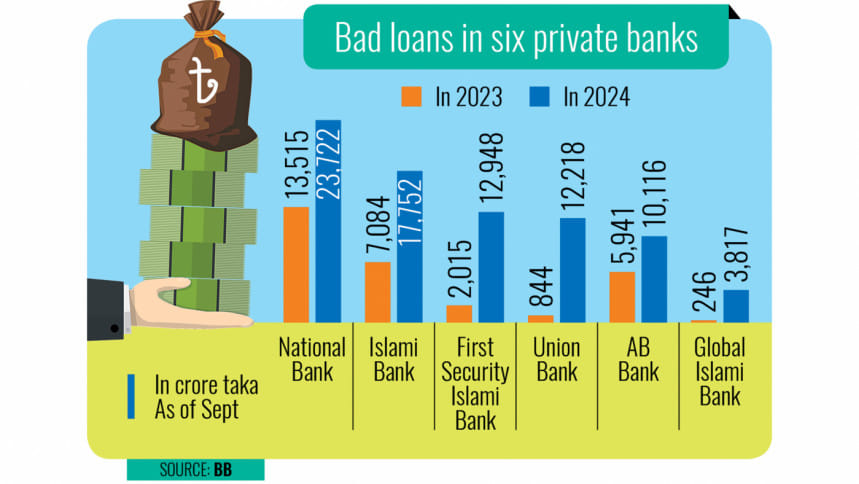

They altogether held Tk 80,573 crore in September this year, which is over 171 percent more than Tk 29,645 crore in September 2023.

National Bank has the highest bad loans among the private commercial lenders. As of September this year, its defaulted loans stood at Tk 23,722 crore, which is 55.81 percent of its total disbursed loans.

The private lender is now suffering from a Tk 16,614 crore provision shortfall.

The bank's bad loans were Tk 13,515 crore a year earlier.

After the formation of the interim government early August, the central bank restructured the board of eleven banks, including National Bank.

The bank is the country's first private sector commercial lender with a prosperous past. But it became a losing concern due to massive loan irregularities, lack of good governance and conflict among directors.

During the 16-year tenure of the previous Awami League government, business conglomerate Sikder Group dominated the bank.

After the recent political changeover, Abdul Awal Mintoo, a businessman and vice-chairman of the Bangladesh Nationalist Party (BNP), became the bank's chairman.

Bad loans at Islami Bank Bangladesh rose to Tk 17,752 crore by September of this year, up from Tk 7,084 crore at the same period last year.

The bad loans figure stood at 11 percent of its total disbursed loans, according to data.

Islami Bank Bangladesh was one of the worst victims of the controversial business conglomerate S Alam Group, which dominated the board of the largest Shariah-based bank until mid-August of this year.

The Chattogram-based conglomerate and its associated companies took out more than 50 percent of the lender's total Tk 163,863.78 crore loans, documents showed.

First Security Islami Bank, Union Bank and Global Islami Bank are three other banks that were under the grip of S Alam Group and saw their bad loans rise sharply in the last year.

In year-over-year calculations, defaulted loans at First Security Islami Bank rose by Tk 10,933 crore to Tk 12,948 crore; bad loans at Union Bank rose by Tk 11,374 crore to Tk 12,218 crore; and bad loans at Global Islami Bank rose by Tk 3,570.91 crore to Tk 3,816.91 crore, according to data.

Those three Shariah-based lenders were also freed from the grip of the S Alam Group as the central bank dissolved the board and formed a new one for each.

Officials of those lenders said that a majority of the disbursed loans taken out by the Chattogram-based business group and its associate companies are now becoming defaulted.

Defaulted loans at AB Bank rose by Tk 4,176 crore to Tk 10,116 crore by September of this year.

Industry insiders said that lackluster loan recovery efforts from top borrowers have contributed to the increase in bad loans at the private sector bank.

Central bank data showed that, except for two or three, bad loans of almost all private sector banks have increased in the last year.

As of September of this year, bad loans in the banking sector stood at Tk 284,977.31 crore, of which Tk 149,806.33 crore were at 43 private commercial banks, according to central bank data.

The figure represents 11.88 percent of their total disbursed loans as of September.

Bad loans at private commercial banks stood at Tk 81,537.81 crore at the same period last year.

Anis A Khan, former chairman of the Association of Bankers, Bangladesh (ABB), told The Daily Star that defaulted loans will increase further in the coming days.

He said that a huge amount of money was siphoned off from the country, which will not return to the banking sector. On the other hand, businesses are now suffering significantly due to global and domestic economic hardships.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments