Compassionate Banking for a Brighter Student Future

Mohammad Ali

Managing Director & CEO, Pubali Bank

The Daily Star (TDS): Why is school banking pivotal for individual development and national advancement?

Mohammad Ali (MA): The youth of today are the household-level trendsetters of tomorrow. They will eventually become parents, social influencers, and dedicated professionals. What we are essentially talking about are the social and financial interactions of the future, which stem from the education received today. In the context of the latter, modern financial systems, such as digital transactions (e.g., at home and outside), are key.

The youth of today are sometimes ahead of their parents when it comes to dealing with the new-age financial sector. They are placing orders online, interacting with card systems, and transacting via bKash. CRM and ATM booths, too, are part of these realities. When a young person opens an account and receives a debit card, they become culturally intertwined with a language that will only be beneficial in the future. We are committed to fostering social, financial, and knowledge-based interactions where young people are prepared to mature. These dimensions are important for more reasons than one.

To reach a certain level of comfort with the financial world, it is crucial for the youth of the country to engage with various levels of interaction. This may pave the way for learning about savings, connectedness, and leading a disciplined life.

TDS: What has been the recent response to school banking initiatives in the country?

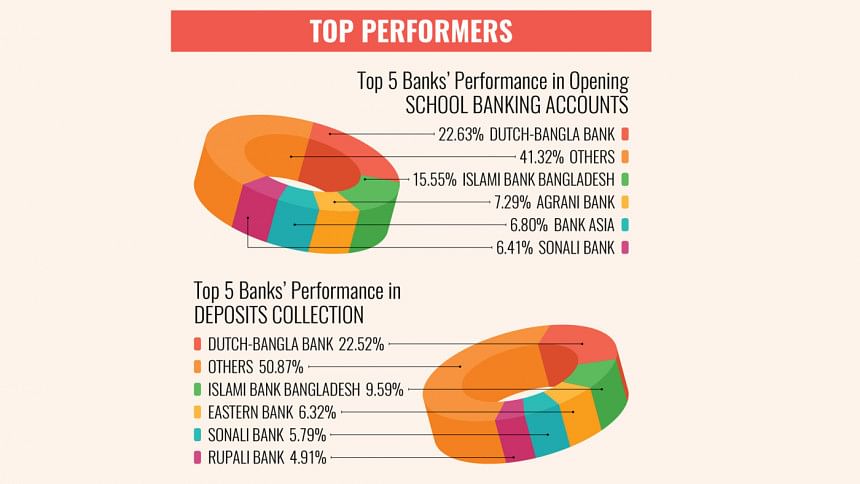

MA: School banking has seen impressive growth, with the market advancing every year. In general, female students have been more careful with their savings than male students. Here, academic institutions need to come forward to embrace the financial world through automated systems. That's when school banking will really take off.

TDS: How does your bank facilitate school banking?

MA: At Pubali Bank, we have taken initiatives such as Shikkhya Sanchay Prokalpa (SSP), which enables the opening of regular accounts and products for international students (e.g., those seeking foreign education). Several schools in Bangladesh are joining our network of mobile banking, where matters such as payments are managed. We have also held campaigns at various institutions, with a recent one in Chittagong where a digital booth was installed. These initiatives allow us to engage with both students and parents.

We are currently heavily involved in introducing new student files. The Sylhet and Gulshan (Dhaka) regions, in particular, have been especially welcoming. I personally believe that international banks and Pubali Bank are primary players in this field.

We regard education as the backbone of communities, and we strive to provide services to those who wish to study abroad and need financial support. All transactions are fully legitimate, supported by genuine documents exchanged between our institution and the respective academic establishments. Promoting students seeking higher education—both for overall development and to attract more remittances in the future—is something that cannot be overlooked.

Many of the current interim government advisers are foreign-educated, and our institution prioritises looking forward to guiding the leaders of the future. Whenever possible, we try to provide the necessary services.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments